The Lock-In Effect Explained: Why 7% Mortgage Rates Are Freezing U.S. Housing Inventory

The U.S. housing market is facing a structural shortage that may last for years—possibly even the rest of the decade. At the center of the crisis is the lock-in effect, a phenomenon where homeowners are financially disincentivized to sell because current mortgage rates are significantly higher than the rate on their existing loan.

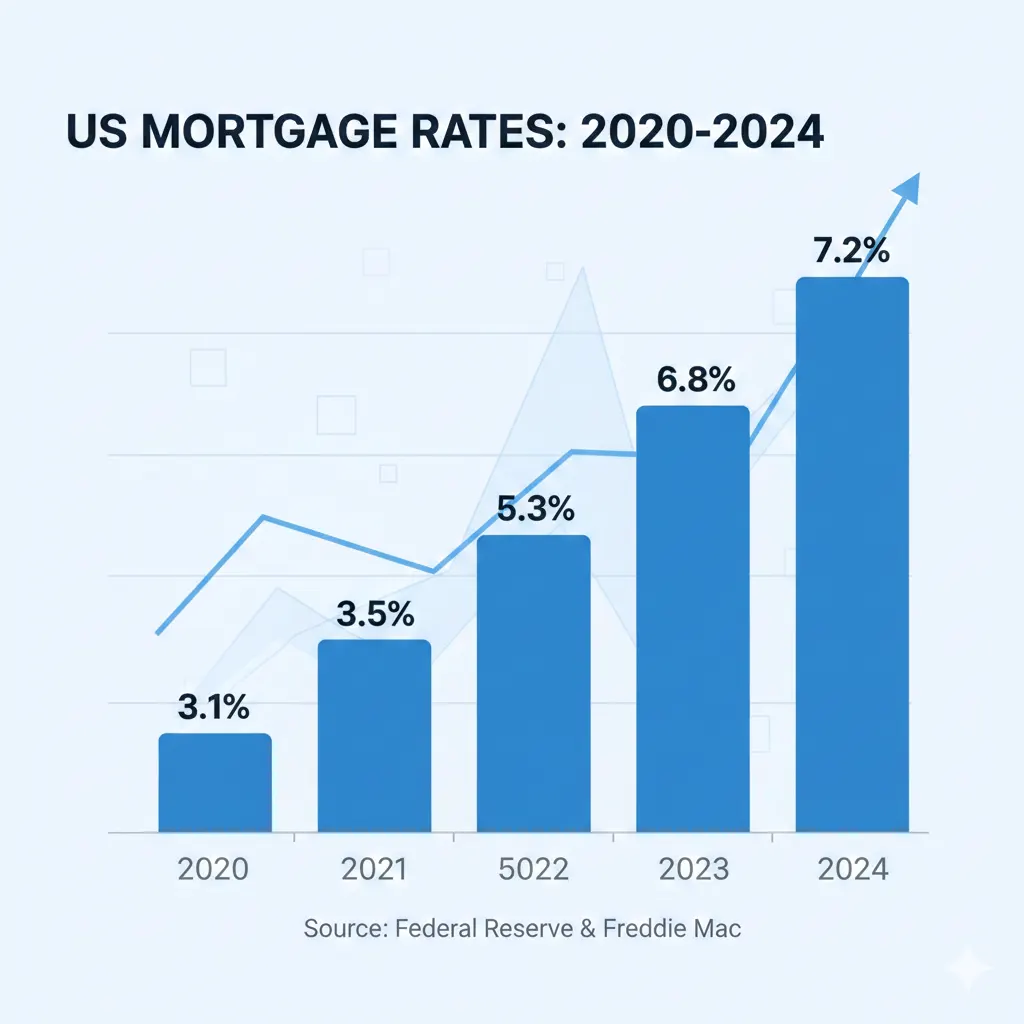

With average 30-year mortgage rates hovering around 7%, and more than 60% of U.S. homeowners locked into mortgages below 4%, the decision to stay put is not emotional—it’s mathematical.

What Is the Lock-In Effect?

