For over three decades, the 4% rule has been the gold standard of retirement planning—a simple formula that promised retirees they could safely withdraw 4% of their nest egg in year one, adjust for inflation annually, and reasonably expect their money to last 30 years. But as we navigate through 2025, with its unique economic landscape of fluctuating interest rates, persistent inflation concerns, and longer lifespans, the burning question remains: Does this tried-and-true retirement withdrawal strategy still hold up?

Understanding the 4% Rule: Origins and Basic Principles

Back in 1994, financial planner William Bengen revolutionized retirement income planning with a straightforward proposition. After analyzing historical market data stretching back to 1926, he determined that retirees could withdraw 4% of their portfolio in the first year of retirement, then adjust that dollar amount for inflation each subsequent year, with a 90% probability of their money lasting at least 30 years.

The safe withdrawal rate was elegant in its simplicity. If you retired with $1 million in retirement savings, you’d withdraw $40,000 in year one. If inflation ran at 2%, you’d take out $40,800 the next year, and so on. It caught on like wildfire because it offered something retirement planning desperately needed: a research-backed, easy-to-understand guideline for retirement spending.

According to Charles Schwab’s research, the rule assumes a very high likelihood (close to 100% in historical scenarios) that your portfolio would last for a 30-year retirement period.

What’s Changed in Retirement Planning Since 1994?

The world of 2025 looks dramatically different from the mid-1990s when Bengen first published his findings. We’ve weathered the dot-com bubble, the 2008 financial crisis, a global pandemic, and periods of both historically low interest rates and sudden inflation spikes. Americans are living longer, with current U.S. life expectancy at 79.1 years, up 16.15% from 68.1 in 1950, which means retirement savings must stretch further than ever before.

These shifts have prompted financial experts to revisit the 4% rule with fresh eyes. According to Northwestern Mutual’s 2025 Planning & Progress Study, Americans believe they’ll need $1.26 million to retire comfortably, though this figure varies significantly based on individual circumstances and location.

The consensus among retirement planning experts? It’s complicated.

The Good News: Updated Withdrawal Rates for 2025

Interestingly, the creator of the 4% rule himself has updated his recommendation. In his 2025 book “A Richer Retirement,” Bengen now suggests that 4.7% may be more appropriate—a significant upgrade that would allow a retiree with $1 million to withdraw $47,000 instead of $40,000 in year one.

The reason for this optimism? More sophisticated analysis incorporating international stocks and small-to-mid cap companies, which add diversification and potentially improve portfolio resilience. For current retirees, Bengen even suggests withdrawal rates of 5.25% to 5.5% may be feasible depending on individual circumstances.

Adding to this positive outlook, higher interest rates in recent years have improved the sustainability equation, making retirement income strategies more viable than during the zero-interest-rate environment of the previous decade.

The Reality Check: Conservative Estimates for Retirement Withdrawals

Not everyone shares Bengen’s optimism. Morningstar’s 2025 research recommends a 3.7% withdrawal rate—down from 4% in 2024. This reduction stems from their long-term assumptions about stock, bond, and cash returns over the next 30 years.

Before you panic about that lower number, it’s important to understand that Morningstar uses extremely conservative assumptions. As Christine Benz, Morningstar’s director of personal finance, points out: “We caution, the assumptions that underpin [the 4% rule] are incredibly conservative. The last thing we want to do is scare people or encourage people to underspend.”

Critical Factors Missing from the Traditional 4% Rule

Here’s where things get really interesting—and where the 4% rule shows its age. As experts universally note, it’s a “research simplification” that doesn’t account for several critical real-world factors affecting retirement planning in 2025:

Tax Implications on Retirement Withdrawals

Every dollar withdrawn from a traditional IRA or 401(k) is taxable income. According to the IRS 2025 contribution limits, understanding the tax treatment of different retirement accounts is crucial. Two retirees with identical portfolios could have vastly different spending power, with some facing cumulative tax bills exceeding $470,000 over retirement, forcing them to withdraw significantly more than 4% just to cover their tax obligations.

