The global AI race continues to reshape stock markets, policy discussions, and semiconductor strategies. Nvidia once again sits at the center of this geopolitical and economic conversation—this time due to renewed U.S. export-control considerations and shifting investor sentiment across tech and AI markets.

As nations push harder for AI supremacy, chip regulations, supply-chain diversification, and hyperscaler demand are becoming major forces influencing the next phase of tech growth.

Why Nvidia Is Back in the Spotlight

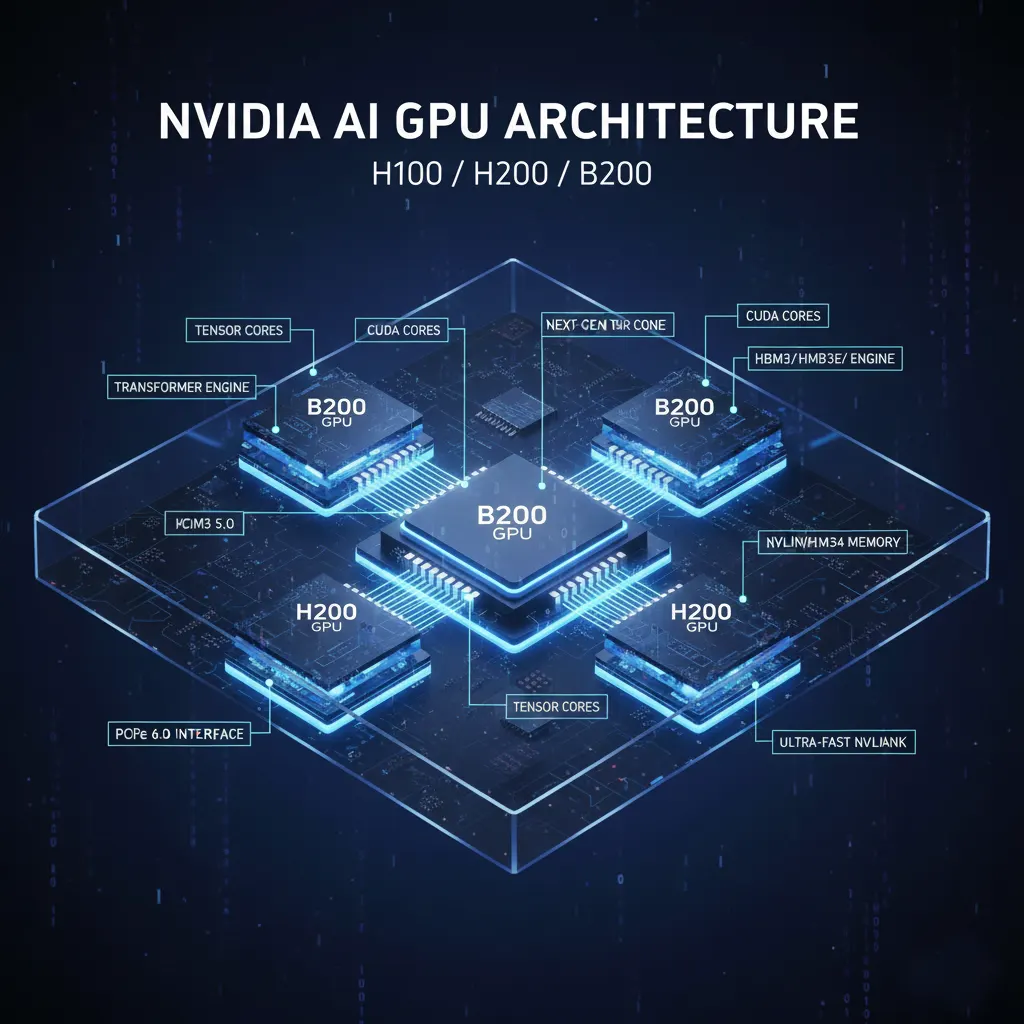

Nvidia’s advanced AI GPUs—especially the H100, H200, B200, GB200, and the upcoming Blackwell platform—remain essential for training large-scale AI models. However, the U.S. continues refining export controls that restrict cutting-edge chip shipments to China and other regions deemed high-risk.

Key Drivers of the Latest Buzz

- Renewed discussions in Washington on tightening or expanding AI-chip export rules.

- Demand for Nvidia GPUs remains extremely high, especially among U.S. cloud providers and global AI labs.

- Investors are reassessing AI stock valuations after months of rapid capital inflows.

- China accelerating local GPU alternatives could reshape long-term competitive dynamics.

These dynamics place Nvidia at a critical intersection of policy, innovation, and market expectation.

Market Reaction: A Shift in Sentiment?

AI-exposed stocks have seen sharp swings recently. While long-term interest remains strong, short-term volatility has increased due to:

1. Profit-taking after big AI stock rallies

Investors saw huge gains in semiconductors, cloud hyperscalers, and AI software names—leading many to lock in profits.

2. Concerns around potential supply constraints

Manufacturing bottlenecks and geopolitical friction continue to inject uncertainty.

3. Growing competition from AMD, Intel, and emerging startups

Although Nvidia dominates, rivals are gaining momentum with either lower-cost or more specialized accelerators.

4. Global policy changes

U.S., China, and Europe each continue to refine their rules around AI, chip imports, and national security.

