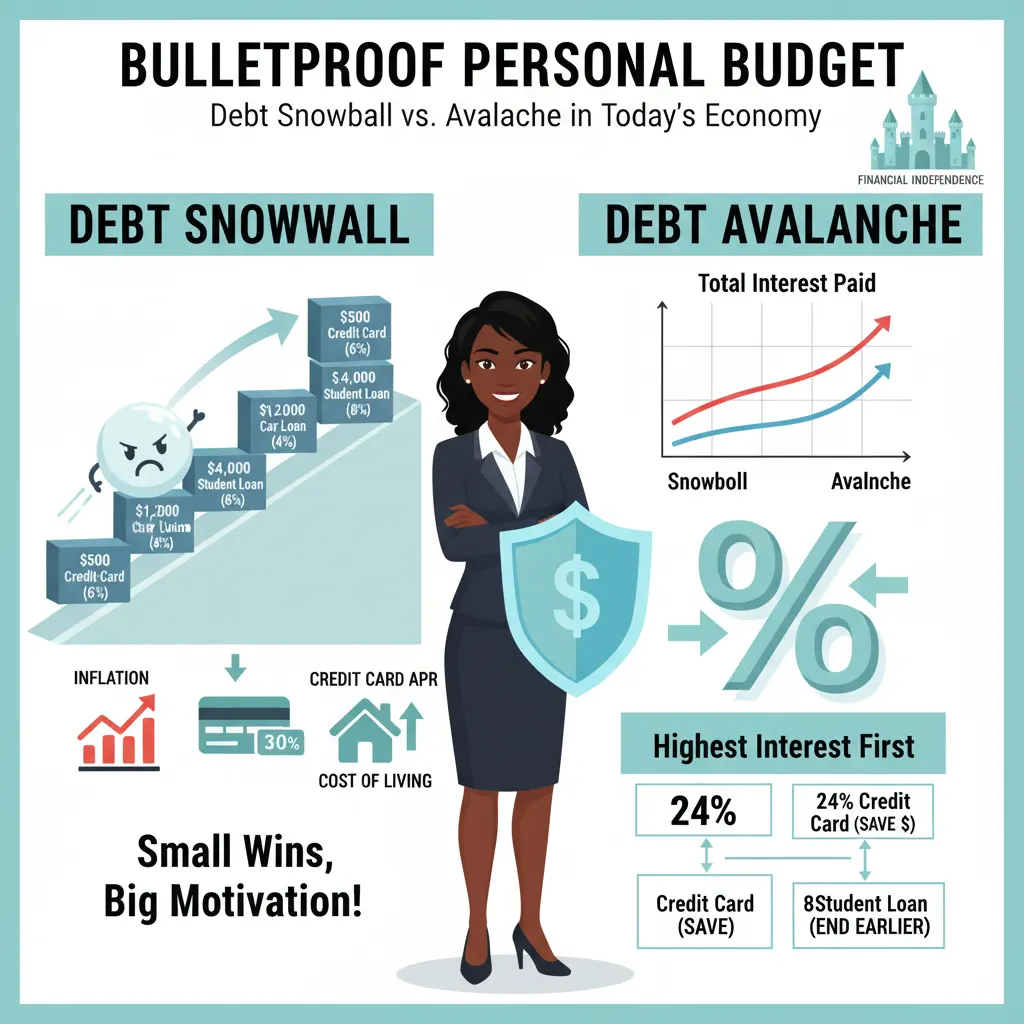

In today’s turbulent U.S. economy—where inflation, credit card APRs, and the cost of living are climbing—having a bulletproof personal budget is more than smart; it’s survival. Whether you’re battling student loans, credit card debt, or auto loans, mastering the Debt Snowball vs. Debt Avalanche methods will help you take control of your money and move toward financial independence.

Understanding the Importance of a Bulletproof Personal Budget

Why Financial Resilience Matters in Today’s Economy

Financial resilience means being able to bounce back from setbacks—like job loss or a medical bill—without falling deeper into debt. According to the Consumer Financial Protection Bureau (CFPB), building a consistent budget is one of the most powerful tools for long-term stability.

A bulletproof budget ensures every dollar has a purpose—whether that’s paying down debt, saving, or investing. It’s not about restriction—it’s about empowerment, flexibility, and peace of mind.