Sequence of Returns Risk

When you retire matters enormously. Two retirees could have portfolios with identical average returns over 30 years, but if one retires just before a market crash and the other during a bull market, their outcomes could be dramatically different. Early losses combined with withdrawals can permanently impair a portfolio’s ability to recover—a crucial consideration for retirement investment strategy.

Inflation and Its Impact on Retirement Spending

Bengen himself calls inflation the “greatest enemy of retirees”. The 4% rule was created during relatively stable inflation periods. The post-pandemic inflation surge demonstrated how quickly purchasing power can erode, forcing retirees to increase withdrawals faster than anticipated just to maintain their lifestyle.

According to Northwestern Mutual’s research, Americans’ top concerns about retirement include “will Social Security be there when I qualify for it” (33%) and “what if inflation rises when I’m retired” (30%).

Healthcare and Long-Term Care Costs

In 2023, the typical American paid about $6,300 a month for a home health aide and $8,700 a month for a semi-private room in a nursing home, according to Genworth’s cost of care study. These expenses could quickly devastate even well-planned retirement withdrawals.

Variable Spending Patterns Throughout Retirement

Research shows that spending typically declines in inflation-adjusted terms as retirees age—except for potential spikes due to healthcare and long-term care needs late in life. This reality contradicts the 4% rule’s assumption of consistent inflation-adjusted spending.