The combination of these factors has created a more cautious—but still highly bullish—medium-term outlook for the sector.

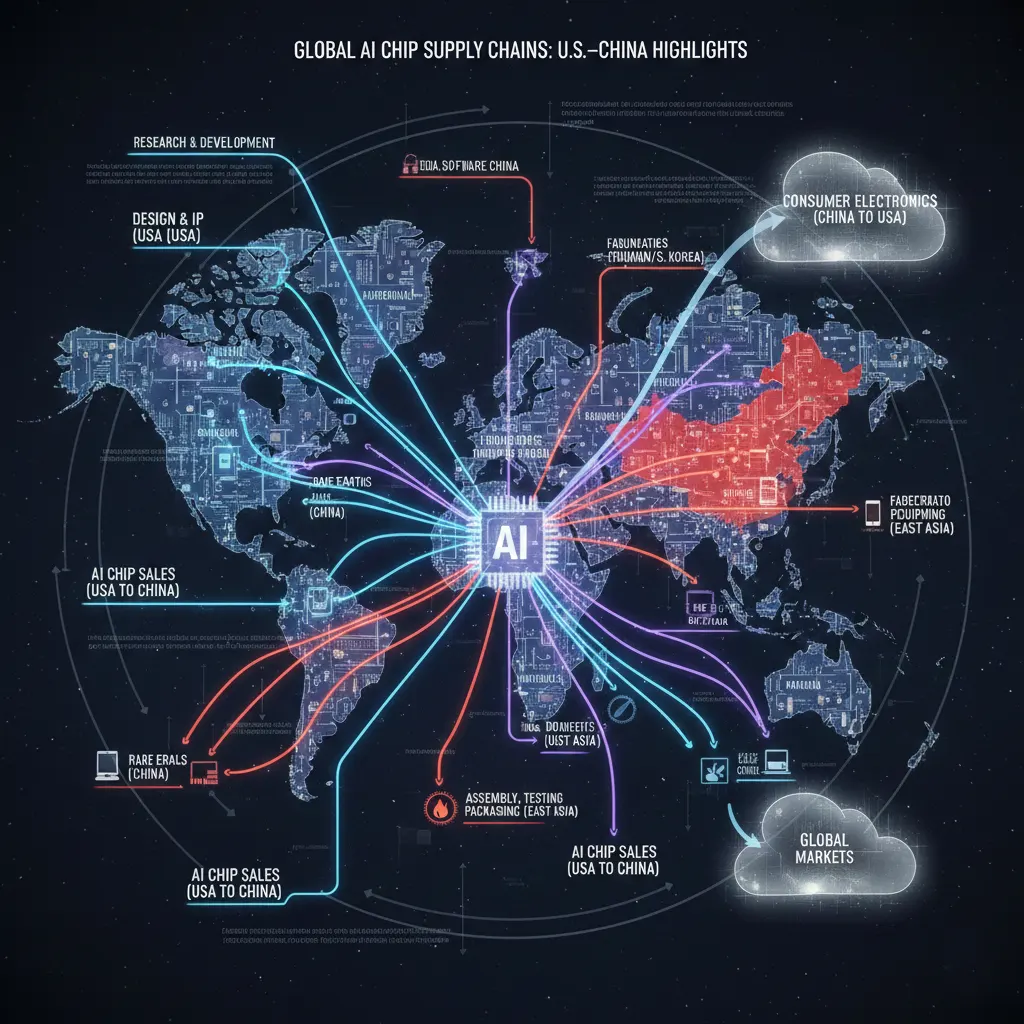

The Geopolitical Angle: U.S.–China AI Competition

Export-control conversations are not just about business—they are about national strategy.

What’s at Stake

- Slowing China’s AI progress by limiting access to advanced silicon.

- Protecting U.S. technological leadership.

- Maintaining global supply chain resilience.

China is accelerating efforts to reduce reliance on U.S. chipmakers, investing heavily in:

- Domestic GPU development

- AI-optimized data center infrastructure

- State-backed semiconductor subsidies

The more restrictions tighten, the faster China attempts to innovate its way around them.

What This Means for Investors

Despite short-term uncertainty, several long-run themes remain strong:

1. AI compute demand will continue rising

Every major industry is increasing AI investment—cloud, healthcare, finance, robotics, automotive, and energy.

2. Semiconductor supply chains remain tight

This supports higher pricing power for leading GPU providers.

3. Diversification matters

Investors may benefit from spreading exposure across:

- Leading GPU manufacturers

- AI-optimized cloud services

- Infrastructure software

- AI cybersecurity

- High-performance computing (HPC) solutions

4. Policy risk will remain elevated

AI is becoming a national security issue—expect recurring headlines affecting stock swings.

Expert Takeaway

Nvidia is not just a semiconductor company anymore—it’s a national-strategy asset at the center of a global power race. Export-control talks will continue to shape market sentiment, but the broader AI supercycle remains intact.

The next 12–24 months will likely see:

- Record AI infrastructure spending

- Increased hyperscaler investment cycles

- More competition, but still high margin opportunities

- Continued policy-driven volatility

For long-term investors, AI infrastructure remains one of the strongest multi-year themes in modern markets.

🔗 External Links

#Nvidia #AI #Semiconductors #TechNews #AIMarket #USChina #GPU #Investing #TechPolicy #MarketTrends