Introduction: The Great American Coast Debate

Are you considering a cross-country move and wondering whether the East Coast or West Coast is more affordable? You’re not alone. With housing prices, cost of living, and job opportunities varying dramatically across the United States, choosing between these two iconic regions can significantly impact your financial future.

The truth is: the West Coast generally has a higher cost of living compared to the East Coast, with expenses for housing, taxes, gasoline, and even college tuition trending more expensive. However, this broad generalization doesn’t tell the whole story. Both coasts offer expensive metropolitan areas alongside surprisingly affordable hidden gems that could fit your budget perfectly.

In this comprehensive 2025 guide, we’ll break down the real costs of coastal living, compare housing markets, analyze salary requirements, and help you determine which coast offers the best value for your money.

Understanding Cost of Living Differences: What the Data Shows

What Is Cost of Living?

According to the U.S. Bureau of Labor Statistics, cost of living represents the total amount of money required to maintain a certain standard of living in a specific location. The Bureau tracks consumer expenditures across major categories, with housing accounting for the largest share at 32.9% of total expenditures in 2023, followed by transportation (17.0%) and food (12.9%).

Regional Cost Disparities

The cost of living calculator from MIT and other authoritative sources reveal significant variations between and within both coasts. Major metropolitan areas like San Francisco, Los Angeles, New York City, and Boston consistently rank among the nation’s most expensive places to live, requiring six-figure incomes to maintain middle-class lifestyles.

However, smaller cities and suburban areas on both coasts offer substantially lower costs. The key is understanding these variations before making your decision.

Housing Costs: The Biggest Factor in Your Budget

West Coast Housing Market Analysis

When it comes to real estate, the West Coast commands premium prices in major metropolitan areas:

California Real Estate Prices:

- San Francisco: Average home prices around $1.2 million

- Los Angeles: Homes averaging nearly $1 million

- San Diego: Median home values consistently above $800,000

- California overall: 38% higher cost of living than the national average

These staggering figures reflect high demand, limited housing inventory, California’s desirable climate, and the booming tech economy. However, areas like Bakersfield, California show costs only 11% above the national average, proving that affordable West Coast living exists.

Pacific Northwest Options:

- Seattle: Median home prices around $800,000-$900,000

- Portland, Oregon: More moderate prices in the $500,000-$600,000 range

- Smaller cities like Eugene, Oregon: Significantly more affordable alternatives

East Coast Housing Diversity

The East Coast offers greater diversity in housing costs. According to Bankrate’s cost of living calculator, the region includes both expensive metros and budget-friendly markets:

High-Cost East Coast Markets:

- New York City: Manhattan apartments averaging $3,500-$5,000+ monthly rent

- Boston: Median home prices exceeding $700,000

- Washington D.C. metro area: Strong housing costs driven by government employment

Affordable East Coast Regions:

- Cumberland, Maryland (21502 zip code): Median home values around $139,702

- Parts of Virginia, North Carolina, and South Carolina: Moderate housing markets

- Upstate New York: Significantly lower costs than NYC metro

- Florida (excluding Miami): 2% lower cost of living than national average

Property Taxes Make a Major Difference

Don’t just look at purchase prices—property taxes significantly impact your monthly housing costs:

West Coast Property Tax Advantages:

- California: Proposition 13 caps property tax rates, providing long-term savings

- Washington: No state income tax, though property taxes are moderate

- Oregon: Higher property taxes but no sales tax

East Coast Property Tax Variations:

- New Jersey, Connecticut, and Massachusetts: Among the highest property tax burdens nationally

- New Hampshire: No income tax on wages, but higher property taxes

- Florida: No state income tax and moderate property taxes

- Southern states generally: Lower property tax rates

According to real estate data, these hidden homeownership costs can add $21,400 annually to your expenses in high-cost regions.

Utility Costs: Where the West Coast Wins

Here’s a category where West Coast living offers clear financial advantages. Thanks to mild temperatures and long daylight hours, utility costs on the West Coast are substantially lower than many East Coast locations.