Modern Retirement Withdrawal Strategies for 2025

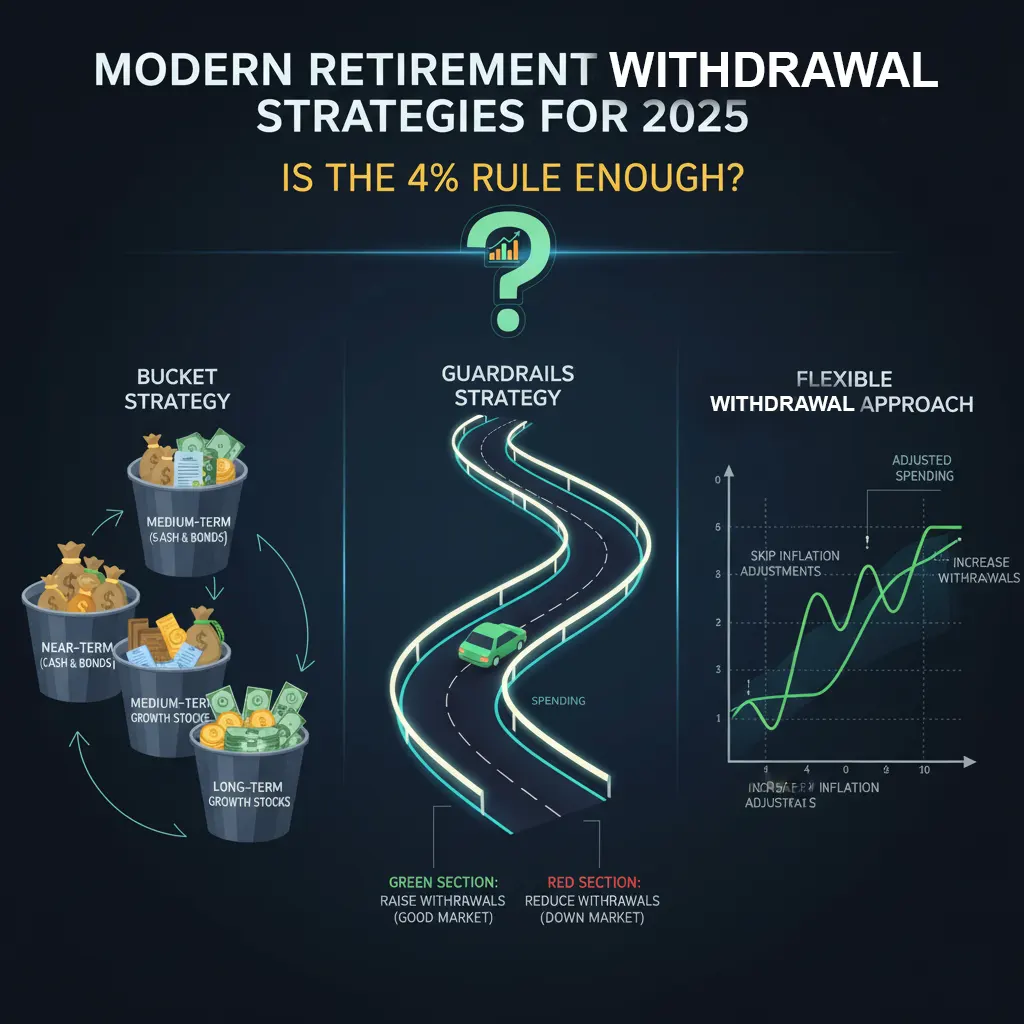

Forward-thinking retirement planners are moving beyond the rigid 4% framework toward more dynamic strategies:

1. Flexible Withdrawal Approach

Instead of mechanically withdrawing the same inflation-adjusted amount regardless of market conditions, consider adjusting your retirement spending based on portfolio performance. With this strategy, you might be able to start with a withdrawal rate of 4.2% by skipping inflation adjustments during down market years.

2. Guardrails Strategy

Implementing guardrails—adjusting withdrawals based on market performance—could allow you to start with a withdrawal rate as high as 5.1%. Give yourself a raise when markets perform well and reduce withdrawals slightly during downturns.

3. The Bucket Strategy for Retirement Assets

Divide your retirement portfolio into time-based buckets:

- Near-term (years 1-5): Cash and bonds

- Medium-term (years 6-15): Balanced investments

- Long-term (years 16+): Growth-oriented stocks

This approach provides psychological comfort and reduces the need to sell stocks during bear markets, a key element of successful retirement asset allocation.

4. Spending Smile Approach

Morningstar data suggests allocating more for early retirement years when you’re healthiest and most active could support a 4.8% first-year withdrawal rate in 2025.

5. Income Floor Strategy

Use guaranteed income sources (Social Security benefits, pensions, annuities) to cover essential expenses, then use portfolio withdrawals for discretionary spending. 77% of retirees use Social Security as a source of retirement income, with 92% of those over 65 doing so, according to retirement income data.

Learn more about maximizing Social Security benefits at the Social Security Administration website.

Is the 4% Rule Still Viable for Retirement in 2025?

The answer is both yes and no.

Yes, the 4% rule remains a reasonable starting point for retirement planning. It’s stood the test of time through multiple market cycles and provides a useful baseline. Even conservative estimates suggest rates between 3.7% and 4% work for many retirees, while others may safely withdraw 4.7% or more.

But no, you shouldn’t blindly apply it without considering your unique circumstances. The 4% rule is best viewed as a launching pad, not a landing spot. Your optimal withdrawal strategy depends on:

- Your total retirement income picture (Social Security, pensions, part-time work)

- Your tax situation and account types (401(k), traditional IRA, Roth IRA)

- Your health and life expectancy

- Your flexibility with discretionary spending

- Your portfolio allocation and investment approach

- Your willingness to adjust spending based on market performance

- Your estate planning goals

Practical Steps for 2025 Retirement Planning

If you’re entering retirement in 2025 or revisiting your withdrawal strategy, here’s how to approach it:

1. Calculate Your Baseline Withdrawal Rate

Start with the 4% rule as a reference point, but consider your portfolio might support anywhere from 3.7% to 5% depending on circumstances. Use retirement calculators from reputable sources like Fidelity or Vanguard to model different scenarios.

