With rising interest rates, new investment tools, and a stronger focus on financial independence, 2026 is shaping up to be one of the best years to build a passive income portfolio. You don’t need a huge budget — just a smart plan and diversified assets that earn money while you sleep.

Resources from Investor.gov, Morningstar, and Fidelity Research help illustrate how income-producing assets can support long-term wealth.

Step 1: Determine Your Income Goal

Start by defining how much passive income you want to earn annually. A clear target helps you pick the right assets and understand how much capital you need.

- Beginner goal: $1,000–$5,000 per year

- Intermediate goal: $5,000–$15,000 per year

- Advanced goal: $15,000+ per year

Write down your number — it guides every decision that follows.

Step 2: Build Your Core Income Foundation

The foundation of a strong passive income portfolio is a mix of stable, low-risk income assets. In 2026, these are especially attractive due to higher yields and predictable payouts.

Top foundational assets:

- High-yield savings accounts

- Treasury Bills (T-Bills)

- Money market funds

- Investment-grade bond ETFs

These assets help stabilize your portfolio while generating steady interest.

Step 3: Add Dividend-Growth Stocks

Dividend-growth stocks offer one of the most reliable forms of passive income. These companies raise their dividends regularly, helping your income grow faster than inflation.

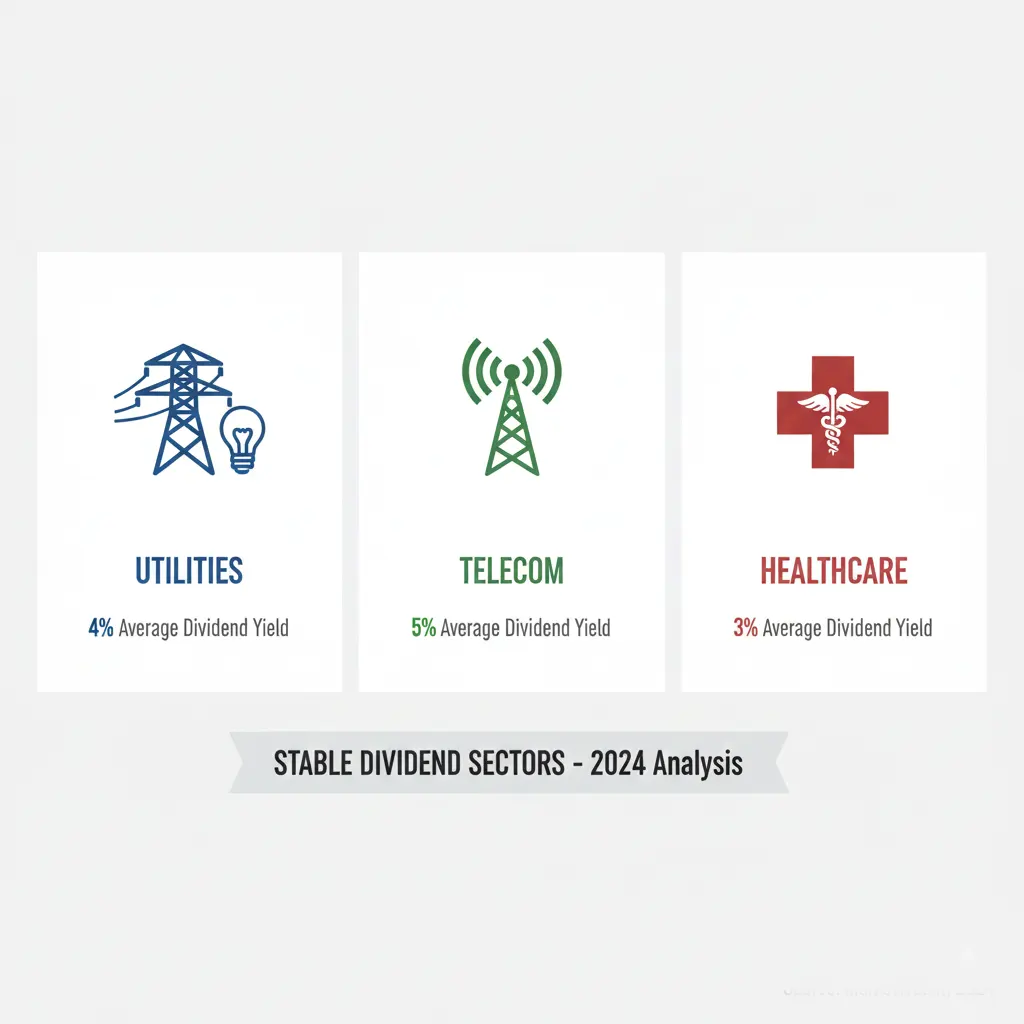

Strong dividend sectors for 2026:

- Utilities

- Telecom

- Healthcare

- Consumer staples

Dividend calendars and stock screeners are available at Nasdaq Dividends.

Step 4: Use ETFs to Automate Diversification

Exchange-traded funds (ETFs) make it easy to automate diversification while earning income through dividends, bonds, or sector exposure.

Recommended ETF types for passive income:

- Dividend ETFs (steady payouts)

- Total market ETFs (broad growth)

- Bond ETFs (consistent income)

- Real estate ETFs (property income without ownership)

Step 5: Add REITs for Real Estate Income

Real Estate Investment Trusts (REITs) provide some of the highest yields in passive income portfolios. They let you earn rental-style income without managing properties.

In 2026, the strongest REIT categories include:

- Data centers

- Healthcare facilities

- Industrial warehouses

- Residential rental REITs

Read industry updates at Nareit.

Step 6: Automate Contributions With Monthly Investing

Set a fixed monthly amount to invest into your passive income assets. Automation removes emotion, helps you stay consistent, and smooths market volatility.

- Auto-invest into ETFs

- Auto-transfer into high-yield accounts

- Auto-purchase fractional dividend shares

This is how passive income becomes long-term wealth.

Step 7: Track, Adjust, and Rebalance

A passive income portfolio still needs occasional adjustments. Rebalancing helps you stay aligned with your goals while maintaining healthy diversification.

- Rebalance every 6–12 months

- Reinvest dividends for compound growth

- Increase allocations to strong performers

Building a passive income portfolio in 2026 is easier than ever thanks to higher yields, better tools, and diversified assets. By setting clear goals, choosing reliable income builders, and automating your strategy, you can create a portfolio that grows quietly in the background — year after year.

#PassiveIncome #Investing2026 #WealthBuilding #SmartInvesting #FinancialFreedom #DividendStocks #ETFs #RealEstateIncome #MoneyManagement #FinanceTips