SpaceX may be on the verge of one of the most transformative financial moves in modern aerospace history. Reports from industry analysts suggest that the company — already the most valuable private space firm in the world — could pursue an IPO valued at up to $1.5 trillion, fueled largely by the explosive growth of its Starlink satellite network. While nothing is officially confirmed, the possibility alone is reshaping expectations for global space infrastructure and SpaceX’s flagship rocket system: Starship.

Coverage from Bloomberg, CNBC, and Reuters indicates that SpaceX may consider spinning off Starlink for a public offering — or combine it with broader Starship-focused funding plans.

Why a Potential $1.5 Trillion IPO Is Even Possible

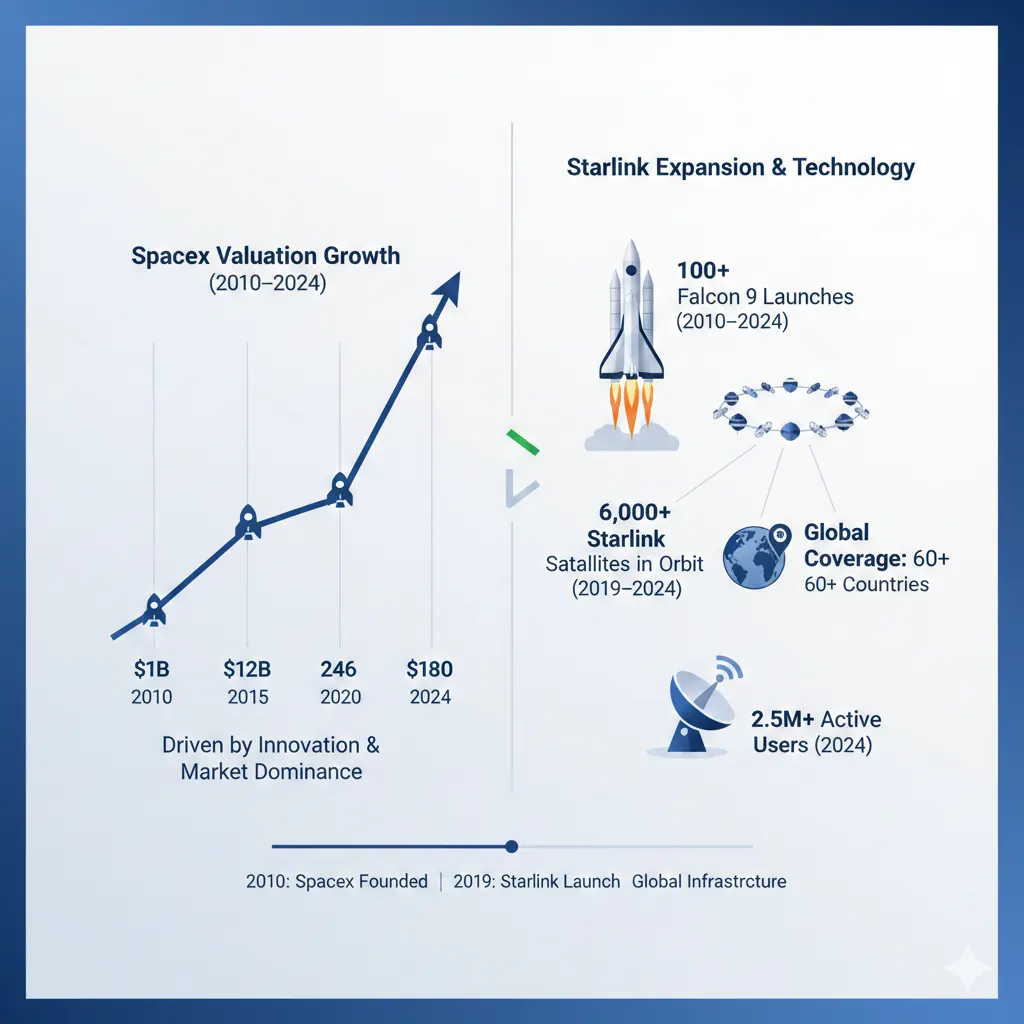

SpaceX’s valuation has surged due to two key strengths: its reusable launch system and the rapid expansion of Starlink. Starlink now operates thousands of satellites in low Earth orbit, providing internet access to over 70+ countries. High growth and recurring revenue make the project a strong candidate for public markets.

Factors behind the valuation:

- Dominance in orbital launch capacity.

- Massive scaling of Starlink’s user base.

- Growing demand for global satellite broadband.

- Starship’s long-term commercial potential.

For updated Starlink coverage maps, see Starlink’s official map.

Would SpaceX Itself IPO — or Just Starlink?

Elon Musk has repeatedly said SpaceX would not go public until its Mars mission is secure. However, analysts believe SpaceX may list Starlink as a standalone company while keeping its launch and Starship divisions private.

Two scenarios discussed by analysts:

- Starlink IPO: Likeliest, based on subscription-driven revenue.

- Combined SpaceX–Starlink listing: Less likely but would represent the largest IPO in history.

What an IPO Would Mean for Starship

Starship — the fully reusable super-heavy launch system — is central to SpaceX’s long-term strategy. A major IPO could accelerate funding for Starship test flights, manufacturing expansion, and crucial infrastructure such as offshore launch platforms.

Potential impacts on Starship:

- Faster development cycles and higher launch cadence.

- Expanded production facilities in Texas, California, and Florida.

- Increased investment in heat shield, Raptor engines, and payload variants.

- Accelerated progress toward lunar and Mars missions.

NASA’s partnership with SpaceX on the Artemis program highlights Starship’s critical role, as referenced by NASA.

How a SpaceX IPO Could Transform the Space Industry

A trillion-dollar space company would reshape the global space economy. SpaceX already leads commercial launch services, but an IPO could set off a new era of competition and investment.

Industry-wide effects might include:

- More funding flowing to satellite constellations and reusable rockets.

- Faster tech adoption by competitors like Blue Origin and Rocket Lab.

- Government programs relying more on commercial launch partners.

- Lower launch costs as Starship matures.

What This Means for Investors (Without Giving Advice)

If SpaceX or Starlink goes public, it may become one of the most watched and debated IPOs of the decade. Financial analysts note high demand — but also emphasize that valuations depend heavily on regulatory approvals, launch performance, competition, and global satellite demand. This article does not constitute investment advice.

Internal Links You May Like

SpaceX’s rumored $1.5 trillion IPO plans represent a historic moment for the space industry. Whether Starlink or the entire company goes public, the move would likely accelerate Starship’s development and expand global access to space infrastructure. With demand for launches, satellites, and deep-space missions rising fast, SpaceX is positioned to define the next era of commercial spaceflight.

#SpaceX #Starship #Starlink #IPO #SpaceIndustry #AerospaceNews #ElonMusk #SpaceEconomy #TechNews #FutureOfSpace