Updated analysis of 2026 EV launches, the current state of U.S. tax incentives, and practical advice for buyers and fleets.

Quick takeaway

2026 looks like a pivotal year for the U.S. EV market: automakers are bringing more model choices and new tech to showrooms, while federal tax incentives have shifted materially since the Inflation Reduction Act-era rollout — some credits remain available but several incentive rules and deadlines have changed. Buyers should check current IRS guidance and dealer eligibility before assuming a credit at purchase.

What’s new in EV models for 2026

Automakers continue to expand EV lineups for the 2026 model year. Industry trackers and reviewers list many upcoming electric sedans, SUVs and trucks — from legacy OEMs and EV specialists — that aim to increase range, lower costs, or add new tech (including advanced driver-assistance systems and new battery chemistries). Expect more entries in mainstream SUV and pickup segments as manufacturers push to capture U.S. demand.

- More mainstream SUVs and pickups: several brands are prioritizing high-selling segments (compact and midsize SUVs; light-duty pickup EVs).

- New battery and charging tech: faster charging, higher usable capacity, and improved thermal management will be key marketing points.

- Advanced driver-assist rollouts: some makers are launching upgraded autonomy hardware/software in 2026 models (see example of Rivian’s roadmap and autonomy announcements).

Federal tax credits — where things stand for 2026 buyers

The federal clean vehicle tax credits are complex and have undergone several changes since they were first revised. The broad outlines that buyers must know:

- New (clean) vehicle credit — up to $7,500: The new clean vehicle credit for qualifying new EVs can provide up to $7,500, but qualification depends on multiple rules (assembly location, critical minerals and battery component sourcing, MSRP caps and buyer income limits). Always confirm a vehicle’s eligibility before purchase via IRS resources and manufacturer disclosures.

- Used clean vehicle credit — up to $4,000: A credit for qualifying used EVs (when conditions are met) can be available up to a stated cap for eligible purchases from licensed dealers, subject to price and income limits.

- Deadlines and program changes: the IRS and federal guidance have updated timelines for some incentive programs and related credits; some program provisions or temporary flexibilities were clarified in 2024–2025 guidance. Buyers and fleet managers should check the latest IRS FAQs and Treasury guidance for any effective deadlines or changes impacting 2026 acquisitions.

Practical note: tax credits are non-refundable (in many cases) and may be transferable to dealers under certain rules, and credits claimed depend on meeting precise documentation and sourcing rules — consult your tax advisor or dealer finance office.

What drivers should expect: price, range, and ownership costs

On the buyer side, three themes will shape the 2026 ownership experience:

1. Price and incentives

MSRP pressures and component costs will influence sticker prices. While credits can materially reduce after-tax costs for qualifying buyers, many of the eligibility rules (including MSRP thresholds and supply-chain sourcing requirements) mean not every EV will qualify. Budget-conscious buyers should calculate both the pre-credit price and the realistic after-credit tax benefit when comparing models.