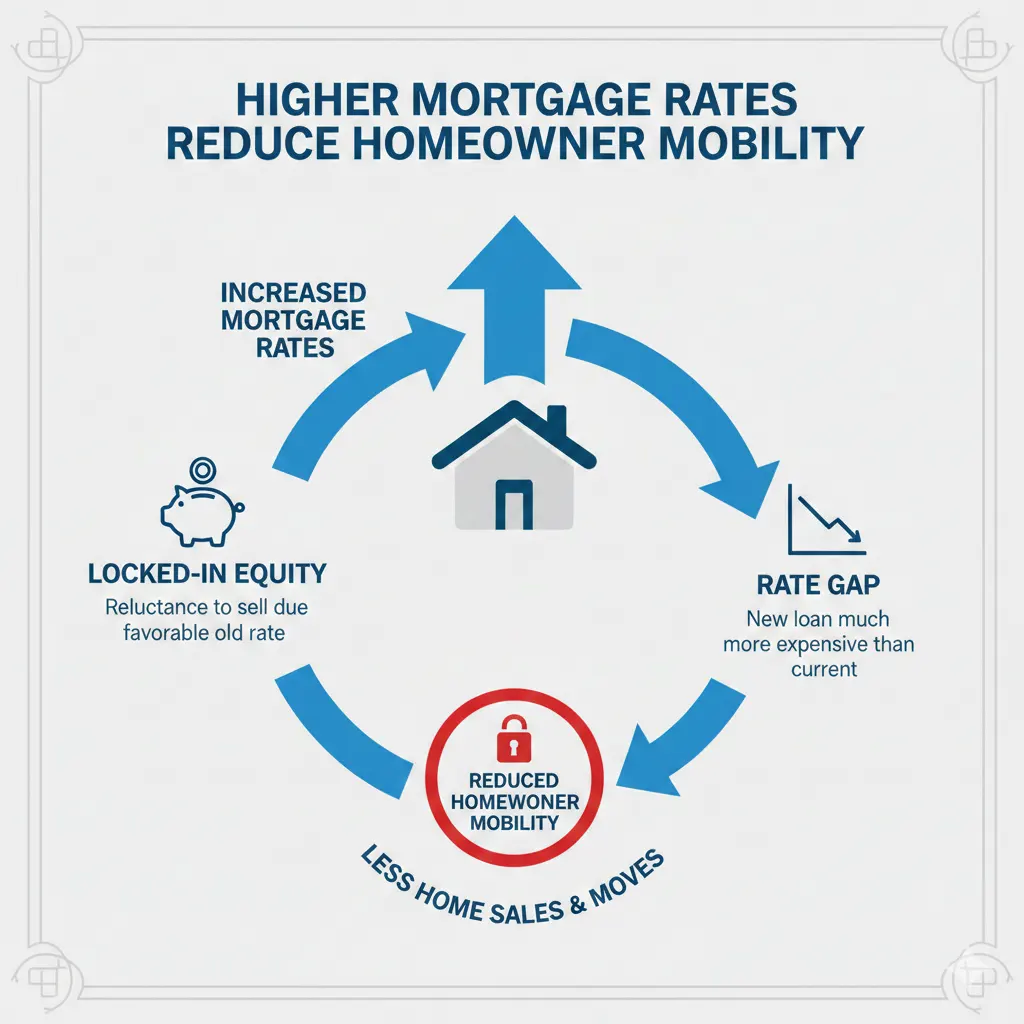

The lock-in effect occurs when homeowners feel financially “trapped” in their current home because selling would require replacing their low mortgage rate with a much higher one. For millions of Americans, that means going from a 3% mortgage to 7%—a difference large enough to add hundreds or thousands of dollars in monthly payments.

This effect has become so widespread that economists now consider it one of the primary structural constraints limiting U.S. housing supply.

Why It Matters

- Homeowners with ultra-low rates won’t sell—even if they want to upgrade or downsize.

- Fewer listings mean intense competition for the homes that do hit the market.

- Prices stay elevated even when demand weakens.

The Math Behind Being “Locked In”

Let’s break it down with a simple example.

- Mortgage on current home: $400,000 at 3%

- Monthly payment: ~$1,686

If that same homeowner buys a new home at current rates:

- Mortgage: $400,000 at 7%

- Monthly payment: ~$2,661

Difference: nearly $1,000 more per month—for the same loan amount.

For many households, this is simply unaffordable, so they stay put.

How the Lock-In Effect Creates a Permanent Inventory Shortage

The lock-in effect has transformed the market in three major ways:

1. Ultra-Low Supply

Existing home listings are near multi-decade lows. Many metro areas are missing 30–50% of the inventory they would normally have.

2. Stalled Mobility for Homeowners

People are delaying life decisions—upsizing, downsizing, relocating—because the financial penalty of moving is too high.

3. Prices Remain High Despite Weaker Demand

Normally, higher interest rates bring down home prices. But the lack of inventory keeps them elevated. Even with rates at 7%, median home prices continue hitting new records in many regions.

Who Is Most Impacted?

- First-time homebuyers facing extreme competition and high prices.

- Move-up buyers who cannot justify swapping a 3% loan for a 7% one.

- Renters because low inventory pushes more people into the rental market.

Will Mortgage Rates Need to Fall to Break the Logjam?

Yes—substantially. Most economists agree that rates must drop into the 5% range before homeowners regain enough incentive to move. Anything above 6% is likely to keep inventory tight.

Until then, expect:

- Fewer listings

- Higher home prices

- Intense bidding wars for desirable properties

- Slower market activity overall

Strategies for Buyers Navigating This Market

While inventory is tight, buyers still have practical strategies:

1. Explore New Construction

Builders are offering rate buydowns and incentives that existing homeowners can’t match.

2. Expand Your Search Radius

Look into emerging suburbs or secondary markets with better supply.

3. Consider Adjustable-Rate Mortgages

If rates eventually fall, refinancing later may reduce long-term costs.

4. Move Fast on Desirable Listings

Well-priced homes in good school districts often receive offers within days.

Internal Resources

Insuring the Uninsurable: Real Estate & Climate Risk

External Sources

Federal Reserve – 30-Year Mortgage Rate Data

NAR – Existing Home Sales Report

Zillow Research – Housing Market Data

Redfin Data Center – Housing Market Trends

The lock-in effect has reshaped the U.S. housing market in ways that may last for years. With millions of homeowners unwilling to trade their historically low rates for today’s 7% loans, the U.S. is facing a structural, long-term inventory crisis.

Until mortgage rates fall meaningfully, the housing market will remain tight—and buyers will need to stay strategic, fast, and flexible.

#HousingMarket #MortgageRates #RealEstate #HomeBuying #USEconomy #HousingCrisis #RealEstateNews #InterestRates #MarketAnalysis