The U.S. housing market is entering a permanent transformation as wildfires, floods, and record-setting storms reshape how homes are valued and insured. This shift—captured by the phrase Insuring the Uninsurable: The Permanent Shift in Real Estate Valuation Due to Climate Risk (Wildfires, Floods, and Premiums)—reflects a new reality where climate risks aren’t temporary; they’re structural.

With more billion-dollar disasters occurring each year, supported by data from NOAA Climate Reports, climate exposure now directly affects a home’s long-term value, insurance cost, and market desirability. Homebuyers, insurers, and lenders across the United States are recalibrating their approach as climate risk becomes a standard part of the property valuation process.

The New Climate Reality Reshaping U.S. Property Values

Climate change now plays a central role in shaping the U.S. housing market. In places where floods, wildfires, and extreme storms are intensifying, home prices are fluctuating dramatically.

How Extreme Weather is Devaluing Homes Across America

States like California, Florida, Texas, and Louisiana are experiencing declining value trajectories due to repetitive weather disasters. Not only do buyers hesitate, but insurers pull back, and lenders raise borrowing requirements.

This combination creates downward pressure on property values, especially in high-risk zones.

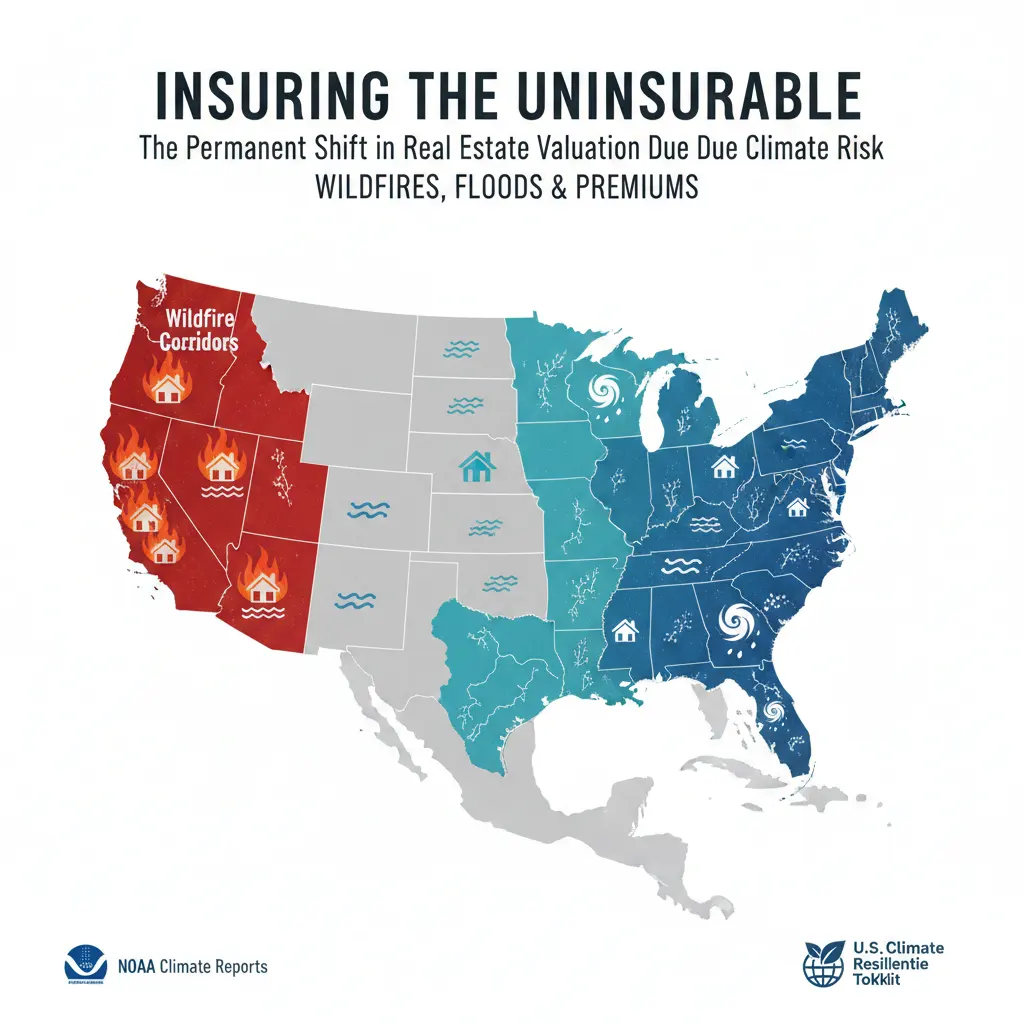

U.S. Regions Most Vulnerable to Wildfires & Floods

Using tools such as the U.S. Climate Resilience Toolkit, homeowners can see that America’s most at-risk areas include:

- Pacific Northwest & California wildfire corridors

- Gulf Coast hurricane & storm surge zones

- Atlantic coast hurricane pathways

- FEMA floodplains throughout the Southeast

These zones experience rapid insurance cost increases and declining buyer interest.

