Artificial intelligence is no longer a niche technology story — it’s now a macroeconomic force. Recent estimates suggest that AI spending accounts for roughly 40% of recent U.S. GDP growth, fueling everything from data center construction to semiconductor demand. As 2026 approaches, economists and investors are asking an uncomfortable question: is this AI-driven boom sustainable, or are we inflating the next tech bubble?

The answer matters not just for Wall Street, but for workers, savers, and the broader U.S. economy.

How AI Became a Major Driver of US Growth

AI investment has surged across multiple layers of the economy. According to analysis from McKinsey & Company, generative AI alone could add trillions of dollars in annual economic value through productivity gains and automation.

At the same time, capital spending tracked by the U.S. Bureau of Economic Analysis shows a sharp rise in investment tied to software, computing equipment, and intellectual property — all closely linked to AI deployment.

Where the Money Is Going

AI-driven growth isn’t evenly distributed. Spending is heavily concentrated in a few areas:

- Semiconductors: Advanced chips designed for AI workloads

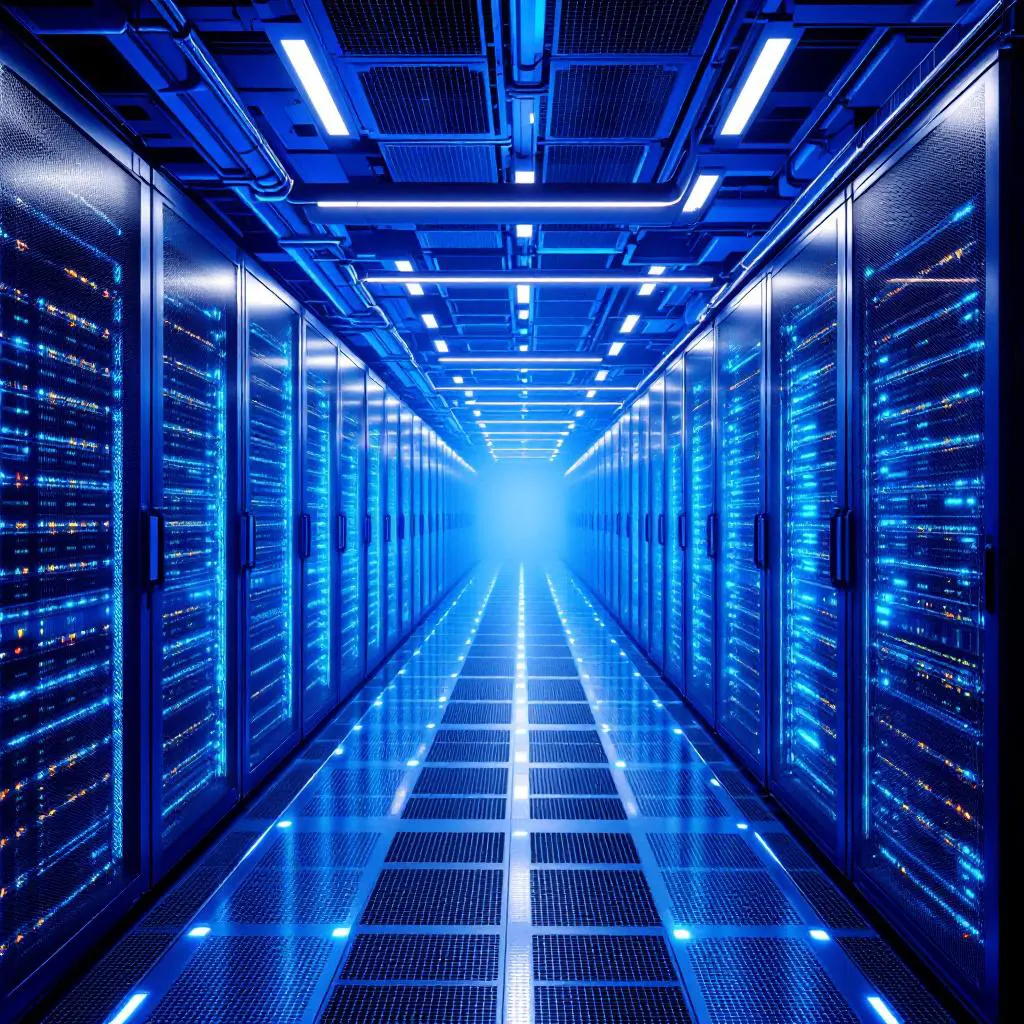

- Cloud infrastructure: Massive data centers and networking

- Defense and government systems: AI-enhanced analytics and automation

Companies like NVIDIA have become symbols of the boom, while cloud providers highlighted by CNBC Technology continue to expand capacity at historic rates.

Why Economists Are Nervous

Rapid growth driven by a single technology has precedent — and not all of it ends well. Economists frequently compare the current moment to the late 1990s internet boom.

Research published by the International Monetary Fund (IMF) warns that productivity-enhancing technologies can create temporary growth spikes that fade if adoption costs outpace real-world returns.

The concern isn’t that AI has no value — it’s that expectations may be rising faster than measurable economic output.

The Bubble Question: Hype vs. Fundamentals

Classic bubble dynamics often include:

- Heavy capital concentration in a narrow sector

- Valuations detached from near-term cash flows

- Assumptions of endless growth

Market analysts at Goldman Sachs have noted that while AI investment is rational, returns may be uneven — with infrastructure providers benefiting sooner than application-layer companies.

If interest rates remain elevated, capital-intensive AI projects could face sharper scrutiny in 2026.

What Happens If AI Growth Slows?

If AI spending decelerates, the effects could ripple across the economy:

- Reduced capital expenditure growth

- Pressure on tech employment

- Stock market volatility tied to AI-heavy indexes

The Federal Reserve has already acknowledged that technology-driven investment cycles play a growing role in economic volatility, especially when combined with tight financial conditions.

So, Is the AI Bubble About to Burst?

Most economists agree that AI is real, transformative, and here to stay. The debate is about timing and scale. A slowdown in AI-driven growth wouldn’t mean failure — but it could expose overinvestment, inflated valuations, and unrealistic forecasts.

As 2026 approaches, the sustainability of AI as 40% of U.S. growth will depend on whether productivity gains materialize broadly — not just in earnings calls and market narratives.

AI has become one of the most powerful economic forces in modern history. But when a single sector drives such a large share of growth, the risks rise alongside the rewards.

Whether this moment becomes a lasting transformation or a painful correction will define the next phase of the U.S. economy — and the tech sector — in 2026 and beyond.

#AIEconomy #TechBubble #AIGrowth #USGDP #ArtificialIntelligence #TechTrends2026 #MacroEconomics