The Numbers Speak Clearly:

- Utility costs in Boston are approximately 55% more expensive than San Francisco

- West Coast residents save thousands annually on heating and cooling

- Temperate California, Oregon, and Washington climates reduce year-round energy consumption

- East Coast residents face harsh winters requiring expensive heating and humid summers demanding air conditioning

The Bureau of Labor Statistics energy category data confirms that climate significantly impacts household budgets, with energy utilities typically ranging between 2-10% of income depending on location.

Income Requirements: What You Need to Earn for Middle-Class Living

City-by-City Salary Requirements

The amount you need to earn varies dramatically by location:

Lower-Cost Cities (Family of Four):

- Eugene, Oregon: Less than $90,000 annually

- Baltimore, Maryland: Under $90,000 annually

- Charlotte, North Carolina: Approximately $85,000-$95,000

High-Cost Metropolitan Areas (Family of Four):

- San Francisco: $200,000+ required for average lifestyle

- New York City: $150,000-$200,000 needed

- Los Angeles: $150,000+ for comfortable living

- Boston: $140,000-$160,000 necessary

This disparity highlights why you can’t simply compare coasts—you must examine specific cities. A $100,000 salary might feel comfortable in Portland but barely cover essentials in Manhattan or San Francisco.

Salary Comparison Tools

Use these authoritative resources to compare purchasing power:

- NerdWallet Cost of Living Calculator

- PayScale Cost of Living Calculator

- Salary.com’s 2025 Cost of Living Tool

These tools help you understand how far your salary will stretch in different locations, accounting for local prices across housing, food, transportation, and other essentials.

State Income Taxes: A Critical Financial Factor

Tax policy significantly impacts your take-home pay and should heavily influence your coastal choice.

States With NO State Income Tax

East Coast:

- Florida (popular retirement and relocation destination)

- New Hampshire (taxes investment income but not wages)

West Coast:

- Washington

- Alaska (technically West Coast)

High-Tax States to Consider

West Coast:

- California: Up to 13.3% for top earners (highest in the nation)

- Oregon: Progressive tax rates up to 9.9%

East Coast:

- New York: Up to 10.9% combined state and NYC tax

- Massachusetts: Flat 5% rate

- New Jersey: Progressive rates up to 10.75%

Tax Strategy Example: A $150,000 salary in California could face $13,000+ in state taxes, while the same salary in Florida or Washington incurs zero state income tax—a massive difference of over $1,000 monthly.