The U.S. Insurance Crisis: Why Homes Are Becoming “Uninsurable”

Insurance companies across the United States are labeling entire regions as too risky to insure.

The Breakdown of Classic Risk-Pooling Models

Traditionally, insurance works by pooling risk across thousands of households. But with extreme weather events striking the same places repeatedly, the losses are no longer spread out—they’re concentrated.

This collapses the old insurance model and leads insurers to increase premiums or leave markets entirely.

Insurer Withdrawals in California, Florida & Louisiana

Major insurance companies have reduced or stopped selling new policies in:

- California — due to catastrophic wildfires

- Florida — because of hurricanes and soaring rebuild costs

- Louisiana — repeated severe storm and flood events

As insurers exit, homeowners are forced to rely on last-resort policies that cost more and cover less.

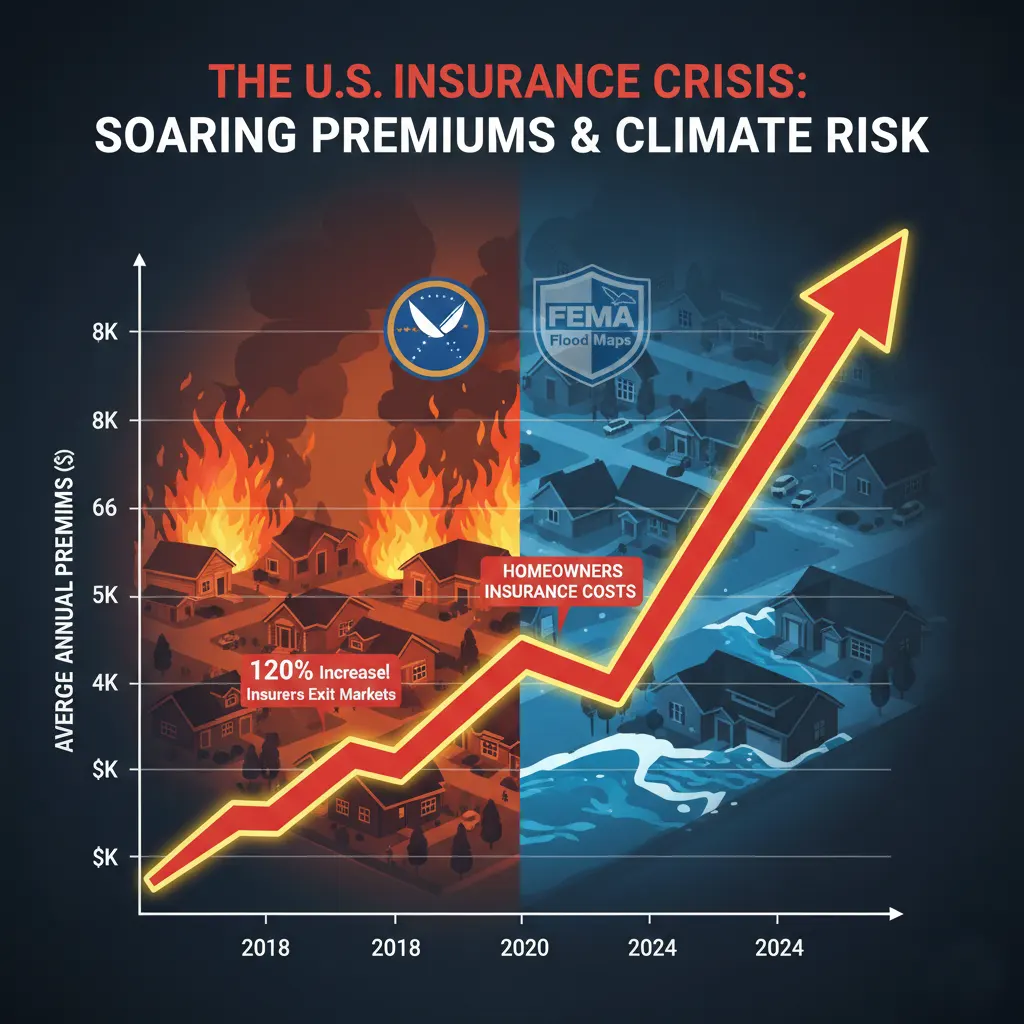

Climate Risks Driving Soaring Premiums in the United States

Insurance premiums are rising faster than inflation in nearly every climate-exposed state.

