The S&P 500 surged to fresh record highs this morning, extending a rally that has carried U.S. equities into the new year with strong momentum. However, as markets celebrate new peaks, investors are asking a familiar question: is this rally sustainable?

Two main forces appear to be driving today’s gains. On one hand, traders are leaning into the seasonal January Effect. On the other, markets are positioning ahead of the closely watched U.S. Consumer Price Index (CPI) data, due tomorrow.

What’s Driving the S&P 500 to New Highs?

Early-year optimism has lifted stocks across multiple sectors, with technology and growth shares leading the advance. According to reporting from AP News market coverage, strong labor data and resilient consumer spending have reinforced confidence that the U.S. economy can avoid a sharp slowdown.

Meanwhile, large-cap stocks have continued to attract institutional flows, helping push major indexes higher even as valuations stretch.

The January Effect: Seasonal Tailwind or Market Myth?

The January Effect refers to the tendency for stocks to rise during the first month of the year, often attributed to renewed investor allocations and year-end tax-loss selling reversals.

Historically, January strength has sometimes signaled positive momentum for the rest of the year. However, as noted by Investopedia’s January Effect analysis, the pattern is inconsistent and far from guaranteed.

Still, traders often respond to the perception of seasonality. As a result, buying pressure can become self-reinforcing in the short term.

Why January Momentum Matters

- Fresh capital allocations at the start of the year

- Improved investor sentiment after year-end rebalancing

- Short-term momentum strategies amplifying gains

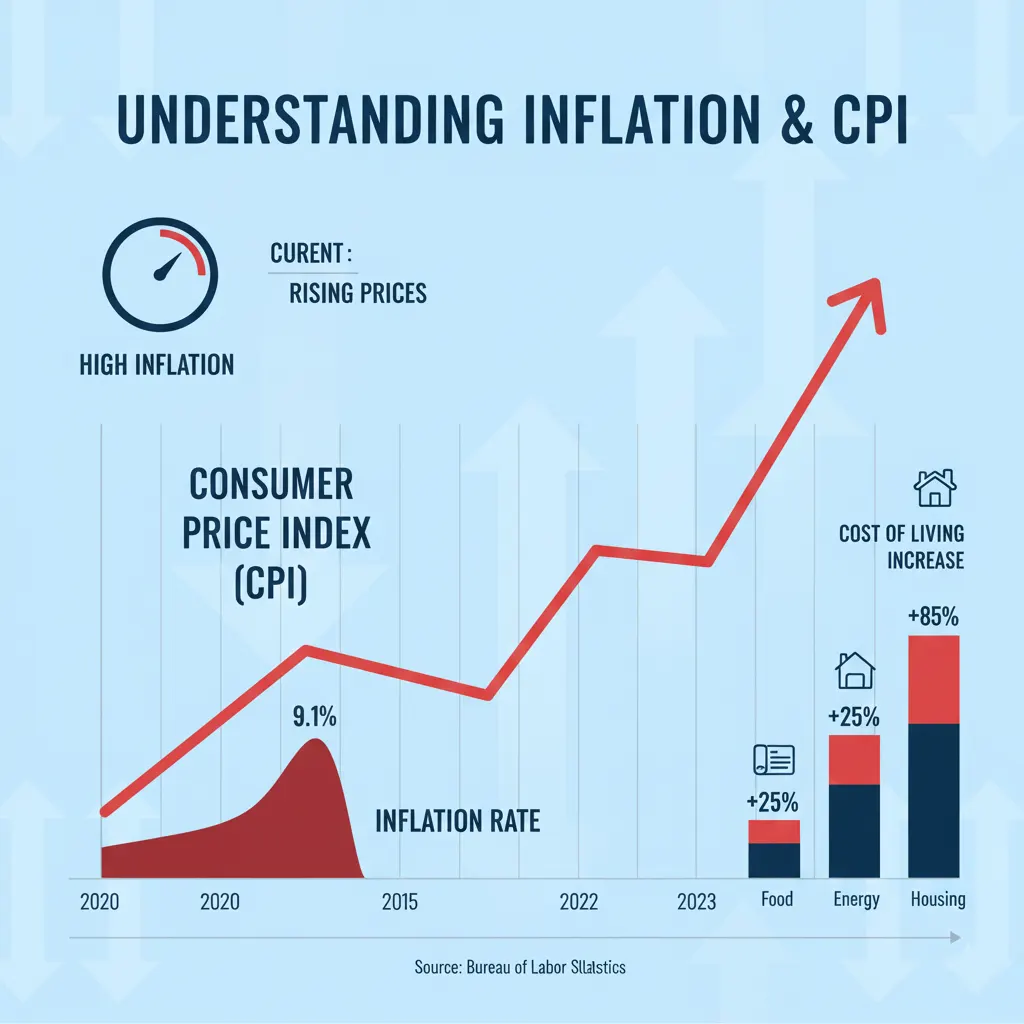

All Eyes on CPI Inflation Data

Beyond seasonal factors, the rally appears closely tied to expectations surrounding tomorrow’s CPI inflation report. Markets are betting that inflation will continue to cool, reinforcing the case for future interest rate cuts.

According to Reuters market analysis, even a modest downside surprise in CPI could further fuel equity gains by easing pressure on Federal Reserve policy.

However, the risk is asymmetric. A hotter-than-expected inflation print could quickly reverse today’s optimism and trigger profit-taking.

Why CPI Matters Right Now

- Shapes expectations for Federal Reserve interest rate policy

- Influences bond yields and equity valuations

- Impacts high-growth and technology stocks the most

Is the Rally on Solid Ground?

While today’s record highs reflect optimism, some analysts urge caution. Valuations across parts of the market remain elevated, and earnings growth will need to catch up to justify current prices.

Strategists cited by CNBC Markets warn that rallies driven by expectations rather than confirmed data can be vulnerable to sudden reversals.

That said, strong balance sheets, easing inflation trends, and continued consumer resilience provide meaningful support beneath the market.

What Investors Should Watch Next

As the week unfolds, sustainability will depend less on headlines and more on follow-through. Key signals include inflation trends, corporate earnings guidance, and bond market reactions.

The S&P 500’s record highs reflect a market caught between confidence and caution. The January Effect may be adding momentum, while CPI anticipation is amplifying optimism.

Ultimately, whether this rally is sustainable will depend on tomorrow’s inflation data — and how convincingly the economy continues to defy slowdown fears.

#SP500 #StockMarket #WallStreet #JanuaryEffect #CPIData #MarketRally #InvestingNews