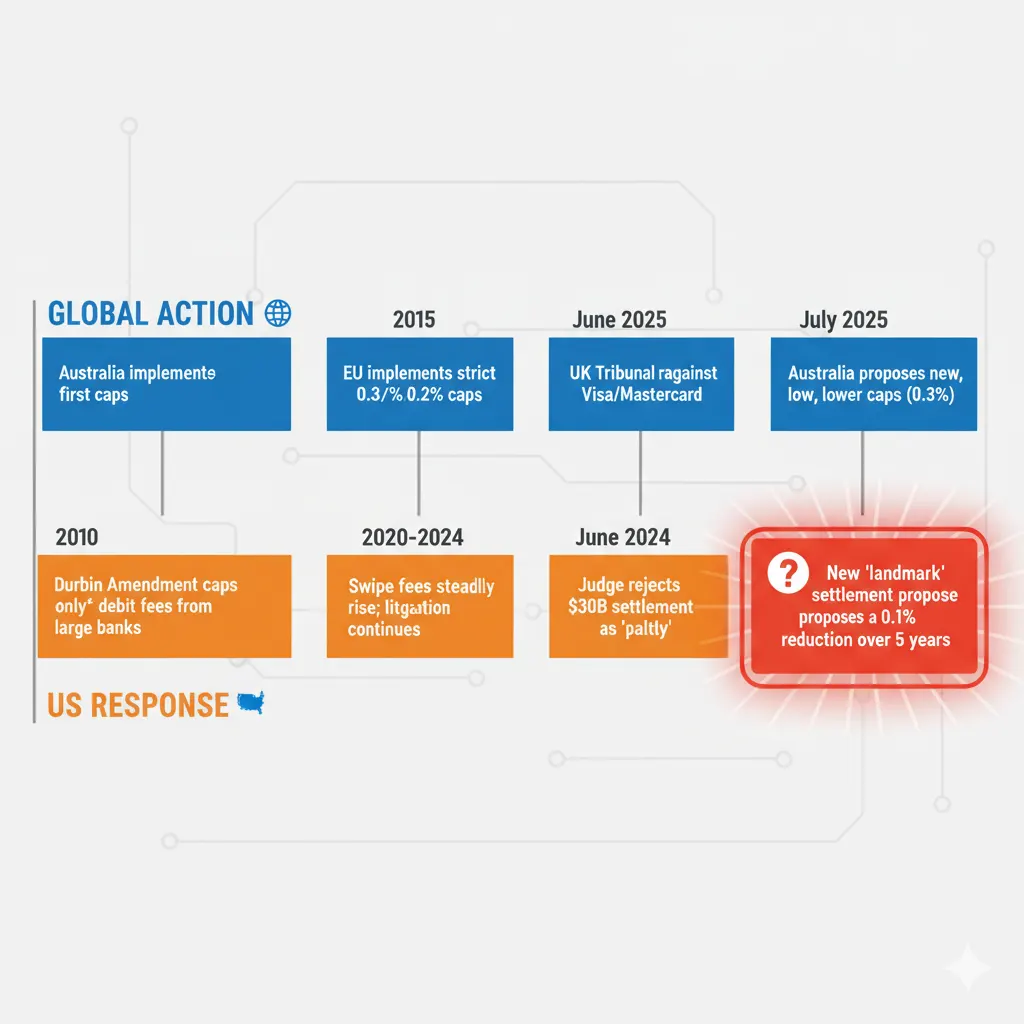

Breaking News: In November 2025, Visa and Mastercard reached a landmark settlement to reduce credit card interchange fees by 0.1% over five years, ending 20 years of litigation with US merchants. But here’s the shocking reality: even with this “historic” reduction, American businesses still pay five to ten times more in swipe fees than their counterparts in Europe and Australia.

If you’re a US merchant watching profits evaporate to credit card processing fees, or a consumer wondering why everything costs more, you need to understand the global swipe fee landscape—and why America remains the world’s most expensive market for accepting card payments.

