For millions of Americans carrying federal student debt, a major financial deadline is quickly approaching. Starting January 1, 2026, the federal government will resume student loan wage garnishments for borrowers who remain in default.

As a result, employers may once again withhold money directly from workers’ paychecks—often without a court order—under collection authority exercised by the U.S. Department of Education.

At the same time, rising housing costs, persistent inflation, and higher everyday expenses mean that many borrowers can no longer absorb sudden income losses. Consequently, the return of wage garnishment could place serious strain on household budgets nationwide.

What Is Student Loan Wage Garnishment?

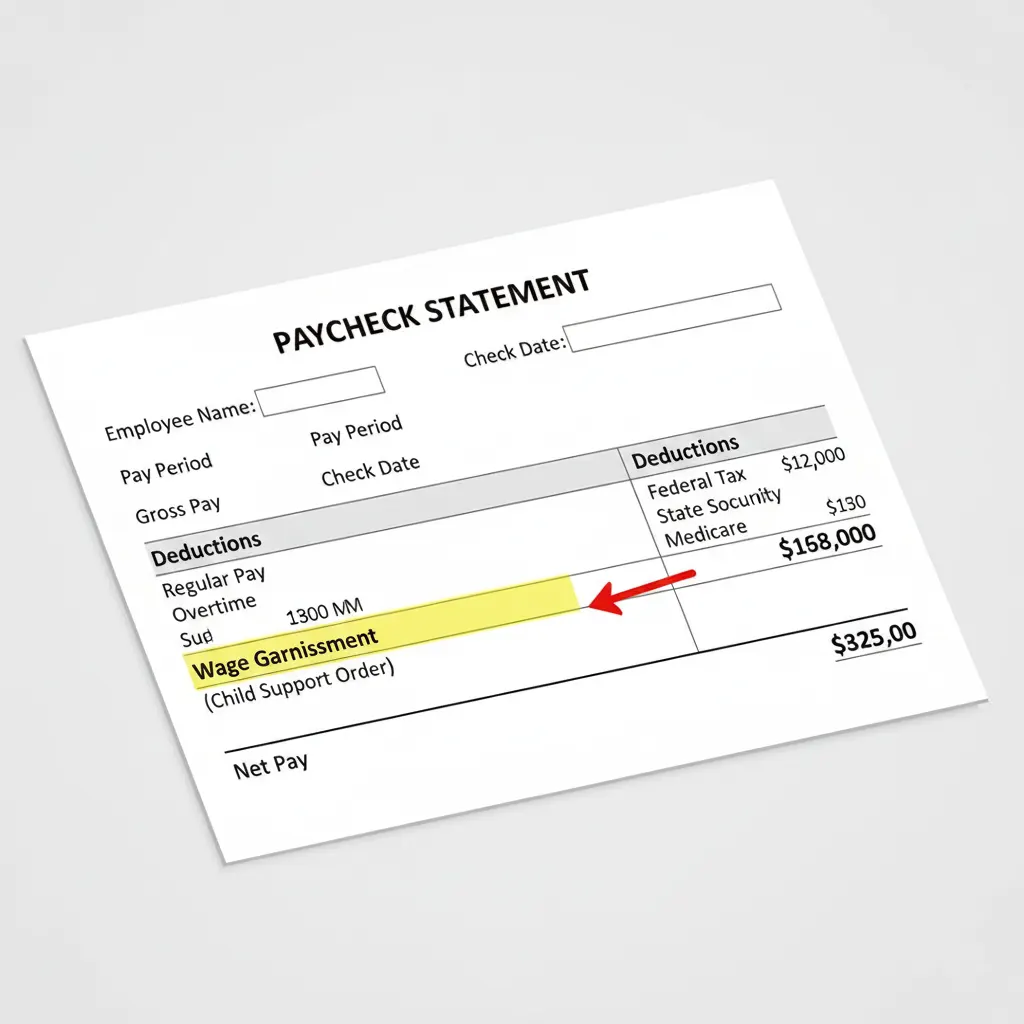

Wage garnishment allows the federal government to collect unpaid federal student loans by ordering an employer to withhold part of a borrower’s earnings.

