Tax season has officially begun in the United States, and many filers are searching for ways to maximize their refunds. The IRS 2026 filing season opened in late January, and taxpayers are now preparing to submit their 2025 returns ahead of the April 15 deadline. With several recent tax law updates and procedural shifts, here are the top 5 changes this year that could significantly impact your refund.

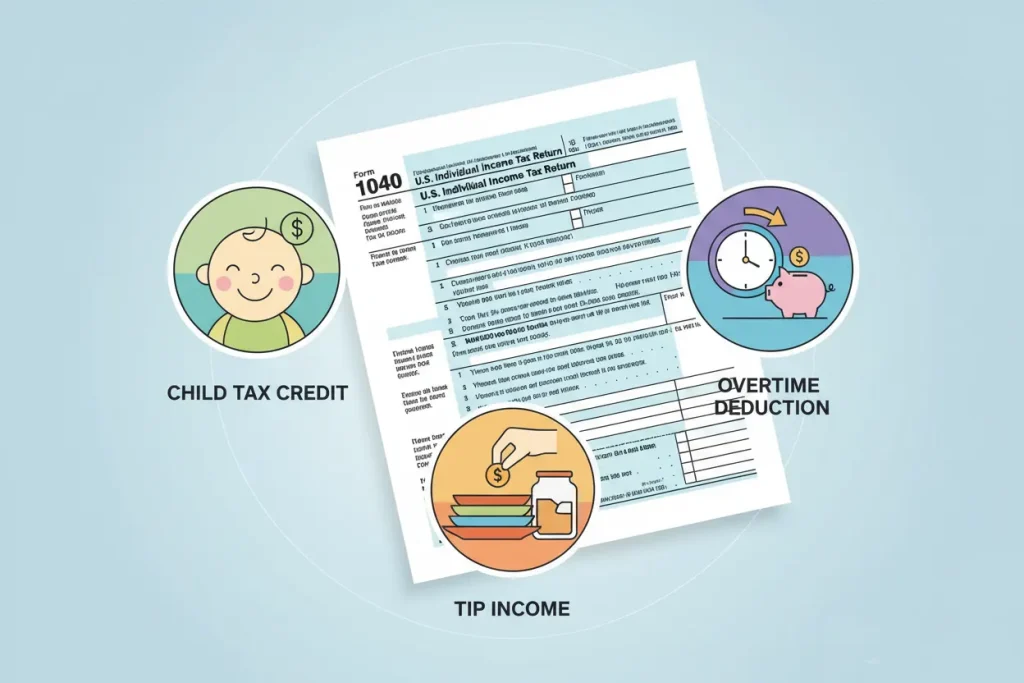

1. Expanded Deductions Under the “One Big Beautiful Bill”

The new tax law commonly referred to as the One Big Beautiful Bill Act introduced broad changes designed to reduce taxable income for many filers. These include higher standard deduction amounts and expanded deductions for tips, overtime, auto loan interest, and senior taxpayers. According to estimates, these adjustments could translate into larger refunds for eligible families.

2. Increased Credits for Families and Workers

Refundable and partially refundable credits such as the Earned Income Tax Credit (EITC) and Child Tax Credit have been expanded for 2026. For example, the Child Tax Credit now tops $2,200 per eligible child, helping many families reduce their tax liability and boost refunds.

3. Direct Deposit and Faster Refund Processing

The IRS encourages taxpayers to choose direct deposit and e-file options to speed processing and receive refunds more quickly. When you e-file and use direct deposit, most refunds are issued within about 21 days. Tools like “Where’s My Refund?” on IRS.gov and the IRS2Go app help you track your refund status throughout the process.

4. Paper Refund Checks Are Being Phased Out

The IRS has begun phasing out paper refund checks as part of a modernization initiative. As of late 2025, the IRS requires most individual taxpayers to receive refunds via direct deposit or another electronic payment method, which can reduce delays and lost checks.

5. Changes in Filing Tools and Deadlines

Notably, the IRS has discontinued its government-run Direct File program for 2026, meaning taxpayers must file for free through Free File software or tax professionals. Filers should also gather all necessary records — such as W-2s, 1099s, and other income documents — before submitting returns.

Tips to Maximize Your Refund

To make the most of these updates:

- Organize your tax documents early, including all incomes, deductions, and credits.

- File electronically and select direct deposit for the fastest refund delivery.

- Review eligibility for all expanded deductions and credits under new law provisions.

- Use IRS online tools and calculators to check your refund status and avoid errors.

As tax laws and procedures continue to evolve, staying informed on changes and taking advantage of every deduction and credit can help maximize your refund this year.

#IRSTaxFiling2026 #TaxRefundTips #TaxSeason2026 #IRSUpdates #TaxCredits #TaxDeductions #TaxStrategy #digitalnewsforall