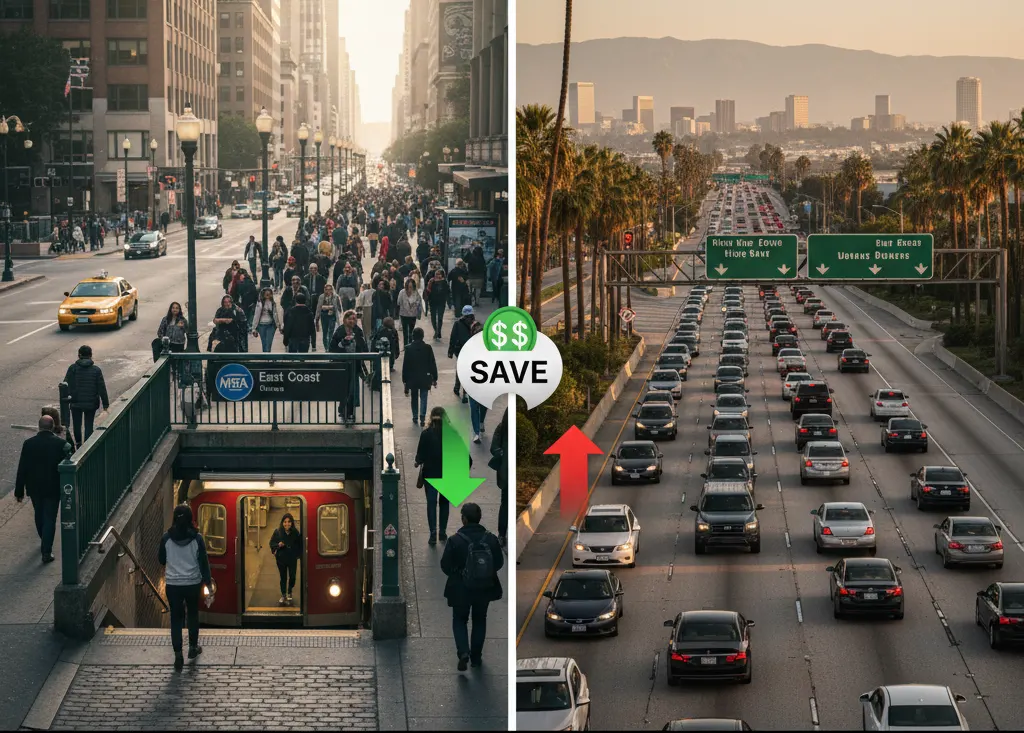

Transportation Costs: Public Transit vs. Car Dependency

East Coast Public Transportation Advantage

The East Coast boasts extensive, affordable public transportation in major cities:

Robust Transit Systems:

- New York City: Comprehensive subway system reaching all boroughs

- Boston: MBTA subway, bus, and commuter rail networks

- Philadelphia: SEPTA regional rail and subway

- Washington D.C.: Metro system connecting city and suburbs

Financial Benefits:

- Eliminate car payments ($400-$700 monthly)

- No auto insurance costs ($100-$300 monthly)

- No maintenance, gas, or parking expenses

- Total annual savings: $10,000-$15,000+

West Coast Car Dependency

Outside of San Francisco and parts of Seattle, personal vehicles are essential on the West Coast:

Car-Dependent Cities:

- Los Angeles: Notorious for car culture and traffic

- San Diego: Limited public transit coverage

- Portland: Improving but still car-reliant for many

- Phoenix, Las Vegas: Sprawling layouts requiring vehicles

Additional Costs:

- Vehicle purchase or lease payments

- Higher gas prices (especially California)

- Insurance premiums

- Maintenance and repairs

- Parking fees in urban areas

Daily Living Expenses: Groceries, Dining, and Entertainment

Grocery Cost Comparisons

According to the MIT Living Wage Calculator, annual food costs for a single adult vary significantly:

Regional Grocery Costs:

- Texas: Approximately $3,812 annually

- Florida and California: Around $4,500 annually

- Hawaii: Highest in the nation (outlier)

- Major metros both coasts: 10-25% above national average

Restaurant and Entertainment Expenses

Restaurant prices remain comparable in similarly sized cities across both coasts, though West Coast cities often embrace casual dining environments that can be more budget-friendly for regular meals out.

Entertainment Differences:

- West Coast: Abundant free outdoor recreation (beaches, hiking, parks)

- East Coast: More museums, cultural institutions (often paid admission)

- Both coasts: Major sporting events and concerts at similar price points

Healthcare Costs and Insurance

Healthcare expenses represent another significant budget consideration, though coverage and costs vary more by state than by coast.

Insurance and Access

East Coast Healthcare:

- Massachusetts: Universal healthcare system offering coverage advantages

- Strong hospital networks in major cities

- Higher costs in urban areas like New York and Boston

West Coast Healthcare:

- California: Expanded Medicaid under Covered California

- Oregon and Washington: Competitive insurance marketplaces

- Rural areas may have limited provider options

Both regions face similar challenges with rising healthcare costs, prescription prices, and insurance premiums. Your specific situation, including employer-provided benefits, matters more than geographical location.

Job Opportunities and Industry Hubs

East Coast Career Centers

Dominant Industries:

- Finance and Banking: Wall Street (NYC) offers top compensation

- Pharmaceuticals and Biotech: Boston’s life sciences corridor

- Healthcare: Johns Hopkins, Mayo Clinic networks

- Government: Washington D.C. federal employment

- Legal Services: Major law firms concentrated in NYC and Boston

- Education: Prestigious universities offering academic careers

Salary Considerations: East Coast finance and law positions often provide six-figure base salaries, but remember to calculate purchasing power after accounting for high living costs.