Impact of FEMA Flood Maps on Home Values

FEMA flood maps determine which homes must carry flood insurance. When a property falls into a Special Flood Hazard Area (SFHA), buyers face:

- Higher premiums

- Mandatory insurance requirements

- Stricter loan conditions

This lowers buyer demand and depresses long-term value.

Weather Trend Data from NOAA Climate Reports

NOAA shows that:

- Mega-wildfires have doubled

- Heatwaves last longer

- Category 4–5 hurricanes are more frequent

- Extreme rainfall events are increasing

Each trend pushes premiums higher and reduces market confidence.

The Hidden Housing Crisis: Premium Inflation and Affordability

Premium inflation represents one of America’s biggest—but least talked about—housing crises.

When Insurance Costs Surpass Mortgage Payments

In some wildfire or hurricane-prone ZIP codes, homeowners pay more for insurance than for their mortgage. This makes homes unaffordable even if prices fall.

Buyer Demand Declines in High-Risk ZIP Codes

High premiums scare buyers away. Over time:

- Fewer offers

- Longer days on market

- Lower resale value

This cycle creates long-term neighborhood decline.

New U.S. Real Estate Valuation Models in the Climate Era

Appraisers and lenders are rewriting how value is calculated.

Risk-Based Appraisal Standards

Modern appraisals incorporate:

- Long-term climate risk

- Insurance availability

- Premium volatility

- Past disaster frequency

Lender Policy Changes Based on Climate Exposure

Lenders increasingly require:

- Multi-year insurance guarantees

- Flood policies for borderline zones

- Higher down payments in high-risk areas

These changes affect affordability and long-term valuation.

Winners & Losers: U.S. Real Estate Market Shifts

Climate Haven States Attracting New Buyers

Safer states gaining value include:

- Michigan

- Minnesota

- Wisconsin

- Ohio

- Pennsylvania

These areas are seeing price increases due to climate migration.

Coastal Declines Backed by NAR Research

The National Association of Realtors reports declining demand in:

- Coastal Florida

- Gulf Coast communities

- Fire-prone Western states

This confirms long-term price stagnation in high-risk zones.

Protecting Home Value: Climate Resilience for Homeowners

Fire-Resistant and Flood-Resistant Home Upgrades

Examples include:

- Class A fire-rated roofing

- Ember-resistant venting

- Fire-safe siding

- Elevated foundations

- Sump pumps and flood vents

These upgrades help reduce premiums and maintain resale value.

Federal Grants from FEMA’s BRIC Program

The BRIC program helps homeowners:

- Improve wildfire resistance

- Strengthen flood protection

- Retrofit critical home systems

These grants reduce out-of-pocket expenses.

The Future of U.S. Property Insurance

Parametric Insurance

This innovative model pays automatically when a weather threshold is met (wind speed, rainfall, fire boundary), allowing:

- Faster payouts

- Lower admin costs

- Broader coverage

State-Level Risk Sharing Innovations

States are experimenting with:

- Regional risk pools

- Catastrophe bonds

- Public–private insurance models

These may redefine insurance in high-risk zones.

FAQs

1. Why are homes becoming uninsurable in the U.S.?

Because insurers face repeated losses from wildfires, hurricanes, and floods.

2. How do rising premiums affect property values?

High premiums reduce buyer affordability, lowering demand and value.

3. Which states are most affected by climate-driven insurance changes?

California, Florida, Texas, and Louisiana.

4. Can homeowners reduce premiums?

Yes—retrofits and mitigation measures can help significantly.

5. Are inland states safer for long-term investment?

Generally yes, supported by FEMA and NOAA data.

6. Is climate migration happening in the U.S.?

Yes—millions are gradually moving to lower-risk regions.

The United States is facing a lasting shift in real estate valuation as insurance costs rise and climate disasters accelerate. Insuring the Uninsurable: The Permanent Shift in Real Estate Valuation Due to Climate Risk (Wildfires, Floods, and Premiums) reflects a structural transformation affecting every homeowner, buyer, and investor. With insurers pulling out, premiums skyrocketing, and climate models predicting further volatility, resilience and informed decision-making are more important than ever.

#ClimateRisk #RealEstateUSA #HomeInsuranceCrisis #WildfireRisk #FloodZones #FEMA #NOAA #HousingMarketUSA #InsurancePremiums #ClimateMigration #PropertyValuation #ResilientHousing