When it comes time to pay your IRS payment in 2026, most taxpayers instinctively choose IRS Direct Pay from a bank account. It feels simple, safe, and fee-free.

But here’s the surprise: for some taxpayers, using a credit card to pay the IRS may actually save money—or at least provide meaningful financial advantages—despite processing fees.

Here’s how IRS payments work in 2026, when credit cards make sense, and why Direct Pay isn’t always the smartest option.

How IRS Payments Work in 2026

The IRS allows taxpayers to pay federal taxes through several approved methods, including:

- IRS Direct Pay (from a bank account)

- Debit card payments

- Credit card payments via IRS-approved processors

- IRS payment plans

Direct Pay remains fee-free, while card payments come with processing fees set by third-party providers. That fee is why many people automatically dismiss credit cards.

The Real Cost of Paying the IRS with a Credit Card

In 2026, IRS-approved processors typically charge:

- Credit cards: ~1.85% to 1.98% of the payment

- Debit cards: Flat fee (usually under $3)

On a $5,000 tax bill, a 1.87% fee equals about $94. At first glance, that sounds like wasted money.

When a Credit Card Can Actually Save You Money

1. Sign-Up Bonuses Can Offset Fees

Many rewards credit cards offer sign-up bonuses worth $500–$1,000+ if you meet a minimum spending requirement. Using an IRS payment to hit that threshold can make the processing fee irrelevant.

For example, paying $4,000 in taxes with a card to earn a $750 bonus is a net win—even after fees.

2. Valuable Rewards and Points

Premium travel and cash-back cards can earn 1.5%–2%+ in value. In some cases, rewards earned nearly cancel out the IRS fee.

Cards tied to airline miles or flexible travel points can produce outsized value if redeemed strategically.

3. Cash Flow and Timing Flexibility

Credit cards buy time. If you pay the IRS in April but don’t owe interest until your statement due date, you effectively get a short-term, interest-free loan.

This can be helpful if you’re managing uneven income or waiting on cash.

4. Avoiding IRS Installment Interest

IRS payment plans charge interest plus penalties. In some scenarios, a 0% APR credit card for 12–18 months can be cheaper than an IRS installment agreement.

When Direct Pay Is Still the Better Choice

Using a credit card isn’t always smart. Direct Pay usually wins if:

- You carry a credit card balance

- You won’t earn bonuses or meaningful rewards

- You’re tempted to delay repayment

- Your tax bill is very large and fees become excessive

Direct Pay is simple, final, and risk-free.

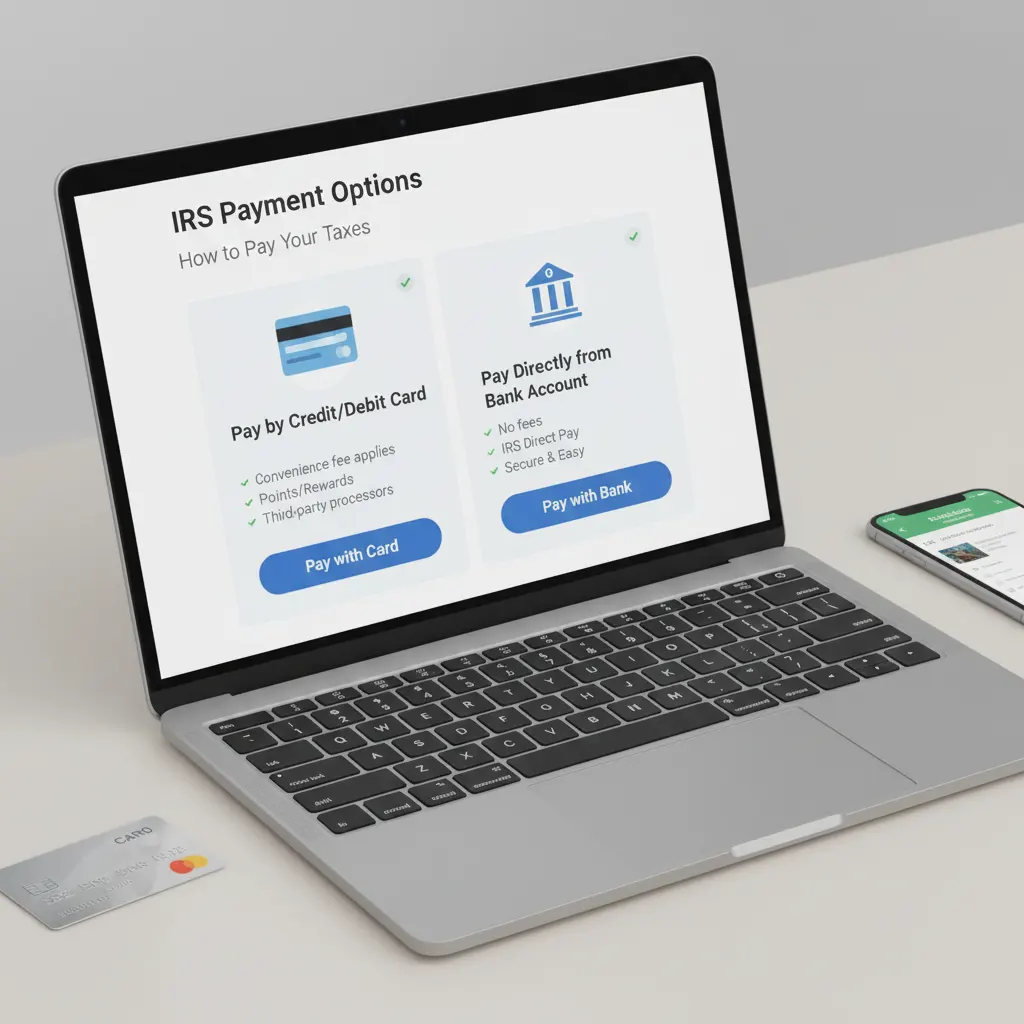

How to Pay the IRS with a Credit Card Safely

If you choose a credit card, follow these best practices:

- Use only IRS-approved processors

- Confirm total fees before submitting payment

- Pay the card balance off immediately if possible

- Track rewards vs fees carefully

You can find official payment options directly on the IRS Payments page.

For most taxpayers, IRS Direct Pay remains the safest default.

But in 2026, using a credit card to pay your IRS bill can be a smart financial move if—and only if—you leverage bonuses, rewards, or 0% APR offers responsibly.

The key isn’t avoiding fees at all costs. It’s understanding the trade-offs and choosing the option that works best for your situation.

#IRSPayment #TaxTips #PersonalFinance #PayTaxes #IRS #MoneySmart #FinancialPlanning #CreditCards