When Christian Bale portrayed Dr. Michael Burry in The Big Short, audiences witnessed a brilliant mind who predicted—and profited from—the 2008 financial crisis. But here’s what the movie didn’t tell you: Burry’s legendary housing market short wasn’t a lucky bet. It was the result of a systematic, disciplined value investing philosophy he had already been refining for years through his hedge fund, Scion Capital.

Breaking News (Q2 2025): Michael Burry has made dramatic portfolio shifts, liquidating most positions and taking massive bearish bets through put options on major tech stocks including Nvidia, Amazon, and Meta. His only remaining long position as of Q2 2025 is Estée Lauder (EL), signaling his contrarian approach to current market conditions.

While working night shifts as a Stanford neurology resident in the late 1990s, Burry wasn’t just treating patients—he was building a reputation as a value investor on internet message boards. His posts were so insightful that Joel Greenblatt of Gotham Capital and legendary investors at Vanguard reached out to him. By 2000, he left medicine to launch Scion Capital, where he would go on to achieve a staggering three-year annualized return of 25.48%.

Today, through his current vehicle Scion Asset Management, Burry continues to apply the same core principles that made him one of the most successful value investors of our generation. Let’s break down the five pillars of the Scion Method that every investor in the USA market should understand.

Principle 1: Margin of Safety Above All Else – The Foundation of Value Investing

“All my stock picking is 100% based on the concept of a margin of safety.” — Michael Burry

Burry’s primary investment objective centers on protecting the downside to prevent permanent capital loss. This concept, pioneered by Benjamin Graham in Security Analysis, means buying securities at a significant discount to their intrinsic value—creating a buffer against analytical errors or unforeseen market events.

Why Margin of Safety Matters in 2025

Think of it this way: a 50% loss requires a 100% gain just to break even. A 70% decline demands a 233% return. Significant losses destroy the magic of compound interest, which is why Burry obsesses over downside protection before ever considering upside potential.

In today’s volatile market environment—with inflation concerns, interest rate fluctuations, and geopolitical tensions—the margin of safety principle has never been more relevant for American investors seeking portfolio stability.

How Burry Applies the Margin of Safety Strategy

When analyzing stocks, Burry starts write-ups by discussing downside protection first, then provides reasons why the stock should trade higher. For example, when evaluating ValueClick, Inc., he began with: “Internet asset play trading below cash and equivalents, with no debt and with an expectation of positive operating earnings.”

This bottom-up investing approach focuses on individual company fundamentals rather than macroeconomic predictions—a strategy that works particularly well for retail investors who lack access to sophisticated economic forecasting tools.

Actionable Takeaway for US Investors: Before asking “How much can I make?”, ask “How much can I lose?” Look for companies trading below their net asset value, with minimal debt, and strong balance sheets. If the downside is protected, the upside often takes care of itself. Use free tools like Yahoo Finance or Finviz to screen for stocks with low debt-to-equity ratios and price-to-book values under 1.0.

Principle 2: Deep, Independent Fundamental Research – Your Competitive Advantage

“My weapon of choice as a stock picker is research.” — Michael Burry

Burry emphasizes thorough research, digging deep into a company’s fundamentals and thoroughly understanding the industry in which it operates. This isn’t about scanning headlines on CNBC or following Wall Street analyst recommendations—it’s about spending hours poring over 10-K filings, understanding business models, and identifying what others have missed.

The Contrarian Advantage in Modern Markets

Burry’s approach involves forming an investment thesis focusing on market inefficiencies and making contrarian bets. He coined the term “ick investing”—taking a special analytical interest in stocks that inspire an initial reaction of “ick” from most investors.

These “ick” stocks can hold hidden potential, making them intriguing prospects for diligent investors. While everyone else was caught up in dot-com mania in the late 1990s, Burry remained committed to boring, out-of-favor value stocks—an approach that protected him during the tech bubble burst.

The Deep Research Process for Individual Investors

Burry closely reviews financial statements and evaluates indicators such as free cash flow, debt levels, and potential liquidation value. He doesn’t rely on speculation—every investment decision is rooted in hard data and meticulous analysis.

