The January 2026 jobs report just dropped — and if you’re shopping for a home or refinancing, it may directly impact your mortgage rate.

Each month, the U.S. Bureau of Labor Statistics (BLS) releases its employment situation summary, detailing nonfarm payrolls, the unemployment rate, and wage growth. Markets react within minutes — and mortgage rates often follow.

What the January 2026 Jobs Report Shows

While headline job gains are important, investors focus on three key metrics:

- Nonfarm payroll additions

- Unemployment rate changes

- Average hourly earnings growth

Strong hiring typically signals economic momentum. But too much strength can reignite inflation concerns — prompting action from the Federal Reserve.

That’s where mortgage rates enter the conversation.

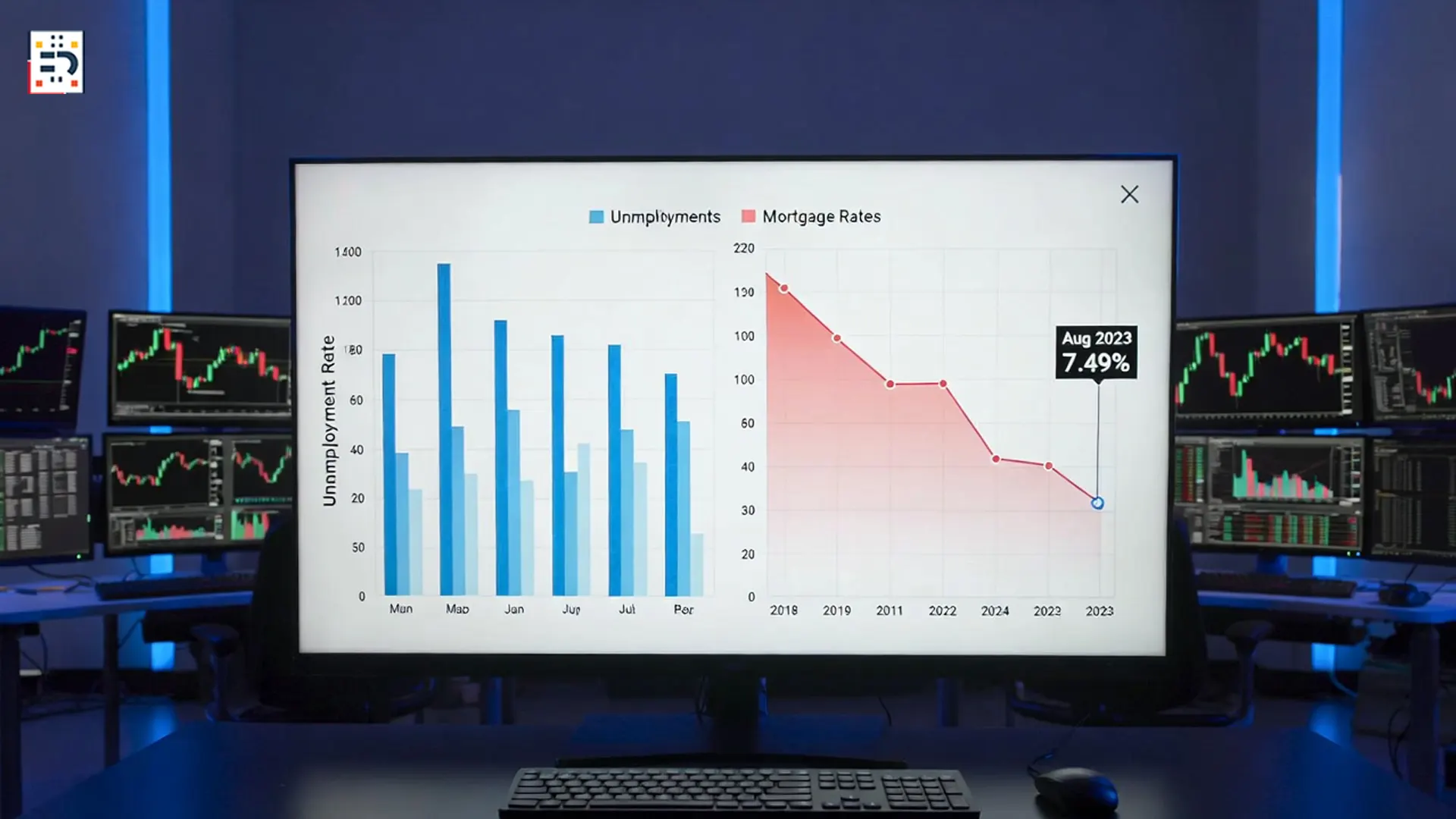

Why Jobs Data Moves Mortgage Rates

Mortgage rates are closely tied to the 10-year Treasury yield, which responds to inflation expectations and Federal Reserve policy projections.

According to housing finance analysis from Freddie Mac, mortgage rate fluctuations often follow major economic releases like the monthly jobs report.

Here’s the simplified chain reaction:

- Strong jobs report → Higher inflation risk

- Higher inflation risk → Fewer or delayed rate cuts

- Delayed rate cuts → Higher bond yields

- Higher bond yields → Higher mortgage rates

Wage Growth: The Hidden Trigger

Average hourly earnings often matter more than total job gains.

If wages rise too quickly, policymakers worry about persistent inflation. Economic coverage from CNBC Economy frequently highlights wage growth as a leading indicator for rate decisions.

In 2026, markets remain highly sensitive to wage-driven inflation pressure.

What This Means for Homebuyers

If January’s employment data came in stronger than expected:

- Mortgage rates could tick upward in the short term

- Rate cut expectations may shift further into late 2026

If the report showed cooling job growth:

- Bond yields may decline

- Mortgage rates could ease modestly

Housing analysts at National Association of Realtors note that rate volatility often creates short-term buying opportunities.

Will the Fed Cut Rates in 2026?

The Federal Reserve’s policy outlook remains central to the housing market.

Minutes and projections available via Federal Open Market Committee releases indicate policymakers are balancing inflation control with labor market stability.

A resilient labor market gives the Fed less urgency to cut rates aggressively.

Watch the Trend, Not Just the Headline

One jobs report rarely determines the long-term direction of mortgage rates. Markets look for patterns.

Three consecutive months of cooling wage growth? That could push rates down.

Three months of overheating employment? Expect upward pressure.

For borrowers in 2026, staying informed about employment data isn’t optional — it’s strategic.

#JobsReport #MortgageRates #FederalReserve #HousingMarket #EconomicNews #RateWatch