2. Range and charging

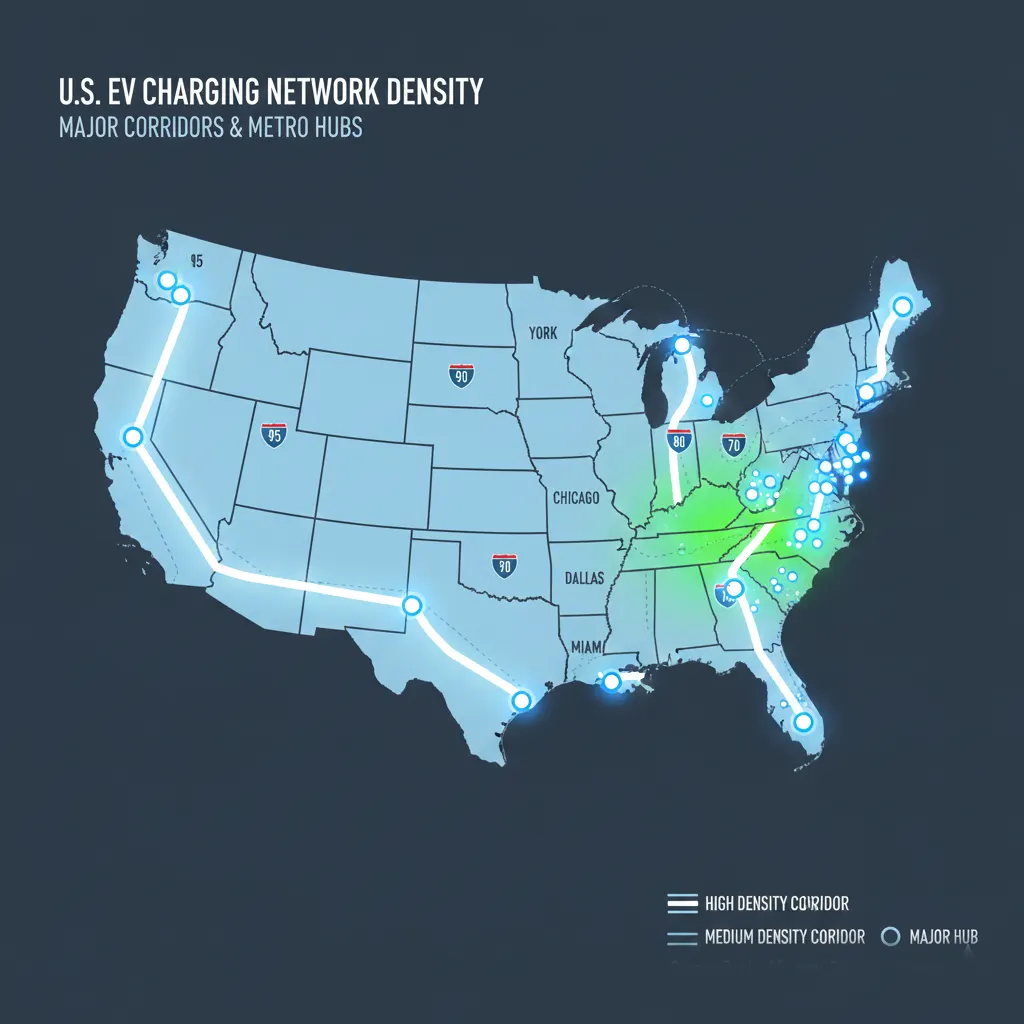

Expect step-changes in advertised range for some mainstream models, and incremental improvements in charging network reliability — but real-world range will still vary with climate, load and driving pattern. Public charging infrastructure is expanding, yet urban/rural disparities persist.

3. Resale and total cost of ownership (TCO)

As model choices increase, resale values will stabilize for proven nameplates, while others could see greater depreciation risk. Evaluate TCO — insurance, maintenance, home charging installation, and expected depreciation — not just the upfront price.

Advice for buyers in 2026

- Verify credit eligibility before signing: ask dealers for written confirmation about whether a vehicle qualifies for the clean vehicle credit and whether a dealer will pass along a transferred credit (if offered).

- Check MSRP and income thresholds: these remain critical for qualification.

- Factor charging costs: home charger installation may qualify for limited credits through mid-2026 in some cases — check IRS guidance for the Alternative Fuel Vehicle Refueling Property credit deadlines.

- Consider timing and supply: new model launches may have constrained initial availability; consider test drives and delivery timelines.

Industry and policy watchers: what to watch next

Policymakers are actively adjusting vehicle and emissions rules, and the EPA and other agencies have signaled reviews and potential timing changes to vehicle pollution rules that could affect automaker compliance strategies and product rollouts. These regulatory shifts — combined with evolving tax-credit interpretations — mean manufacturers may adjust model portfolios or pricing strategies during 2026.

2026 will deliver more EV choices and incremental technological progress — but buyers need to be diligent about tax-credit rules and vehicle eligibility. For those who qualify, credits can be significant; for others, narrowing purchase options and careful TCO analysis will be essential.

#EVs #ElectricVehicles #TaxCredits #CleanEnergy #EV2026 #Driving #Automotive