For American retail investors, this means leveraging freely available resources:

- SEC EDGAR Database: Read complete 10-K and 10-Q reports

- Company Investor Relations Pages: Access earnings transcripts and presentations

- Industry Reports: Understand competitive dynamics and market trends

- Trade Publications: Stay informed about sector-specific developments

Actionable Takeaway: Develop your own research capability. Read annual reports cover to cover. Look at industries others are ignoring—sectors like small-cap industrials, regional banks, or overlooked consumer goods companies. Your competitive advantage comes from knowing something the market doesn’t—and you can’t get that from financial media soundbites.

Principle 3: Focus on Free Cash Flow and EV/EBITDA – The Real Value Metrics

“Intrinsic value is determined by free cash flow.” — Michael Burry

Unlike many investors who fixate on price-to-earnings ratios, Burry tends to ignore P/E ratios and thinks that return on equity is both deceptive and dangerous, hence preferring minimal debt in his investment selections.

The Superior Screening Method: EV/EBITDA

Burry screens through large numbers of companies by looking at the EV/EBITDA ratio, with acceptable ratios varying by industry and its current position in the economic cycle. His favorite metric is the EV/EBITDA ratio as it takes debt into account—something particularly crucial in today’s higher interest rate environment.

Enterprise Value to EBITDA (EV/EBITDA) tells you how many years it would take for a company’s operations to pay off its entire enterprise value. Unlike P/E ratios, it accounts for debt—critical for understanding a company’s true financial health, especially for companies in capital-intensive industries.

Why Free Cash Flow Dominates in 2025

Free cash flow represents the actual cash a business generates after capital expenditures—money that can be used for dividends, buybacks, debt reduction, or growth investments. When evaluating QUIP, Burry noted that free cash generation was great relative to market cap, with total capex of only $1 million over three years while operating cash flows totaled $14.4 million.

This is the kind of cash-gushing business Burry loves—companies that don’t require heavy reinvestment to maintain their operations. In an economic environment where access to capital may become more expensive, companies with strong free cash flow generation have a significant competitive advantage.

Actionable Takeaway for Value Investors: Learn to calculate free cash flow using the formula: Operating Cash Flow – Capital Expenditures. Both numbers are available on company cash flow statements. Look for companies with:

- Consistent, growing free cash flow over 3-5 years

- Low EV/EBITDA ratios compared to industry peers (typically below 10 is attractive)

- Free cash flow yield above 5% (FCF divided by market cap)

Use screening tools like Finbox or Stock Rover to filter companies meeting these criteria in the US market.

Principle 4: Hunt in Overlooked Waters – The Small-Cap Value Opportunity

“I care little about the level of the general market and put few restrictions on potential investments.” — Michael Burry

Burry loves small-cap and micro-cap stocks because they’re one of the least fished areas of the market, with his seven ideas on Value Investors Club having an average market cap of just $132 million—far below the radar of major institutional investors.

Why Micro-Caps Offer Superior Returns

Most institutional investors ignore micro-cap stocks for several structural reasons:

- Limited liquidity makes it difficult to build large positions without moving the market

- Less analyst coverage means less readily available information

- Position sizing constraints – they can’t move the needle for billion-dollar funds

But for individual investors and smaller funds, this creates significant opportunity. According to research from Ibbotson Associates, small-cap value stocks have historically outperformed large-cap growth stocks by approximately 2-3% annually over long periods.

Current Market Context (November 2025)

Interestingly, Burry’s recent Q2 2025 portfolio reveals he’s shifted focus, taking concentrated put positions against mega-cap tech stocks while maintaining only one long position in Estée Lauder—demonstrating his willingness to adapt his hunting grounds based on market valuations.

