After years of caution, stalled deal-making, and regulatory uncertainty, global mergers and acquisitions (M&A) activity is showing clear signs of revival. As 2026 unfolds, analysts and investors alike are asking the same question: Is this the year of the megamerger?

From technology and energy to healthcare and financial services, deal volumes are climbing toward levels last seen before the pandemic—signaling a renewed appetite for consolidation in boardrooms worldwide.

What the Data Says About the M&A Rebound

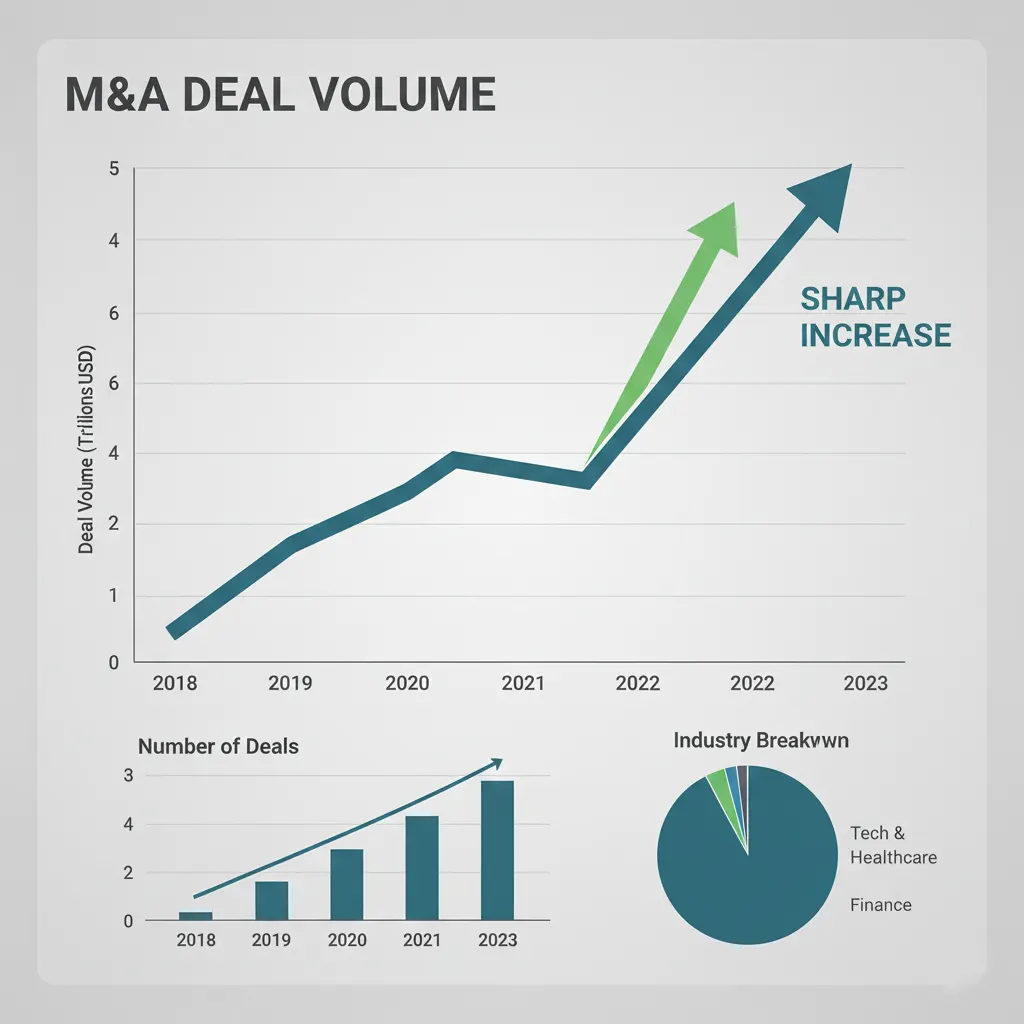

Global deal activity slowed dramatically during the pandemic and the high-interest-rate cycle that followed. But recent figures suggest momentum is shifting.

According to Bloomberg’s M&A market data, announced deal volumes have steadily increased over the past several quarters, with multiple transactions exceeding the $10 billion mark.

This rebound reflects not just pent-up demand, but improving macroeconomic conditions that make large-scale acquisitions more feasible.

Why Megamergers Are Back on the Table

Several forces are converging to reignite M&A activity in 2026.

1. Stabilizing Interest Rates

With central banks signaling a pause—or reversal—in aggressive rate hikes, the cost of capital has become more predictable. As noted by the U.S. Federal Reserve, financial conditions are easing enough to support long-term investment decisions.

2. Strong Corporate Balance Sheets

Many large corporations entered 2026 with record cash reserves after years of conservative spending. This financial flexibility makes all-cash and mixed-structure deals more attractive.

3. Strategic Pressure to Scale

In highly competitive sectors, scale matters. Consulting firm McKinsey & Company notes that companies increasingly view acquisitions as the fastest route to growth, market share, and technological capability.

Industries Leading the Megamerger Wave

Not all sectors are rebounding equally. The strongest M&A activity is concentrated in a few key industries.

- Technology & AI: Platform consolidation and data acquisition

- Energy: Traditional firms acquiring renewables and infrastructure

- Healthcare: Scale-driven mergers among providers and biotech firms

- Financial Services: Banks and fintechs pursuing efficiency and reach

According to PwC’s global deals outlook, these sectors are best positioned to justify megadeals despite regulatory scrutiny.

Regulatory Risks Still Loom Large

While deal appetite is growing, megamergers face heightened antitrust oversight. Regulators in the U.S. and Europe remain cautious about market concentration.

The Federal Trade Commission and international counterparts have made clear that large acquisitions will undergo rigorous review, particularly in technology and healthcare.

As a result, companies are structuring deals more carefully—often divesting assets preemptively to gain approval.

What This Means for Investors

For investors, a return to pre-pandemic M&A levels can create both opportunity and risk.

- Target companies may see short-term valuation premiums

- Acquirers face execution and integration risks

- Entire sectors can re-rate based on consolidation trends

Research from S&P Global Market Intelligence suggests that disciplined acquirers with clear strategic goals tend to outperform following major deals.

Is 2026 Truly the Year of the Megamerger?

While it may be too early to declare a full return to peak M&A excess, the signs are unmistakable: confidence is rising, capital is loosening, and strategic urgency is back.

If economic stability holds and regulatory outcomes become more predictable, 2026 could indeed mark the year when megamergers reclaim center stage in global business.

The resurgence of large-scale M&A reflects more than just deal-making enthusiasm—it signals a broader shift in corporate strategy after years of disruption.

Whether this momentum results in lasting value or short-lived consolidation will depend on execution, regulation, and the global economic backdrop. For now, one thing is clear: the era of cautious corporate silence is ending.

#Megamerger #MergersAndAcquisitions #MAndA #BusinessNews #FinanceNews #GlobalMarkets #CorporateStrategy