2. Map Your Essential Retirement Expenses

Identify non-negotiable costs (housing, healthcare, food, utilities). Individuals 65 years of age or older spent $52,141 on average in 2021, with housing as their largest monthly expense and food as their second largest expenditure, according to the Bureau of Labor Statistics.

3. Maximize Tax-Advantaged Retirement Accounts

For 2025, the 401(k) contribution limit is $23,500, with a $7,500 catch-up contribution for those 50 and older. Workers aged 60-63 can contribute an additional $11,250 through the “super catch-up” provision under SECURE 2.0.

4. Build Flexibility Into Your Retirement Plan

Accept that your withdrawal rate may need to vary year-to-year based on market conditions and personal needs. This adaptability is crucial for sustainable retirement income.

5. Plan for Inflation in Retirement

Ensure your strategy includes meaningful inflation adjustments, especially given recent volatility. Consider Treasury Inflation-Protected Securities (TIPS) as part of your fixed-income allocation.

6. Maintain an Emergency Fund

Keep 6-12 months of expenses in accessible, low-risk accounts separate from your long-term retirement investments. This prevents forced withdrawals during market downturns.

7. Review and Adjust Annually

Retirement planning isn’t set-it-and-forget-it. Review your strategy at least yearly and adjust as needed. Track your actual spending against projections and make course corrections.

8. Consider Professional Retirement Planning Guidance

A qualified financial advisor specializing in retirement planning can help tailor a strategy to your specific situation. According to FINRA, working with a professional can potentially increase both your spending power and peace of mind.

Key Retirement Statistics for 2025

Understanding where you stand compared to other Americans can help inform your retirement readiness:

- The average retirement age is 64.7 for men and 62.1 for women

- Nearly 7 in 10 (67%) Americans between ages 50 and 74 don’t have a formal retirement plan

- 54% of American households reported having no dedicated retirement savings as of 2022

- In 2025, the average monthly Social Security benefit for retired workers is $1,976

- Almost half (46%) of Americans between the ages of 60-75 say they plan to work part-time in retirement

These statistics highlight both the challenges and opportunities in retirement planning for Americans in 2025.

Evolving Your Retirement Withdrawal Strategy

The 4% rule isn’t dead—it’s evolving. Like any rule of thumb, it’s most valuable as a starting point for deeper conversation rather than a definitive answer. The fundamental insight remains true: sustainable retirement withdrawals require balancing current spending needs against future uncertainties.

In 2025, we have better tools, more data, and more sophisticated retirement strategies than Bengen had in 1994. We also face different challenges, from longer lifespans to more volatile inflation. The key is using the 4% rule as a foundation while building a personalized strategy that accounts for your complete financial picture.

Remember, retirement planning isn’t just about making your money last—it’s about funding the life you want to live. Being too conservative can be just as problematic as being too aggressive. The goal is finding that sweet spot where you can enjoy your hard-earned retirement without constantly worrying whether you’ll run out of money.

As William Bengen himself emphasizes, “Everyone is different. Personalize it for your situation.” There’s no single withdrawal rate that works for everyone, and no rule can guarantee your money will last. But armed with knowledge, flexibility, and perhaps professional guidance, you can create a retirement income plan that works for your unique 2025 retirement reality.

Additional Resources for Retirement Planning

- IRS Retirement Plans Overview

- Social Security Retirement Benefits

- Department of Labor Retirement Toolkit

- FINRA’s Retirement Calculator

- Consumer Financial Protection Bureau – Planning for Retirement

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Retirement planning is highly individual, and what works for one person may not work for another. Consider consulting with a qualified financial advisor before making major retirement decisions. Always verify current contribution limits and tax rules with the IRS or a tax professional.

#RetirementPlanning #4PercentRule #Retirement2025 #FinancialFreedom #SafeWithdrawalRate #Investing #RetirementIncome #PersonalFinance