A combined $27 trillion economic bloc has just taken a major step toward deeper integration. A landmark trade agreement between India and the European Union is being quietly described by trade analysts as the “Mother of All Deals.” While the agreement is still evolving, its implications could ripple far beyond Brussels and New Delhi—reaching straight into US markets.

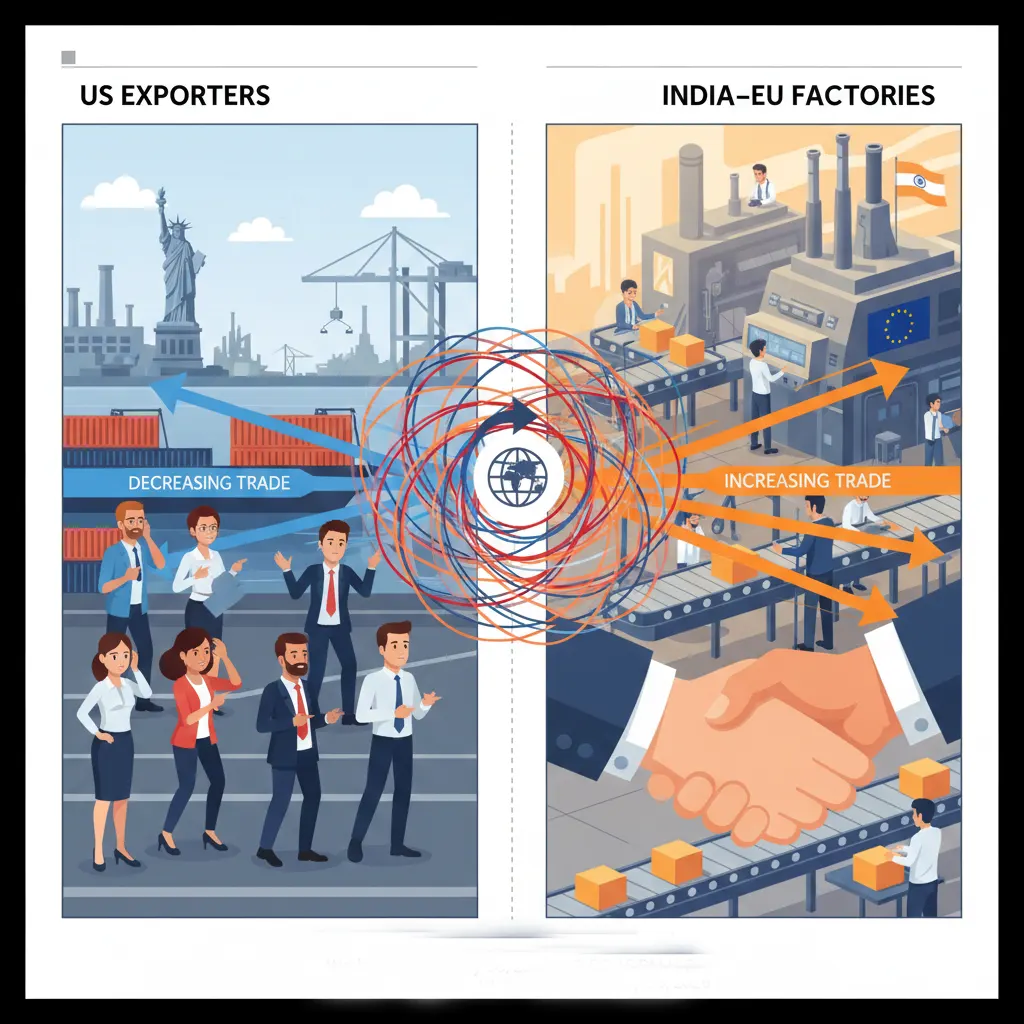

For American consumers, the pact could mean cheaper goods. For US exporters, it could mean stiffer competition in two of the world’s fastest-growing and wealthiest markets.

What Is the India–EU Trade Pact?

The deal aims to dramatically reduce tariffs, streamline regulations, and boost investment flows between India and the EU. Together, the two represent more than a quarter of global GDP and a massive share of the world’s manufacturing and services output.

Negotiations have focused on key sectors including automobiles, pharmaceuticals, technology services, green energy, and agriculture—industries that also happen to be central to US exports.

Why This Deal Is a Big Deal

Trade agreements of this scale are rare. Unlike narrower regional deals, the India–EU pact links a rapidly industrializing economy with one of the world’s most advanced consumer markets.

For multinational companies, this creates a powerful incentive to shift supply chains and investment toward India–EU trade corridors, potentially bypassing US suppliers.

How US Consumers Could Benefit

American consumers may see indirect benefits. Increased competition and lower production costs could reduce prices on:

- Pharmaceuticals and generic medicines

- Automobiles and auto components

- Consumer electronics

- Green energy technologies

As Indian and European firms scale up production and exports, global supply increases could help ease inflationary pressures.

Why US Exporters Are Nervous

For US companies, the concern is market access. If European and Indian firms receive preferential treatment under the pact, American exporters could face higher relative tariffs and regulatory barriers.

This is especially sensitive in sectors where the US currently competes strongly, such as aerospace, advanced manufacturing, and digital services.

A Strategic Shift in Global Trade

The deal also has geopolitical implications. As the EU diversifies away from overreliance on China and India positions itself as a manufacturing alternative, the US risks being left out of a rapidly consolidating trade axis.

Some analysts see the pact as part of a broader realignment of global trade—one where mega-regional agreements increasingly shape economic power.

What This Means for US Policy

The India–EU agreement may add pressure on Washington to rethink its own trade strategy. Calls for renewed trade engagement, whether through bilateral deals or broader frameworks, are likely to grow louder.

Without comparable agreements, the US could find itself reacting to global trade shifts rather than shaping them.

The “Mother of All Deals” between India and the EU is not just a regional trade story—it’s a global economic turning point. For US consumers, it may bring lower prices. For US exporters, it could bring tougher competition.

Either way, the ripple effects of this $27 trillion pact are only just beginning.

#IndiaEUDeal #GlobalTrade #USMarkets #InternationalEconomy #TradePolicy #ExportEconomy #ConsumerPrices #Geopolitics