Oil stocks are surging today as global markets react to dramatic developments surrounding Venezuela’s oil sector. From geopolitical shocks to renewed speculation about access to the world’s largest proven crude reserves, investors are rapidly repositioning across the energy sector.

Major oil producers, drilling companies, and oilfield service firms are seeing sharp gains, even as crude prices move only modestly. Here’s what’s driving the rally — and why markets are reacting so aggressively.

1. Venezuela Back in the Global Oil Spotlight

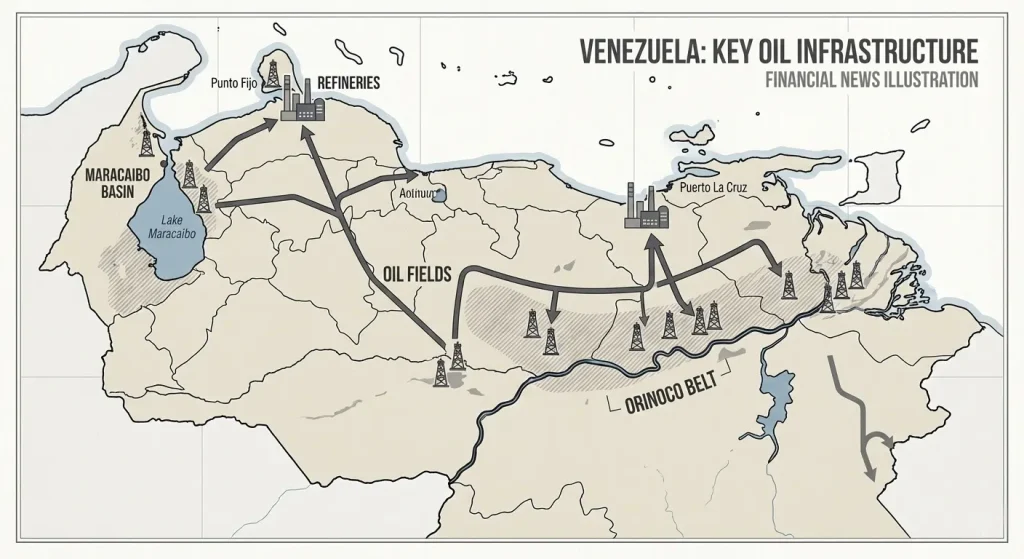

Venezuela holds the largest proven oil reserves in the world, yet years of sanctions, underinvestment, and political instability left its production capacity crippled.

Recent developments involving U.S. political intervention and renewed discussions around Venezuelan crude exports have triggered a reassessment of future supply dynamics. Even the possibility of increased output has been enough to send shockwaves through oil markets.

For investors, Venezuela represents both risk and opportunity — and markets are clearly pricing in the upside.

2. Supply Disruption Fears Are Lifting Oil Prices

According to Reuters energy market coverage, oil prices are rising on concerns about potential supply disruptions linked to Venezuela and other geopolitically sensitive producers.

When traders perceive any threat to global supply, oil markets typically add a risk premium. That premium flows directly into the share prices of energy companies, especially those with upstream exposure.

- Lower expected supply = higher crude prices

- Higher crude prices = stronger oil company margins

- Stronger margins = rising stock valuations

3. U.S. Oil Companies Seen as Key Beneficiaries

Investors are betting that U.S.-based energy giants could play a major role if Venezuelan oil assets are reopened to international investment.

Companies frequently mentioned by analysts include:

- Chevron

- Exxon Mobil

- ConocoPhillips

- Oilfield services leaders like SLB (Schlumberger) and Halliburton

These firms have the technical expertise, capital strength, and historical exposure needed to help rebuild Venezuela’s oil infrastructure — a process that could take years but promises substantial long-term revenue.

4. Why Oil Stocks Are Rising Even Faster Than Oil Prices

Interestingly, energy stocks are outperforming crude prices themselves. According to analysis from Barron’s, this disconnect highlights how much of today’s rally is driven by expectations rather than immediate fundamentals.

Markets are forward-looking. Traders are pricing in:

- Future production access

- Reconstruction contracts

- Higher long-term global demand

- Reduced geopolitical uncertainty over time

This speculative optimism is especially powerful in capital-intensive sectors like energy.

5. The Risks Investors Are Still Watching

Despite today’s rally, analysts caution against excessive optimism.

Key risks include:

- Severely degraded Venezuelan oil infrastructure

- Potential policy reversals or renewed sanctions

- Long timelines before meaningful production increases

- Future oversupply that could pressure oil prices

As noted by multiple energy analysts, Venezuela cannot instantly return to peak production levels — rebuilding output could take several years and billions in investment.

Oil stocks are skyrocketing today because Venezuela is once again reshaping the global energy narrative. The combination of geopolitical shocks, supply risk premiums, and speculation around unlocking massive oil reserves has reignited investor appetite across the energy sector.

While today’s rally is driven largely by expectations rather than immediate output gains, Venezuela’s reemergence as a potential oil powerhouse could have lasting implications for global markets — and for energy investors willing to navigate the volatility.

#OilStocks #EnergyStocks #VenezuelaOil #CrudeOil #GlobalMarkets #StockMarketNews #Investing #FinancialNews