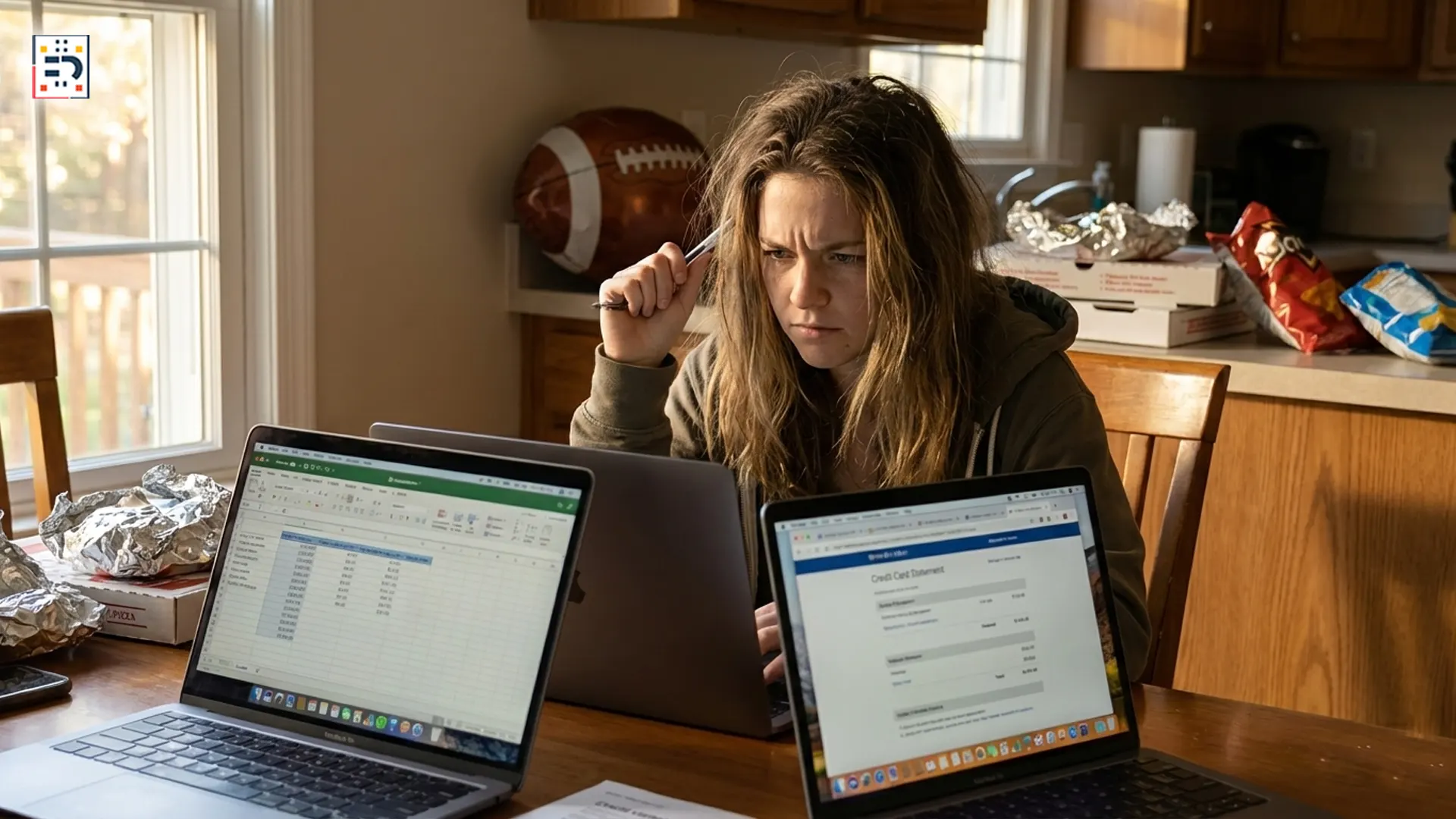

The party is over. The wings are gone. The confetti has settled. And now? The credit card notifications are rolling in.

One week after the Super Bowl, many households across the United States are dealing with what experts call a “financial hangover.” Between hosting costs, streaming subscriptions, upgraded TVs, sports betting apps, and food delivery splurges, February spending can easily derail your 2026 financial goals.

But here’s the good news: Today is Single Tasking Day — the perfect reminder that focusing on one financial fix at a time can reset your entire budget for March.

Why the Post-Super Bowl Financial Hangover Hits Hard

According to consumer spending data from the Federal Reserve, Americans increasingly rely on credit for short-term lifestyle events. Add in food inflation and subscription fatigue, and your February statement may look uncomfortable.

Common post-game expenses include:

- Party hosting supplies & bulk groceries

- Last-minute electronics purchases

- Streaming upgrades

- Sports betting losses

- Impulse online shopping

If you used rewards credit cards, you may have earned points — but high interest from issuers like Chase or American Express can wipe out those gains fast if balances carry into March.

Step 1: Practice “Single Tasking” on Your Finances

Single-tasking means focusing on one financial priority at a time instead of trying to overhaul everything in one stressful evening.

Start with just ONE of these:

Option A: Review One Statement

Log into your banking app and review only your February credit card statement. Categorize spending. No judgment — just awareness.

Option B: Cancel One Subscription

Check recurring payments. Use tools like Mint or your bank’s subscription tracker to eliminate at least one unused service.

Option C: Make One Extra Payment

Even an extra $50 toward your highest APR card reduces compounding interest significantly.

Step 2: Rebuild March With the 72-Hour Reset Rule

Before making any non-essential purchase in March, apply this rule:

Wait 72 hours before buying anything that isn’t a necessity.

This technique reduces emotional spending — especially after high-adrenaline events like the Super Bowl.

If you’re carrying balances, explore balance transfer options through reputable institutions or compare rates on platforms like Bankrate.

Step 3: Reconnect With Your 2026 Financial Goals

Pull out your January goals. Were you planning to:

- Build a 6-month emergency fund?

- Max out your 401(k)?

- Start investing?

- Pay off high-interest debt?

If investing is on your roadmap, review educational tools from Investopedia before making decisions.

Single-task your comeback. Choose ONE measurable action for March:

- Increase automatic savings by 1%

- Cut dining out to once per week

- Redirect tax refund toward debt

Step 4: Create a “Super Bowl Sinking Fund” for 2027

Yes, start now.

Divide estimated 2027 hosting costs by 12 months and auto-transfer that amount into a dedicated savings bucket. That way next year’s celebration won’t sabotage your budget.

Many high-yield savings accounts — including options from Ally Bank — offer competitive APYs for short-term goal savings.

Momentum Beats Motivation

Financial recovery doesn’t require a dramatic overhaul. It requires focus.

On Single Tasking Day, remember:

One focused money move today can prevent three months of financial stress.

March is your reset month. Use it wisely.

#PersonalFinance #BudgetReset #MoneyManagement #DebtFreeJourney #FinancialGoals2026 #SingleTaskingDay #SmartSpending