The Rare Birds Portfolio Strategy

Burry invests in “rare birds”—mostly asset plays, but also arbitrage opportunities and companies selling at less than two-thirds of net value. These aren’t sexy tech stocks featured on TechCrunch. They’re companies like:

- Industrias Bachoco (IBA): A Mexican poultry producer that traded at just 2× ex-cash earnings and 0.5× price-to-book, while similar companies were valued 3–5× higher

- Regional manufacturing equipment makers overlooked by Wall Street

- Family-owned businesses with solid fundamentals but no institutional coverage

Actionable Takeaway for Small Investors: Don’t limit yourself to S&P 500 stocks everyone’s talking about. Use stock screeners on platforms like:

- Finviz – Free screener with excellent filtering options

- Stock Screener (SEC) – Access company filings directly

- Russell 2000 Components – List of US small-cap companies

Filter for companies with:

- Market caps under $500 million

- Debt-to-equity ratios below 0.5

- Price-to-book values under 1.0

- Positive free cash flow

Read the 10-Ks yourself—if institutional analysts aren’t covering it, you might find genuine value others are missing.

Principle 5: Long-Term Conviction with Patience – The Time Arbitrage

“I seek individual investments that will allow me to target total portfolio returns of at least 20% annually after fees and expenses over a period of years, not months.” — Michael Burry

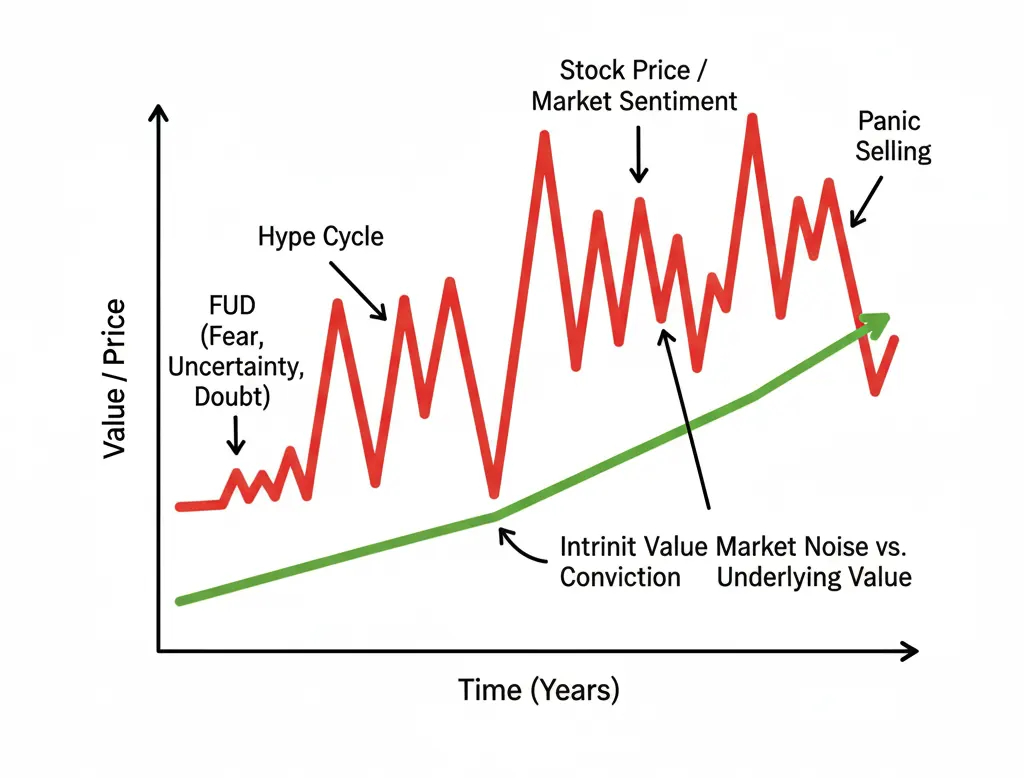

Burry invests with a long-term outlook, holding undervalued stocks until the market acknowledges their actual value. This isn’t day trading or momentum investing—it’s patient, conviction-based investing that exploits the market’s short-term focus.

The Market Can Stay Irrational – Lessons from The Big Short

Burry famously learned that the market can stay irrational longer than you can stay solvent. His housing market short is the perfect example. He began building his position in 2005, endured two years of losses and investor redemptions, and was proven spectacularly right in 2007-2008—but the psychological toll was immense.

