AI chips power everything from data centers to autonomous vehicles — and right now, they sit at the center of one of the world’s most consequential geopolitical debates. The United States continues tightening export rules on Nvidia’s high-performance AI processors, limiting what can be sold to China. These decisions signal a long-term shift in global technology power, supply chains, and AI competition.

According to reports from Reuters, The New York Times, and Financial Times, the latest rules now cover a broader range of chips, including customized GPUs built to fit under prior export thresholds.

What Prompted the New Restrictions?

The US government says the restrictions aim to safeguard national security by preventing high-performance AI chips from being used in military or strategic applications. The tightened rules target chips with advanced compute capabilities used to train large-scale AI models — the kind increasingly powering robotics, missile detection, and surveillance systems.

Nvidia’s A100, H100, and newer AI accelerators were previously restricted. The latest update also limits customized “China-only” versions designed to comply with earlier thresholds.

Why Nvidia Is Caught in the Middle

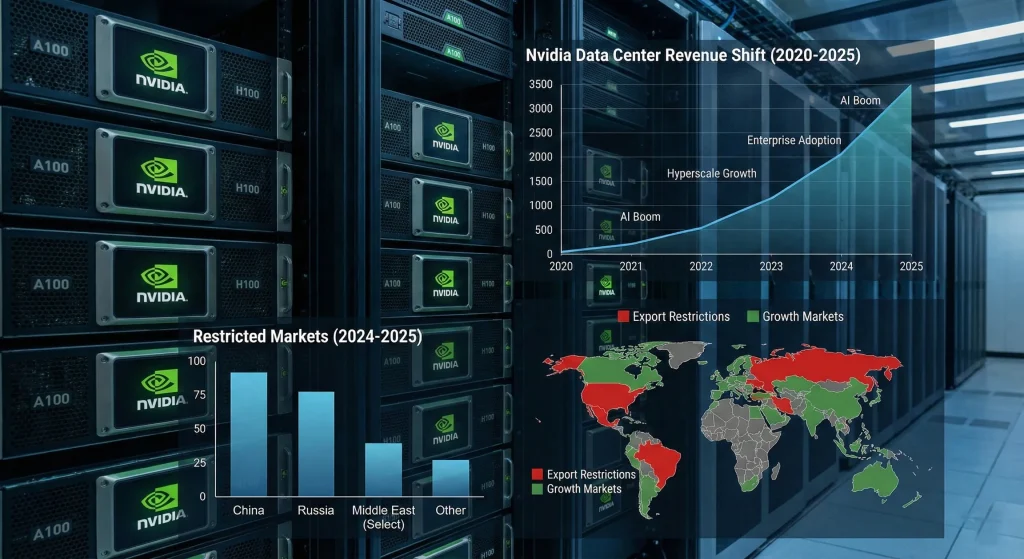

Nvidia dominates the global market for training-grade AI GPUs. China has historically represented a major share of Nvidia’s data center revenue. By tightening restrictions, the US cuts off a large and fast-growing market for Nvidia — forcing the company to redesign chips repeatedly to comply with evolving rules.

According to analysis from Bloomberg, Nvidia may need to shift focus toward alternative markets, including cloud providers in the US, Europe, and the Middle East.

How China Is Responding

China is accelerating domestic chip development, with major investment flowing into local GPU startups and state-backed semiconductor programs. While Chinese companies still trail in cutting-edge manufacturing and performance benchmarks, experts note that restrictions may push China to innovate faster.

China is also strengthening partnerships with non-US suppliers — including foundries and chip designers not covered by US rules.

What This Means for the Global AI Race

The US–China chip landscape is shifting from competition to strategic decoupling. Instead of one integrated market, the world is splitting into two AI ecosystems — each with its own hardware, supply chains, and software frameworks.

Potential long-term outcomes:

- A US-led ecosystem centered around Nvidia, AMD, Intel, and TSMC.

- A China-led ecosystem focused on domestic GPUs, accelerators, and open-source frameworks.

- Separate AI stacks where models and tools evolve independently.

AI researchers warn that fragmentation could slow global scientific collaboration but increase regional specialization.

Will These Rules Slow AI Progress?

In the short term, China may face delays in scaling large AI models. However, restrictions may also motivate rapid advancement in domestic accelerators, packaging technologies, and chiplet architectures.

Meanwhile, US companies face revenue losses from restricted markets — but analysts expect accelerated government support for domestic chip manufacturing.

For a broader look at export rule impacts, review guidance on the U.S. Bureau of Industry and Security website.

The China chip debate is more than a business story — it’s a defining moment in global technology strategy. The US–Nvidia export rules reflect deeper concerns about national security, AI leadership, and supply-chain independence. What happens next will determine not only the future of semiconductor innovation, but also the balance of global AI power for decades to come.

#Semiconductors #AIChips #Nvidia #USChina #TechPolicy #ExportControls #Geopolitics #AITech #ChipIndustry #TechNews