What Are Swipe Fees? Understanding Interchange Fees in 2025

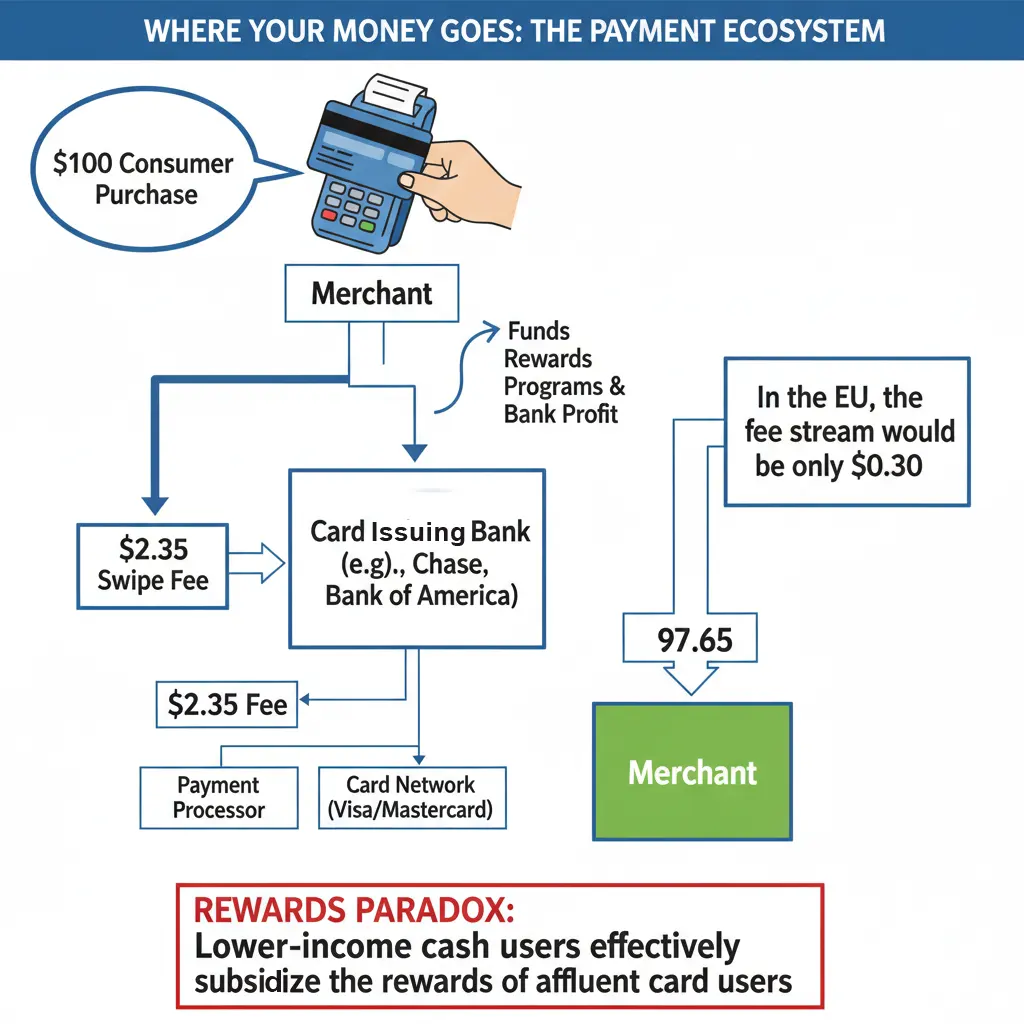

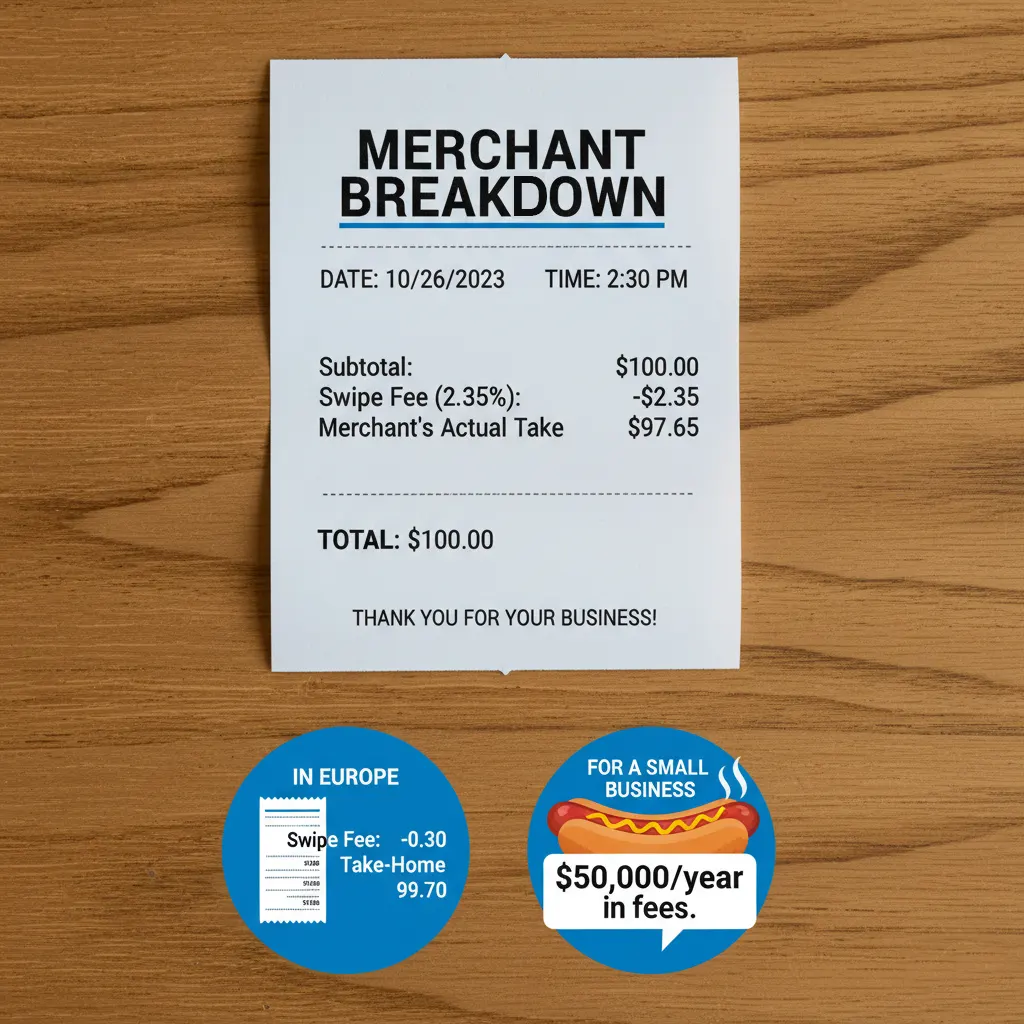

Credit card swipe fees (officially called interchange fees) are charges merchants pay every time a customer uses a credit or debit card. The average swipe fee in the US is currently 2.35% for Visa and Mastercard credit cards, though rates can range from 1.5% to 3.5% depending on card type and transaction method.

In 2024, total swipe fees in the United States reached $111.2 billion for credit cards alone, representing one of merchants’ highest operating costs after labor and rent. For context, the National Retail Federation estimates these fees add over $1,200 annually to costs for the average American family.

These fees are set by card networks like Visa and Mastercard, distributed primarily to card-issuing banks, with smaller portions going to payment processors and the networks themselves. The critical difference? While most developed nations regulate these fees, the US lets the market decide—and merchants (and ultimately consumers) pay the price.

Europe’s Regulated Interchange Fee System: The 0.3% Standard

In 2015, the European Union revolutionized payment processing with the Interchange Fee Regulation (IFR), establishing strict caps across all 27 member states:

- Credit card interchange fees: 0.3% maximum

- Debit card interchange fees: 0.2% maximum

These caps apply to consumer cards across the European Union, representing a dramatic reduction from pre-regulation levels that previously approached US rates.

The impact has been substantial. European merchants save billions annually, while consumers benefit from lower retail prices. Despite concerns from the payment industry, the caps haven’t destroyed innovation—Europe continues advancing contactless payments, open banking, and real-time payment systems.

UK Competition Tribunal Ruling: Strengthening Fee Caps

In June 2025, the UK Competition Appeal Tribunal unanimously ruled that Visa and Mastercard’s interchange fee structures violated competition law, particularly for business cards and cross-border transactions. This landmark decision could further reduce interchange fees across Europe and set precedents for other jurisdictions.

Australia’s Pioneering Approach to Credit Card Fees

Australia led the world in interchange fee regulation, implementing caps in 2003—more than a decade before Europe. The Reserve Bank of Australia currently caps domestic credit card interchange at 0.8% and debit cards at 0.2%.

2025 RBA Proposed Reforms

The Reserve Bank of Australia proposed even stricter interchange fee caps in July 2025, including a 0.3% cap for domestic credit cards and $0.06 for domestic debit transactions, with new caps on international transactions. These changes, expected to take effect July 2026, would bring Australian credit card fees closer to European levels.

