By Digital News 4 All Business Desk

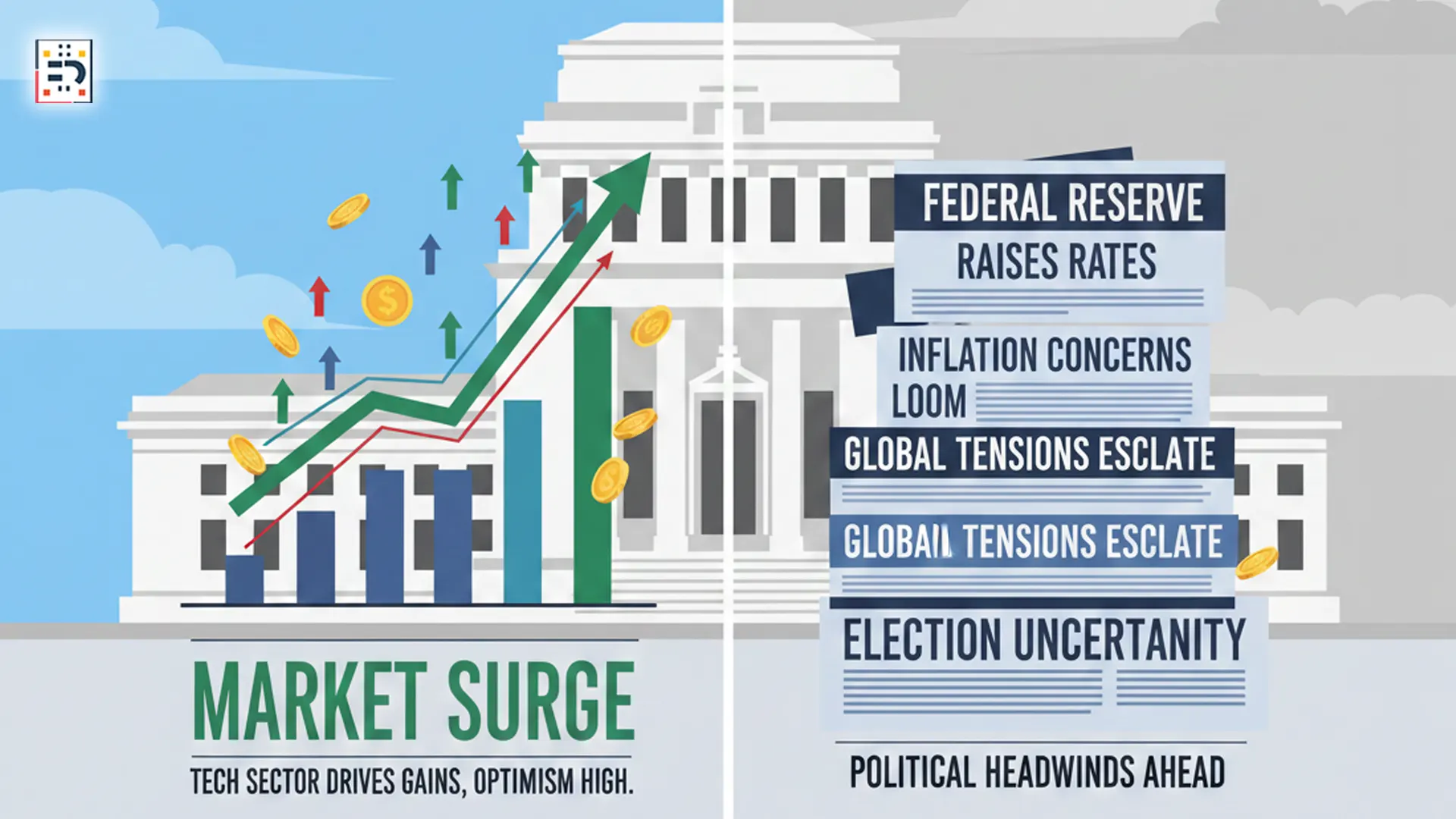

Headlines suggest chaos. Markets suggest confidence. As political scrutiny around Federal Reserve Chair Jerome Powell intensifies, U.S. stock markets continue to hover near record highs.

For many Americans, this creates confusion. Why does the market keep rising during political instability? And what does it mean for your 401(k)?

What Is the Powell Investigation — in Simple Terms?

The investigation focuses on whether Federal Reserve leadership followed ethics and disclosure rules. It does not involve monetary policy changes. It also does not affect how interest rates are set today.

The Federal Reserve operates independently from Congress and the White House. Markets care less about political noise and more about whether that independence remains intact.

So far, investors see no immediate threat to the Fed’s core mission. That matters more than headlines.

Why the Stock Market Keeps Rising

Stock prices move based on expectations about the future. Right now, investors see three supportive forces.

- Inflation continues to cool compared to previous years

- Corporate earnings remain strong

- Interest rate cuts appear possible later in the year

According to market data tracked by Bloomberg, large institutional investors remain focused on earnings growth and long-term rate trends. Political investigations rank far lower on that list.

Why Political Instability Doesn’t Always Hurt Markets

Markets dislike uncertainty. However, they dislike sudden economic shocks even more.

In this case, the investigation has not changed policy direction. The Fed continues to signal data-driven decisions. That consistency reassures investors.

Historically, markets often rise during political turmoil. Analysts at CNBC note that as long as economic fundamentals stay intact, stocks tend to look past Washington drama.

What This Means for Your 401(k)

For the average worker, daily market swings matter less than long-term trends. Most 401(k) plans invest across diversified stock and bond funds.

If markets rise, your account benefits over time. Short-term headlines rarely change retirement outcomes unless they trigger recessions.

Financial planners writing for Morningstar stress that staying invested historically outperforms reacting to political news. Timing the market often causes more harm than good.

Should You Be Worried?

Concern is natural. Panic is not productive.

The investigation does not affect:

- Your current retirement contributions

- Employer matching

- Long-term market growth assumptions

Unless policy direction changes, most retirement strategies remain valid. Markets respond to earnings, inflation, and rates—not hearings.

The Bigger Picture

This moment highlights a key lesson. The stock market is not the same as politics.

Markets look forward. They price probabilities, not headlines. As long as the economy stays resilient, markets can rise even when institutions face scrutiny.

Political investigations generate noise. Markets generate signals.

For long-term investors and 401(k) holders, the signal remains steady. Focus on fundamentals. Ignore short-term drama.

In times like these, patience often proves more valuable than prediction.

#StockMarketNews #FederalReserve #InvestingExplained #401k #EconomicClarity