The Federal Reserve has pushed anticipated rate cuts to July 2026. For first-time homebuyers, that delay changes the math.

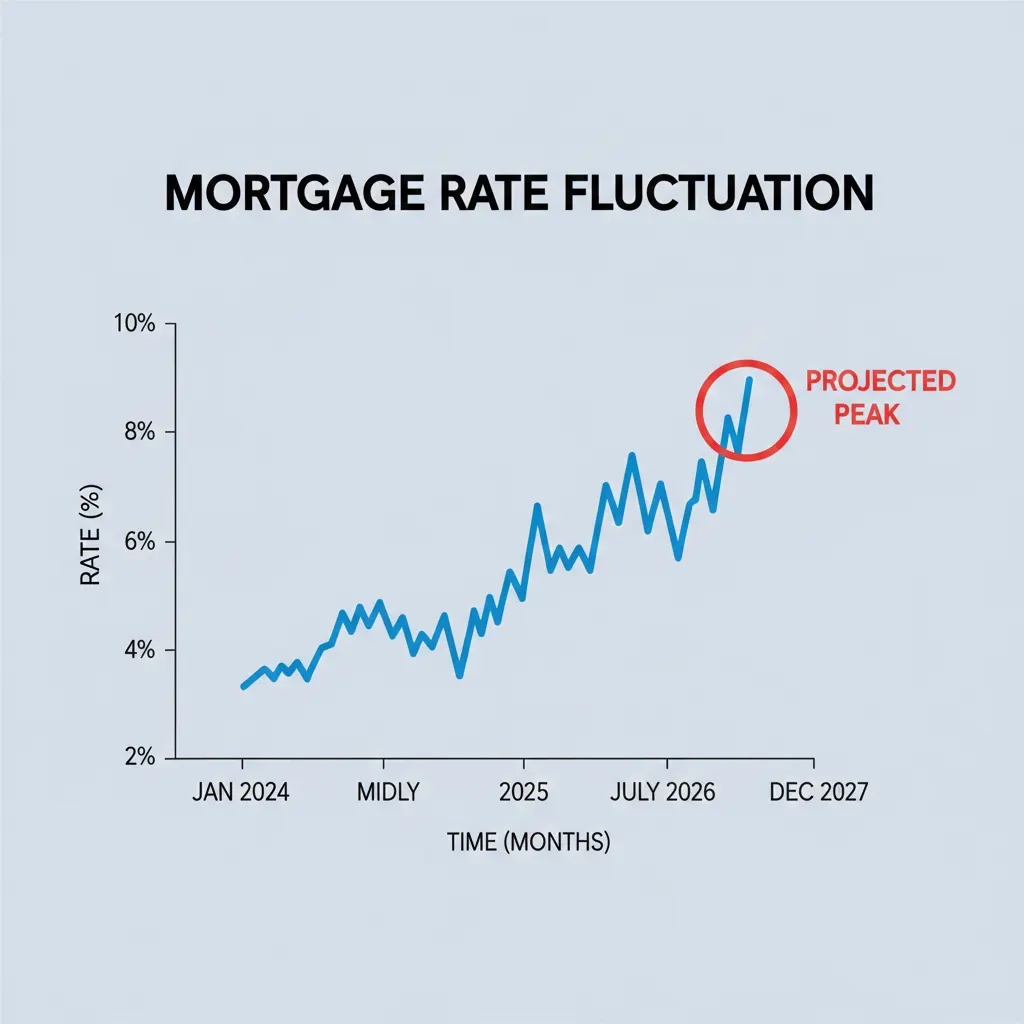

Mortgage rates have already fluctuated throughout early 2026. Now, with the Fed signaling patience, buyers face a key decision: lock in a rate now or wait for potential cuts this summer?

This guide breaks down what the July pivot means — and how to think strategically about your next move.

Why the Fed Delayed the Rate Cut

The Federal Reserve adjusts the federal funds rate to manage inflation and employment. According to recent statements and economic data releases, inflation remains sticky.

Therefore, policymakers are holding rates steady longer than expected.

Although the Fed does not directly set mortgage rates, its policy strongly influences them. Financial markets — including Treasury yields — respond immediately to Fed guidance.

For broader housing data trends, reports from the National Association of Realtors show inventory slowly improving but affordability remaining tight.

How Fed Policy Affects Mortgage Rates

Mortgage rates are closely tied to the 10-year Treasury yield. When investors anticipate rate cuts, yields typically fall. However, if cuts are delayed, rates may stay elevated.

Data from Freddie Mac’s Primary Mortgage Market Survey shows rates remain sensitive to inflation expectations.

Consequently, waiting for July does not guarantee significantly lower rates.

Option 1: Lock in Your Mortgage Rate Now

Locking your rate protects you from unexpected increases. If economic data surprises markets, rates could rise before July.

Pros:

- Payment certainty

- Protection against inflation shocks

- Faster closing timeline

Cons:

- You may miss a small drop if rates fall later

Many lenders allow rate locks for 30–60 days. Some even offer “float-down” options if rates improve.

Option 2: Wait for the July Rate Cut

If the Fed cuts rates in July, mortgage rates could trend downward. However, markets often price in anticipated cuts ahead of time.

Additionally, if lower rates stimulate demand, home prices may rise. Therefore, you could save on interest but pay more for the property itself.

Housing economists cited by Reuters Markets warn that buyer competition may intensify quickly after rate relief.

Payment Example: Why Timing Matters

On a $400,000 mortgage:

- At 7.0% interest: Approx. $2,661/month (principal & interest)

- At 6.5% interest: Approx. $2,528/month

That difference equals roughly $133 per month. Over 30 years, the savings become meaningful.

However, if home prices rise 3–5% due to renewed demand, that gain could offset rate savings.

What First-Time Buyers Should Consider

- Your budget stability: Can you comfortably afford current payments?

- Refinancing flexibility: Could you refinance later if rates drop?

- Market competition: Will waiting increase bidding wars?

- Credit score: Higher scores secure better rate tiers

The Consumer Financial Protection Bureau recommends focusing on long-term affordability rather than short-term speculation.

The Refinance Strategy

Some buyers are adopting a “marry the house, date the rate” mindset.

This strategy involves buying now and refinancing later if rates fall significantly.

However, refinancing comes with closing costs. Therefore, calculate break-even timelines carefully.

Lock or Wait?

If you find the right home and can comfortably afford current rates, locking now reduces uncertainty.

If your timeline is flexible and economic data trends favor cooling inflation, waiting until July could yield modest savings.

Ultimately, no one can predict rates perfectly — not even the Fed.

The smartest move is choosing stability over speculation.

#FedRateCut #MortgageRates #FirstTimeHomebuyer #HousingMarket2026 #HomeBuyingTips #InterestRates #RealEstateNews #FinanceGuide