The Australian experience proves regulated fees work. Card usage has grown consistently, payment innovation flourishes, and merchants report significant cost savings.

The US Exception: Why American Swipe Fees Remain Sky-High

Current State of US Interchange Fees

US merchants paid an average of 2.26% in swipe fees for Visa and Mastercard transactions in 2023, with total credit and debit card swipe fees reaching a record $187.2 billion in 2024. This represents approximately eight times higher than European credit card fees and three times higher than Australian rates.

Only one segment has regulatory protection: debit cards from large banks are capped at 21 cents per transaction under the 2010 Durbin Amendment, but this covers just a fraction of the market, leaving credit cards and small bank debit cards unregulated.

The November 2025 Visa-Mastercard Settlement

The new settlement would reduce interchange fees by 0.1 percentage points for five years and cap standard consumer rates at 1.25% for eight years. However, merchant groups including the National Retail Federation have strongly opposed the agreement.

The Merchants Payments Coalition argues that the 0.1% reduction “is a small fraction of the 2.35% average swipe fee” and that Visa and Mastercard could still raise their network fees without restriction, potentially erasing any savings.

Erika Polmar of the Independent Restaurant Coalition noted that “swipe fees are one of our highest operating costs after labor, and they’ve quadrupled since 2010”, emphasizing that the settlement falls far short of meaningful relief for small businesses.

Small Business Impact: The Real Cost of High Swipe Fees

Restaurant and Retail Struggles

Gene-Christian Baca, owner of Walter’s Hot Dogs in New York, estimates paying $50,000 annually in credit card processing costs—representing 3% of total sales. This is money that could otherwise fund employee wages, business expansion, or lower menu prices.

A 2025 J.D. Power survey found that 34% of US small businesses now add credit card surcharges to transactions to offset these costs, though this practice reduces customer satisfaction by 24 points on a 1,000-point scale.

The Credit Card Rewards Paradox

Here’s the uncomfortable truth: credit card rewards programs are financed by interchange fees, meaning lower-income consumers who use cash or debit effectively subsidize rewards for affluent credit card users.

Research from the Federal Reserve Bank of Boston shows the average cash-using household pays $149 annually to card users, while card-using households receive $1,133 from cash users—a reverse wealth transfer that high interchange fees enable.

If interchange fees are reduced, rewards programs would likely become less generous, as “rewards are financed by interchange fees,” according to Joanna Stavins, principal economist at the Federal Reserve Bank of Boston.

International Comparison: Fee Structures Around the World

According to Federal Reserve Bank of Kansas City data from August 2025, interchange fee structures vary dramatically by country:

| Country/Region | Credit Card Fee | Debit Card Fee | Regulation Type |

| United States | ~2.35% average | $0.21 + 0.05% (large banks only) | Minimal |

| European Union | 0.3% cap | 0.2% cap | Strict caps |

| United Kingdom | 0.3% cap | 0.2% cap | Strict caps |

| Australia | 0.8% cap (0.3% proposed) | 0.2% cap | Regulated |

| Canada | ~1.4% average | ~0.8% average | Voluntary commitments |

The data is clear: America is an outlier, with interchange fees 780% higher than Europe for credit cards.

Why Does the US Resist Interchange Fee Regulation?

Political and Industry Factors

Several forces maintain the status quo:

- Market Ideology: The US traditionally favors market-based solutions over regulatory intervention, even in markets lacking true competition.

- Powerful Lobbying: Card networks and issuing banks wield significant political influence. The Electronic Payments Coalition, representing major banks like Bank of America, Chase, and Citibank, supports the current settlement, arguing it provides adequate relief.

- Rewards Culture: American consumers have become addicted to lucrative credit card rewards—travel points, cash back, and premium perks—creating a constituency that benefits from high fees (at least directly).

- System Complexity: The US payment ecosystem is vast and fragmented, making comprehensive reform politically challenging.

Legislative Efforts: The Credit Card Competition Act

The Credit Card Competition Act, sponsored by Senators Dick Durbin (D-IL) and Roger Marshall (R-KS), aims to increase competition among credit card networks, but the bill has stalled amid fierce opposition from banking interests.

The Merchants Payments Coalition argues that without Congressional action, meaningful interchange fee reform remains unlikely.

