Wall Street is on edge ahead of the rescheduled U.S. jobs report, now set for release this Wednesday. The unusual delay of January’s labor data has injected fresh uncertainty into both the stock and housing markets, with investors preparing for potential volatility—or even a sharp market correction.

Why the Jobs Report Was Delayed

The monthly employment report, normally released by the U.S. Bureau of Labor Statistics (BLS), was postponed due to data processing issues. While officials insist the delay does not reflect data quality problems, markets rarely respond calmly to uncertainty.

According to economists cited by CNBC, any disruption to high-impact economic data can amplify speculation about hidden weakness or unexpected strength.

Why Investors Are Nervous Right Now

The timing could not be worse. Stocks are trading near record levels, bond yields remain elevated, and housing affordability continues to strain buyers. Investors fear that a surprise in labor data could force a rapid repricing of risk.

Market strategists at Bloomberg note that delayed data often increases volatility because traders lack clarity on the Federal Reserve’s next move.

The Housing Market Is Watching Closely

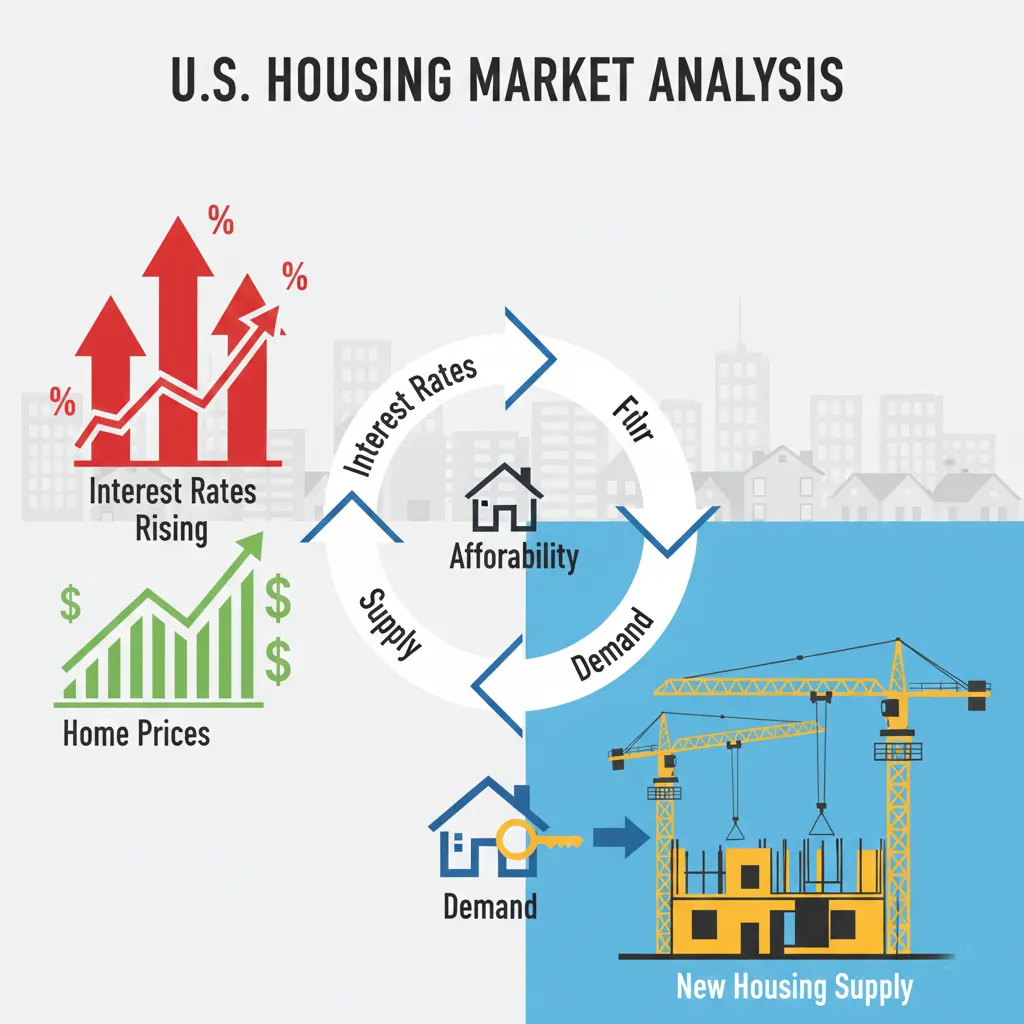

The housing sector has become especially sensitive to labor data. Strong job growth could push mortgage rates higher, while weak numbers could signal slowing demand.

Recent analysis from Realtor.com Research shows that even small shifts in rate expectations can quickly affect buyer activity and home prices.

What the Fed Might Do With the Data

Federal Reserve officials have repeatedly said they remain “data dependent.” A stronger-than-expected jobs report could delay rate cuts, while weaker numbers might revive hopes for policy easing.

As explained in recent commentary by the Federal Reserve and coverage from The Wall Street Journal, labor market strength remains one of the Fed’s primary inflation indicators.

Why “Market Correction” Is Trending

On platforms like X and Reddit’s investing forums, traders are openly debating whether markets have become too complacent.

After months of gains, even a modest surprise could trigger profit-taking. Analysts warn that corrections often begin when confidence feels highest.

What Investors Should Watch on Wednesday

- Nonfarm payroll growth compared to expectations

- Changes in the unemployment rate

- Wage growth trends

- Market reaction in bonds and rate-sensitive stocks

Whether the report confirms economic strength or reveals cracks, its delayed release has already raised the stakes. By midweek, markets may finally get the clarity they’ve been missing.

#JobsReport #MarketCorrection #StockMarket #HousingMarket #EconomicData #InvestorSentiment