Under federal law, the government can take up to 15% of a borrower’s disposable income; however, it must leave the borrower with at least 30 times the federal minimum wage each week.

Unlike many other debts, federal student loans do not require a lawsuit or court judgment before garnishment begins. This authority is granted under the Higher Education Act.

Why Wage Garnishments Are Returning in 2026

In recent years, emergency relief measures largely paused federal student loan collections. Those protections included:

- Suspended wage garnishments

- Paused tax refund offsets

- Temporary relief from collection fees

However, those safeguards were never meant to be permanent. According to policy guidance discussed by the Congressional Budget Office, the federal government is expected to fully restart collection enforcement once transition periods end.

January 1, 2026 is widely cited as a key date when borrowers who remain in default may once again face aggressive collections.

Who Is Most at Risk of Garnishment?

You may be vulnerable to wage garnishment if:

- Your federal student loans are in default

- You have not enrolled in a repayment or rehabilitation program

- You have ignored collection notices from loan servicers or the government

Default typically occurs after 270 days of missed payments. Once in default, loans may be transferred to collections and become subject to garnishment.

Borrowers with private student loans are generally subject to state laws and court judgments, but federal loans follow separate rules administered by the Federal Student Aid office.

How Wage Garnishment Works

If garnishment is initiated, the government sends a notice to both the borrower and their employer. The employer is legally required to comply.

Key points to understand:

- Garnishment can begin without a lawsuit

- Up to 15% of disposable pay may be withheld

- Multiple jobs can be affected

- Bonuses and commissions may also be included

According to guidance from the Consumer Financial Protection Bureau (CFPB), borrowers must be notified in advance and given limited options to object or request a hearing.

How to Stop or Avoid Student Loan Garnishment

The good news: wage garnishment is not inevitable. There are several ways borrowers can prevent or stop it.

1. Enroll in an Income-Driven Repayment Plan

Programs such as Income-Driven Repayment (IDR) base monthly payments on income and family size. In some cases, payments can be as low as $0.

2. Loan Rehabilitation

Loan rehabilitation allows borrowers in default to make a series of agreed-upon payments to remove the default status. Successful rehabilitation can stop garnishment and restore eligibility for benefits.

3. Loan Consolidation

Federal loan consolidation can also remove loans from default if certain conditions are met. More details are available through Federal Direct Consolidation.

4. Request a Garnishment Hearing

Borrowers may request a hearing to challenge garnishment based on:

- Financial hardship

- Incorrect loan status

- Disability or unemployment

What Happens If You Do Nothing?

Ignoring student loan notices can make the situation significantly worse. Beyond wage garnishment, borrowers may face:

- Tax refund offsets through the Treasury Offset Program

- Withheld Social Security benefits

- Damage to credit reports

- Loss of eligibility for deferment or forgiveness programs

Over time, collection fees and interest can dramatically increase the total balance owed.

Impact on Employers and Workplaces

Employers are legally required to comply with federal wage garnishment orders. Failure to do so may result in penalties.

From an HR perspective, garnishments can:

- Create administrative burdens

- Increase payroll complexity

- Cause employee stress and productivity issues

This is one reason many financial advisors encourage early action long before garnishment resumes.

Why This Matters More in 2026

Economic pressures remain high, especially for younger workers and middle-income households. With rising housing costs and persistent inflation, losing even 10–15% of take-home pay can destabilize finances.

As reported by Brookings Institution, student loan repayment challenges continue to disproportionately affect certain demographics, including first-generation college graduates.

What Borrowers Should Do Now

If you have federal student loans, the most important step is awareness. Confirm your loan status by logging into your account at StudentAid.gov.

From there:

- Update your contact information

- Review repayment options

- Respond promptly to any notices

Acting early can mean the difference between manageable payments and involuntary paycheck deductions.

The return of student loan wage garnishments on January 1, 2026 represents a major financial turning point for borrowers in default. While not every borrower will face garnishment, those who ignore their loan status risk serious and lasting consequences.

Fortunately, borrowers still have time to act. By reviewing loan accounts, enrolling in repayment programs, and responding promptly to official notices, individuals can protect their income and regain financial stability.

#StudentLoans #WageGarnishment #PersonalFinance #DebtRelief #StudentDebt #FinanceNews