This lesson is particularly relevant for today’s investors dealing with:

- Meme stock volatility driven by social media

- AI hype cycles creating temporary dislocations

- Macro uncertainty causing knee-jerk market reactions

Managing a Concentrated Portfolio in 2025

Unlike index-hugging managers who own hundreds of stocks, Burry runs an extremely concentrated portfolio. His approach prioritizes gradual, sustainable growth over rapid returns. As of Q2 2025, Burry’s portfolio consists of:

- One long position: Estée Lauder (EL) – 150,000 shares

- Multiple put positions: Including major bets against Nvidia, Amazon, Meta, and Chinese tech stocks

This represents one of his most bearish stances in years, with portfolio positioning suggesting expectations of market corrections ahead.

The Importance of Temperament Over Intelligence

Burry emphasizes that fundamental analysis isn’t a sure-fire way of succeeding in the stock market, but it does at least put the odds on your side. Success requires not just analytical skill, but emotional discipline to stick with your thesis when the market disagrees—something legendary investor Warren Buffett also emphasizes.

Actionable Takeaway for Patient Investors:

- Build positions gradually in companies where you have genuine conviction based on your research

- Set realistic timeframes – expect to hold quality value stocks for 3-5 years minimum

- Ignore short-term volatility – focus on whether business fundamentals remain intact

- Diversify across sectors – hold 10-20 positions maximum to balance concentration with risk management

- Use a investment journal – document your thesis and review regularly to learn from both wins and losses

Don’t panic when the market temporarily moves against you—as long as the fundamentals remain intact and your original investment thesis holds true, temporary price weakness can be an opportunity to add to positions at better valuations.

The Scion Method in Today’s Market: November 2025 Update

Michael Burry’s current portfolio reflects both his timeless principles and his adaptability to current market conditions. His dramatic Q2 2025 portfolio restructuring reveals several key insights:

Current Holdings and Market Positioning

Long Position:

- Estée Lauder (EL): Burry’s only remaining long position, with 150,000 shares valued at approximately $9.5 million. Despite the stock’s 80% decline from its peak, Burry sees contrarian value in the global beauty giant’s potential turnaround, particularly as Chinese luxury demand potentially recovers.

Major Put Positions (Bearish Bets):

- Nvidia (NVDA): 250,000 put contracts worth approximately $85 million

- Amazon (AMZN): 75,000 put contracts valued at $40.5 million

- Meta Platforms (META): 100,000 call contracts worth $73.8 million (note: also holding calls, suggesting complex hedging)

- Alibaba (BABA): 200,000 put contracts worth $26.4 million

- JD.com (JD): 200,000 put contracts valued at $16.6 million

- PDD Holdings (PDD): 200,000 put contracts worth $23.7 million

This positioning suggests Burry sees significant overvaluation in mega-cap tech stocks and continued headwinds for Chinese e-commerce companies facing US tariffs and domestic economic challenges.

Key Lessons for Modern American Investors

- Protect your downside first — A margin of safety isn’t optional; it’s essential, especially in richly valued markets

- Do your own homework — Information advantages come from deeper research, not faster news from Bloomberg or MarketWatch

- Focus on cash generation — Profits can be manipulated through accounting; free cash flow can’t

- Fish where others won’t — The best opportunities are often in overlooked corners like Russell Microcap Index constituents

- Have patience and conviction — Value realization takes time; don’t confuse volatility with permanent capital loss

What Burry’s 2025 Portfolio Tells Us About Current Markets

Burry’s aggressive bearish positioning through put options suggests he believes:

- Tech valuations remain elevated despite recent corrections

- AI hype has created bubble-like conditions in certain sectors

- Chinese markets face structural headwinds from US-China tensions

- Traditional value opportunities exist in beaten-down sectors like consumer discretionary

For value investors, this creates a roadmap: avoid crowded momentum trades, hunt for genuine asset value, and maintain dry powder for opportunities when market dislocations occur.