West Coast Tech Premium

Silicon Valley and Beyond:

- Technology Companies: Google, Apple, Meta, Microsoft offer substantial compensation

- Startup Ecosystem: Venture capital funding and equity opportunities

- Entertainment Industry: Los Angeles film and media production

- Aerospace: Seattle’s Boeing and space industry

Compensation Structure: West Coast tech positions frequently include equity compensation (stock options, RSUs) that can significantly boost total earnings beyond base salary. However, San Francisco’s high costs often offset these generous packages.

Remote Work Game-Changer

The shift to remote work post-pandemic has fundamentally changed the equation. According to recent Bureau of Labor Statistics research, remote work contributed to over 60% of housing price increases between 2019-2021 as workers relocated to more affordable areas while maintaining coastal salaries.

Remote Work Strategy: Consider living in lower-cost regions (Texas, North Carolina, Florida) while working remotely for companies paying West Coast or East Coast salaries—the best of both worlds.

Hidden Costs and Quality of Life Factors

Climate Impact on Your Budget

West Coast Climate Advantages:

- Year-round mild temperatures reduce clothing expenses

- Lower utility bills save thousands annually

- Outdoor recreation often free or low-cost

- Less weather-related vehicle maintenance

East Coast Climate Considerations:

- Four-season wardrobe requirements increase costs

- Snow removal, winter tires, and weather damage

- Higher heating bills in winter

- Air conditioning costs in humid summers

Other Financial Considerations

Commute Times and Costs:

- Los Angeles traffic: 2+ hours daily commuting common

- San Francisco Bay Area: Long commutes from affordable suburbs

- New York/Boston: Time spent commuting, but via affordable transit

College Costs:

- West Coast: Higher tuition at public universities

- East Coast: More private universities with high costs

- Both: Student loan burdens affect long-term finances

Which Coast Wins? Making Your Decision

Choose the West Coast If You Value:

✓ Milder year-round weather with lower utility bills and reduced climate-related expenses

✓ Diverse outdoor recreation including beaches, mountains, and national parks

✓ Technology industry opportunities with high salaries and equity compensation

✓ Laid-back cultural atmosphere and progressive policies

✓ Asian and Latin American cultural connections and cuisine

✓ States with no income tax (Washington, Alaska)

Best West Coast Value Cities:

- Portland, Oregon

- Eugene, Oregon

- Sacramento, California

- Spokane, Washington

- Boise, Idaho (near West Coast)

Choose the East Coast If You Value:

✓ More affordable housing options in mid-sized cities and suburbs

✓ Robust public transportation eliminating vehicle costs

✓ Traditional industries like finance, law, pharmaceuticals, and healthcare

✓ Four distinct seasons and established communities

✓ European travel proximity (shorter, cheaper flights)

✓ Greater regional diversity in cost of living

✓ Rich history and culture with colonial heritage

Best East Coast Value Cities:

- Raleigh-Durham, North Carolina

- Richmond, Virginia

- Pittsburgh, Pennsylvania

- Buffalo, New York

- Jacksonville, Florida

10 Smart Strategies for Maximizing Your Budget on Either Coast

1. Look Beyond Major Metropolitan Areas

Consider suburban or exurban areas with easy access to city centers but significantly lower costs. New Jersey suburbs can offer NYC access at half the price, while East Bay provides San Francisco access affordably.

2. Calculate Total Compensation, Not Just Salary

Factor in state taxes, transportation costs, and housing expenses when comparing job offers. A $120,000 Austin salary might provide more disposable income than $180,000 in San Francisco.

3. Use Cost of Living Calculators

Before accepting any offer, use tools from NerdWallet, Bankrate, or PayScale to understand real purchasing power.

4. Embrace Regional Advantages

- East Coast: Maximize public transit savings

- West Coast: Take advantage of mild weather and outdoor activities

5. Research Specific Neighborhoods

Costs vary dramatically even within the same city. Queens offers more affordable NYC living than Manhattan; Oakland costs less than San Francisco.

6. Consider Timing Your Move

Housing markets fluctuate seasonally. Moving during winter often provides better rental deals as demand decreases.

7. Negotiate Remote Work Flexibility

Many companies now offer location-independent positions. Negotiate the ability to live in affordable areas while earning competitive salaries.

