The recent decision by a well-known BBQ chain to file for Chapter 11 bankruptcy protection has sent ripples through the restaurant industry. While the brand itself still enjoys loyal customers, its financial troubles highlight deeper challenges facing restaurants in 2025.

This filing is less about one company failing—and more about an industry under sustained pressure.

What Chapter 11 Bankruptcy Really Means

Chapter 11 allows businesses to restructure debt while continuing operations. According to guidance from the U.S. Courts, companies use this process to renegotiate leases, reduce liabilities, and stabilize cash flow.

For restaurant chains, Chapter 11 is often a last attempt to adapt to changing consumer and economic realities.

Why the BBQ Chain Filed for Chapter 11

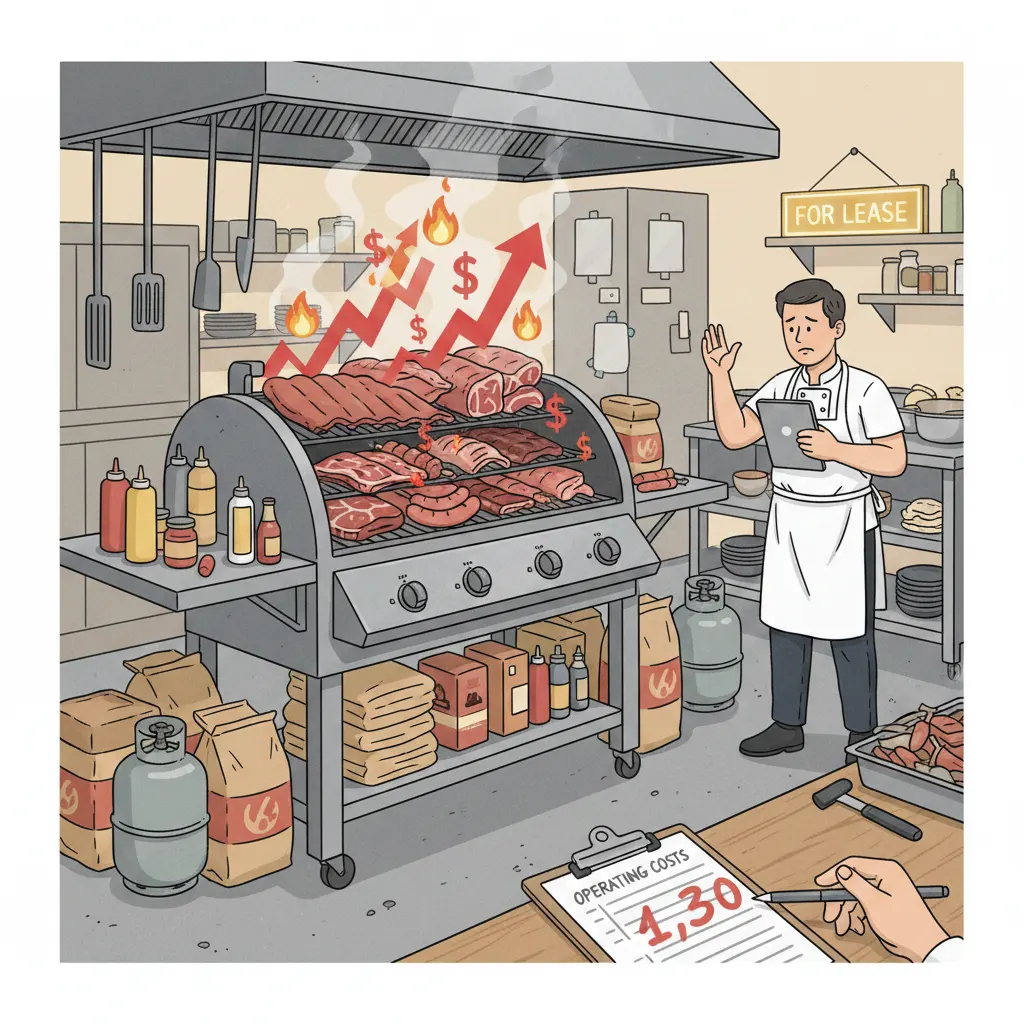

Industry analysts point to a combination of financial and operational pressures that made bankruptcy unavoidable:

- Rising food and meat costs

- Higher labor wages and staffing shortages

- Long-term lease obligations signed before inflation surged

- Slower dine-in traffic compared to pre-2020 levels

Restaurant cost data tracked by the National Restaurant Association shows margins have tightened significantly across casual dining brands.

Inflation’s Ongoing Impact on Restaurants

Even as inflation cools in some sectors, restaurants continue to feel its effects. BBQ chains are particularly vulnerable because beef, pork, and poultry prices remain volatile.

According to food price trend analysis from the U.S. Department of Agriculture, protein costs have fluctuated sharply, making menu pricing difficult to manage without alienating customers.

Consumers Are Spending Differently in 2025

Another key factor is changing consumer behavior. Diners are eating out less frequently and becoming more price-conscious, especially for casual dining experiences.

Market research reported by McKinsey & Company indicates that consumers are prioritizing value, convenience, and at-home dining over traditional sit-down meals.

A Broader Pattern Across the Restaurant Industry

This BBQ chain is not alone. In recent years, multiple restaurant brands across casual dining, fast casual, and franchised concepts have sought bankruptcy protection or closed underperforming locations.

Common warning signs include:

- Overexpansion before demand stabilized

- High debt loads from private equity ownership

- Inflexible real estate commitments

- Failure to adapt menus and pricing models

What This Means for Other Restaurant Chains

The lesson for restaurant operators in 2025 is clear: adaptability is no longer optional. Chains that survive will likely:

- Reduce physical footprints

- Focus on takeout and delivery efficiency

- Renegotiate leases aggressively

- Simplify menus to control costs

Restaurant consultants frequently cited by Forbes note that profitability—not brand recognition—is now the key measure of long-term survival.

Is Chapter 11 the End—or a Reset?

Filing for Chapter 11 does not necessarily mean a brand is finished. Many restaurant chains have successfully restructured and emerged leaner and more focused.

For this BBQ chain, the coming months will determine whether bankruptcy serves as a reset—or a warning sign of deeper trouble.

The Chapter 11 filing of a popular BBQ chain underscores a hard truth about the restaurant industry in 2025: loyalty alone is no longer enough. Rising costs, shifting consumer habits, and financial missteps are forcing brands to adapt—or disappear.

For diners, investors, and operators alike, this case offers a clear look at where the industry is heading next.

#Chapter11 #RestaurantIndustry #BBQChain #BusinessNews #FoodIndustry #EconomicTrends