Implementing the Scion Method: A Practical Guide for US Investors

Step 1: Build Your Research Foundation

Start by creating a systematic research process:

- Industry Analysis: Understand the competitive landscape using resources like IBISWorld or Statista

- Company Screening: Use SEC EDGAR to access all public company filings

- Financial Analysis: Master reading 10-K reports, focusing on MD&A sections and footnotes

- Valuation Work: Calculate intrinsic value using discounted cash flow models (free templates available on Investopedia)

Step 2: Develop Your Screening Criteria

Create filters based on Burry’s principles:

- Margin of Safety: Price-to-book < 1.0, or Price below tangible book value

- Quality: Debt-to-equity < 0.5, Interest coverage ratio > 3x

- Cash Flow: Free cash flow yield > 5%, positive operating cash flow for 5+ years

- Size: Market cap between $50M – $2B (small to mid-cap range)

- Valuation: EV/EBITDA < 8 (varies by industry)

Step 3: Position Sizing and Risk Management

Follow these guidelines for portfolio construction:

- Concentration: Hold 10-20 positions maximum

- Position size: No single position exceeds 10% of portfolio at cost

- Sector limits: Maximum 30% in any single sector

- Cash buffer: Maintain 10-20% cash for opportunities

- Rebalancing: Review quarterly, act on annual thesis changes

Step 4: Continuous Learning and Adaptation

Value investing requires ongoing education:

- Read classic texts: Graham’s The Intelligent Investor, Greenblatt’s The Little Book That Beats the Market

- Follow value investors: Study 13F filings from successful managers

- Join communities: Participate in Value Investors Club or Seeking Alpha

- Track your performance: Use portfolio tracking tools like Personal Capital or Morningstar

Common Pitfalls to Avoid: Learning from Burry’s Mistakes

Even legendary investors make errors. Here are key mistakes to avoid:

1. The Liquidity Trap

Burry’s housing short succeeded, but he faced massive redemption pressure before being proven right. Lesson: Ensure you have sufficient liquidity and time horizon to weather being temporarily wrong.

2. Over-Concentration Risk

While concentrated portfolios can generate alpha, they also increase risk. Diversify across at least 10 positions to protect against unexpected company-specific events.

3. Ignoring Macro Catalysts

Burry’s 2025 bearish positioning shows he now pays attention to macroeconomic factors like tariffs and interest rates. Don’t be so focused on bottom-up analysis that you miss top-down risks.

4. The Value Trap

Not every cheap stock is a good value. Avoid companies in terminal decline or facing structural headwinds. Look for temporary issues creating opportunity, not permanent impairments.

Is the Scion Method Right for You?

The beauty of Burry’s approach is that it doesn’t require insider connections, expensive Bloomberg terminals, or a PhD in finance. What it requires is:

- Discipline to follow a systematic process

- Patience to wait for the market to recognize value

- Independence to think differently from the crowd

- Diligence to do thorough research

- Emotional control to stick with your thesis during volatility

As Burry himself wrote in his early internet posts: “If I see value in it, it’s a potential portfolio candidate.” That simple philosophy—combined with rigorous analysis and the courage of conviction—has generated extraordinary returns over decades.

Is This the Right Time for Value Investing?

Given current market conditions in November 2025:

- High valuations in mega-cap tech suggest limited upside

- Interest rate normalization makes bonds more competitive with stocks

- Economic uncertainty increases the importance of strong balance sheets

- Market concentration creates opportunities in overlooked sectors

These factors suggest value investing principles are particularly relevant right now for American investors.

The Path Forward

The Scion Method isn’t about predicting the next crisis or finding the next meme stock. It’s about systematically identifying undervalued businesses trading at significant discounts to intrinsic value, protecting your downside through margin of safety, and having the patience to let value reveal itself over time.

In a market dominated by algorithmic trading and short-term thinking, these principles are more valuable than ever. The question is: do you have the discipline to follow them?

#ValueInvesting #MichaelBurry #ScionCapital #StockMarket #Investing101 #MarginOfSafety #FreeCashFlow #ContrarianInvesting #StockScreening #FundamentalAnalysis #SmallCapStocks #UndervaluedStocks #StockPicking #InvestmentStrategy #PortfolioManagement