The United States and China are racing toward the future—but they are running on very different tracks. The U.S. continues to dominate global capital markets, technology platforms, and financial innovation. China, meanwhile, is investing heavily in physical infrastructure, industrial capacity, and long-term technological systems.

This contradiction is increasingly described by economists as the innovation paradox: America captures value, while China builds capability.

America’s Innovation Model: Monetize First, Build Later

America excels at turning ideas into money. Its core advantage lies in financialization, intellectual property, and platform-driven business models.

- Big Tech monetizes data and attention

- Wall Street turns innovation into tradable assets

- Startups optimize for growth, valuation, and exits

From Silicon Valley to Wall Street, the U.S. innovation engine is optimized for shareholder value. Apps scale faster than factories, and software outperforms manufacturing in margins.

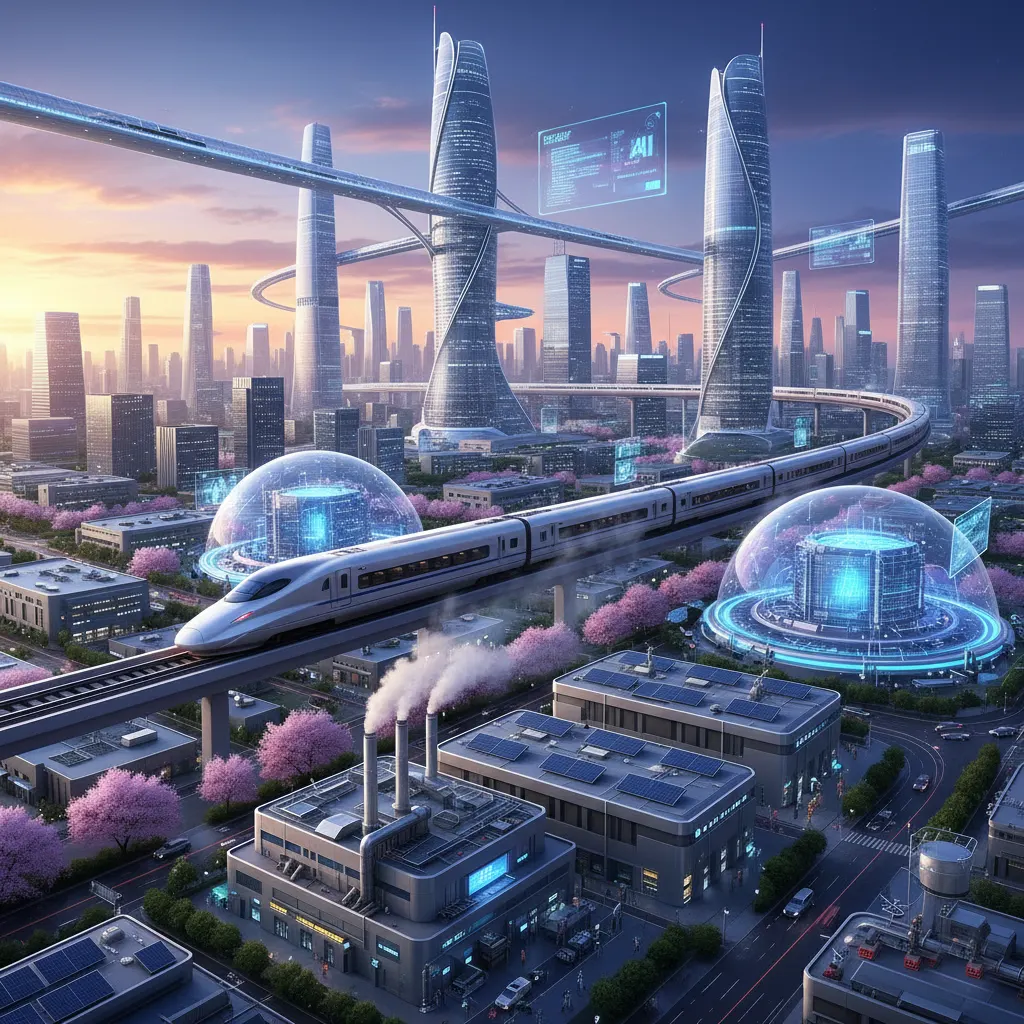

China’s Innovation Model: Build First, Profit Later

China has taken a fundamentally different approach. Instead of prioritizing short-term returns, it invests in national infrastructure and long-term industrial capacity.

- High-speed rail and logistics networks

- Advanced manufacturing and industrial robotics

- AI, semiconductors, and energy systems

Many of these projects sacrifice short-term profitability to gain scale, resilience, and strategic independence—advantages that compound over decades.

Why America Still Wins—For Now

Despite concerns over deindustrialization, the U.S. remains dominant in critical areas:

- The global reserve currency system

- Venture capital and private equity

- Software, cloud computing, and digital ecosystems

As long as the dollar anchors global trade and U.S. firms control digital platforms, America can remain wealthy without building everything domestically.

The Risk Hidden in the Paradox

The danger is structural rather than immediate.

Long-term reliance on offshore production risks weakening:

- Supply chain resilience

- Industrial skills and workforce depth

- Technological sovereignty

China’s strategy emphasizes self-sufficiency. America’s strategy emphasizes return on capital. Both work—until global shocks test the system.

What the Future Likely Looks Like

The coming decade will measure not just wealth, but resilience.

America is likely to dominate finance, software, and high-margin innovation. China may dominate infrastructure, manufacturing, and applied technology.

The real question is whether wealth without production can endure in a fragmented global economy.

Two Paths, One Global System

The innovation paradox reveals a deeper truth: there is more than one way to build power.

America extracts value from the world. China builds the systems the world depends on.

For now, both models coexist. History suggests that when wealth and capability diverge for too long, the balance eventually shifts.

#Innovation #ChinaVsUS #GlobalEconomy #FutureOfTech #Geopolitics #Infrastructure #ArtificialIntelligence #Economics