8. Factor in Career Growth Potential

Sometimes accepting a higher cost of living makes sense if career acceleration opportunities justify short-term sacrifice.

9. Build an Emergency Fund

Higher cost of living areas require larger safety nets. Aim for 6-12 months expenses rather than the standard 3-6 months.

10. Rent Before Buying

Test out a new city by renting for at least one year before committing to a home purchase. This allows you to explore neighborhoods and understand true costs.

It’s More Complex Than East vs. West

After analyzing housing costs, taxes, transportation, utilities, and income requirements, the answer to “which coast is cheaper?” is: it depends entirely on your specific situation, career, priorities, and chosen location.

Key Takeaways:

Overall Trends:

- West Coast generally has higher housing costs in major metros

- East Coast offers more diverse cost-of-living options

- West Coast residents save significantly on utilities

- East Coast excels in public transportation access

- State income taxes vary widely on both coasts

The Real Answer: The cheaper coast isn’t the East or West—it’s whichever specific location aligns best with your financial situation, career goals, and lifestyle preferences. San Francisco and Manhattan are both expensive; Cumberland, Maryland and Eugene, Oregon are both affordable.

Making Your Decision:

Rather than choosing based on regional stereotypes, take these steps:

- Research specific cities using authoritative cost-of-living calculators

- Calculate your personal budget based on actual housing, transportation, and living expenses

- Consider total compensation including salary, taxes, and benefits

- Factor in quality of life beyond just costs

- Think long-term about career growth and housing appreciation

- Visit before committing to experience the culture and lifestyle firsthand

2025 and Beyond

In 2025, Americans have more flexibility than ever to choose locations based on what matters most. Remote work, changing housing markets, and evolving economic conditions mean the traditional coast-to-coast divide matters less than specific city selection.

Whether you’re drawn to Pacific sunsets or Atlantic history, mild California weather or New England seasons, tech industry innovation or Wall Street finance, make your decision based on comprehensive financial analysis—not assumptions about which coast costs more.

Use the resources provided throughout this guide, including the Bureau of Labor Statistics data, cost of living calculators, and MIT’s Living Wage Calculator to make an informed decision that serves your financial future.

Remember: the cheapest option isn’t always the best option for your long-term financial health, career advancement, and overall happiness. Find the balance that works for you.

Frequently Asked Questions (FAQs)

Q: Is the East Coast or West Coast more expensive overall?

A: The West Coast is generally more expensive, particularly in major cities like San Francisco and Los Angeles. However, both coasts have affordable areas, and specific city choice matters more than regional location.

Q: Which coast has cheaper housing?

A: The East Coast offers more housing diversity and affordable options in mid-sized cities. The West Coast has higher average housing costs but also provides affordable options outside major metros.

Q: Do West Coast jobs pay more than East Coast jobs?

A: Tech industry jobs on the West Coast often pay premium salaries with equity compensation. East Coast finance and legal positions also offer high compensation. The key is comparing purchasing power after accounting for local costs.

Q: Which coast is better for retirement?

A: Florida (East Coast) is popular due to no state income tax, moderate costs, and warm weather. However, West Coast locations like Southern California and Arizona also attract retirees. Consider healthcare access, climate preferences, and proximity to family.

Q: How do taxes differ between coasts?

A: Major differences exist: California has the highest state income tax (13.3%), while Florida, Washington, and New Hampshire have no income tax on wages. Property taxes also vary significantly by state regardless of coast.

Q: Can I afford to live on the coast with a $60,000 salary?

A: In major coastal metros (NYC, SF, LA, Boston), $60,000 is challenging. However, many smaller coastal cities and suburbs make this salary workable, especially in lower-cost regions like the Carolinas, parts of Florida, or smaller Oregon cities.

Q: Is it worth moving to the West Coast for tech jobs?

A: If you can secure a position with total compensation exceeding $150,000, West Coast tech opportunities often justify the high costs. However, many tech companies now offer remote positions, allowing you to work for West Coast companies while living affordably elsewhere.

#EastCoastVsWestCoast #CostOfLiving #CostOfLiving2025 #RelocatingUSA #MovingTips #EastCoast #WestCoast #USALiving #AffordableLiving #HousingCosts