August 2025 Court Ruling: Regulation II Under Fire

In August 2025, a US District Court in North Dakota vacated Regulation II—the Federal Reserve’s framework for setting debit card interchange fees—ruling that it exceeded statutory authority. The decision was stayed pending appeal, but it highlights ongoing legal battles over payment regulation.

If the ruling stands, merchants could see lower interchange fees, though the Federal Reserve is expected to appeal to the Eighth Circuit.

Does Innovation Require High Interchange Fees?

Payment industry advocates claim high US swipe fees fund innovation and security. The international evidence suggests otherwise.

- Sweden (EU-capped fees): One of the world’s most cashless societies

- United Kingdom (0.3% credit cap): A global fintech powerhouse

- Australia (0.8% credit cap): Pioneered real-time payment systems ahead of the US

- Netherlands (EU-capped fees): Leading in contactless payment adoption

Europe’s Payment Services Directive and open banking standards have driven innovation without uncapped interchange fees, proving that payment advancement doesn’t require merchants to subsidize card issuer revenues.

Consumer Impact: Who Really Pays for Swipe Fees?

While merchants directly pay interchange fees, economists universally agree these costs pass through to consumers via higher retail prices. In 2024, American families paid close to $1,200 in swipe fees passed through retail prices.

This creates a hidden tax on all consumers—whether they use cards or not—to fund a payment system that primarily benefits card issuers and affluent rewards card users.

State-Level Actions

Illinois attempted to bar interchange fees on taxes and tips, though a federal judge partially halted the law in December 2024, applying it only to state banks while exempting national banks. This patchwork approach highlights the need for federal reform.

Credit Card Surcharging: Merchants Fight Back

Unable to negotiate lower fees, many US merchants now add credit card surcharges. LendingTree found that 73% of credit card holders would use cards less if they regularly faced surcharges, creating a dilemma for businesses.

Credit card surcharges typically range from 1% to 4% of the purchase price, though they’re illegal in Connecticut and Massachusetts. Merchants must carefully implement surcharge programs to avoid alienating customers while managing crushing payment processing costs.

The Path Forward: Will America Follow Global Standards?

Settlement Skepticism

Judge Margo Brodie rejected a previous $30 billion settlement in June 2024, calling the $6 billion in annual savings “paltry” relative to what Visa and Mastercard could still charge. The new settlement faces similar scrutiny.

The National Restaurant Association called the 0.1% reduction “barely more than last year’s increase” and stated: “If the courts can’t fix this, it’s time for Congress to take action”.

What Real Reform Would Look Like

Meaningful US interchange fee reform would require:

- Credit card fee caps similar to Europe’s 0.3% standard

- Transparency requirements for all payment processing fees

- Prohibition of anti-steering rules that prevent merchants from directing customers toward cheaper payment methods

- Network competition mandates to break the Visa-Mastercard duopoly

The $80 Billion Question

The difference between US interchange fees and international regulated rates represents approximately $80 billion annually in excess costs borne by American merchants and consumers.

International data from the Federal Reserve and payment industry analysts confirms the US maintains the highest credit card interchange fees in the developed world—not because American payment systems are more sophisticated, secure, or innovative, but because we’ve chosen not to regulate them.

Europe and Australia demonstrate that robust, innovative, widely-used card payment networks function perfectly well with interchange fees at a fraction of US levels. The question isn’t whether lower fees are possible—it’s whether American policymakers will prioritize merchant and consumer interests over payment industry profits.

As digital payments continue their inexorable growth, the swipe fee debate will only intensify. Whether through judicial intervention, Congressional action, or continued litigation, change appears inevitable. The only question is: how long will American businesses and consumers wait?

Key Takeaways for US Merchants

- Compare globally: US interchange fees are 5-10x higher than Europe/Australia

- Know your costs: Credit card processing fees typically range from 1.5% to 3.5% per transaction in 2025

- Consider surcharging: 34% of small businesses now add credit card surcharges

- Stay informed: The November 2025 Visa-Mastercard settlement requires court approval

- Advocate for reform: Contact representatives about the Credit Card Competition Act

For more information on payment processing regulations, visit the Federal Reserve’s Payment System Resources or consult with organizations like the National Retail Federation and Merchants Payments Coalition.

#SwipeFees #InterchangeFees #CreditCardFees #MerchantServices #PaymentProcessing #SmallBusiness #RetailBusiness #VisaMastercard #InterchangeReform #MerchantRights #2025Business #PaymentRegulation