The Foundation of Financial Control: Income, Expenses, and Goals

Start by listing all income sources (salary, side hustles, rental income) and every monthly expense. Divide them into:

- Needs: Rent/mortgage, groceries, insurance, transportation

- Wants: Subscriptions, dining out, hobbies

- Savings & Debt Payments: Retirement, emergency funds, credit card payments

Set SMART goals (Specific, Measurable, Achievable, Relevant, Time-bound). NerdWallet’s budgeting guide offers excellent U.S.-based resources to help you track spending and define goals effectively.

What Is the Debt Snowball Method?

How the Debt Snowball Works: Small Wins, Big Motivation

The Debt Snowball Method, made famous by Dave Ramsey, focuses on paying off the smallest debt first, regardless of interest rate. Once that debt is gone, roll its payment into the next smallest—creating momentum like a snowball rolling downhill.

Steps:

- List all debts from smallest to largest.

- Make minimum payments on everything except the smallest.

- Throw every extra dollar at that smallest debt.

- Once it’s gone, “snowball” the payment toward the next one.

Pros and Cons of the Debt Snowball Approach

Pros:

- Quick emotional wins boost motivation.

- Easy to understand and stick with.

- Great for beginners struggling to stay consistent.

Cons:

- May cost more in total interest than the Avalanche method.

- Not ideal for large, high-interest debts.

Real-Life Example

Imagine you owe:

- $500 (credit card at 6%)

- $1,200 (car loan at 4%)

- $4,000 (student loan at 8%)

Using the Snowball, you’d first pay off the $500, then tackle the $1,200 loan. The psychological satisfaction of seeing “paid in full” keeps motivation high.

What Is the Debt Avalanche Method?

How the Avalanche Works: Tackling Interest for Long-Term Savings

The Debt Avalanche Method prioritizes debts by interest rate—you pay the highest-interest balance first. This minimizes total interest paid and helps you become debt-free faster.

The Investopedia comparison of Snowball vs. Avalanche confirms that, mathematically, Avalanche saves you more money over time.

Steps:

- List debts by interest rate (highest to lowest).

- Pay minimums on all except the highest-rate debt.

- Pay that one off first.

- Move down the list.

Pros and Cons of the Debt Avalanche Approach

Pros:

- Saves the most on interest overall.

- Pays off debt faster if you stay disciplined.

Cons:

- Can feel slow at first.

- Harder to stay motivated without visible early progress.

Real-Life Example

If your highest-interest debt is a 24% credit card, followed by an 8% student loan, focus on the credit card first. You’ll save hundreds in interest—money that can later grow in a high-yield savings account instead of going to lenders.

Debt Snowball vs. Debt Avalanche: Key Differences

| Feature | Debt Snowball | Debt Avalanche |

|---|---|---|

| Focus | Smallest debt first | Highest interest first |

| Motivation | Quick emotional wins | Long-term savings |

| Total Interest Paid | Higher | Lower |

| Complexity | Simple | Slightly more technical |

For more in-depth analysis, see Wells Fargo’s breakdown of Snowball vs. Avalanche, which emphasizes choosing the one you’ll actually stick to.

How to Choose Between the Two Methods

Factors to Consider

- Budget size: Smaller incomes may benefit more from Snowball momentum.

- Income stability: If you have an unpredictable income, Snowball offers emotional reinforcement.

- High-interest debt: Use Avalanche if you carry large credit card balances over 20%.

- Mindset: If you’re emotional with money, Snowball helps; if you’re analytical, Avalanche wins.

Hybrid Strategy: The Best of Both Worlds

Combine both for maximum results:

- Use Snowball to clear one or two small debts first.

- Then switch to Avalanche for interest-heavy debts.

This hybrid method gives you early wins and long-term savings—a strategy recommended by CNBC Make It.

Step-by-Step Guide to Building a Bulletproof Budget

Step 1: Track Your Spending

Review your last 3 months of bank statements. Use U.S.-based tools like:

These apps sync to your accounts, auto-categorize spending, and show exactly where your money goes.

Step 2: Prioritize Needs Over Wants

Cut down recurring expenses. Cancel unused subscriptions, downgrade streaming services, and dine out less. Every saved dollar accelerates your debt payoff.

Step 3: Allocate Extra Income

When you receive a bonus or tax refund, split it smartly:

- 70% toward debt

- 20% into savings

- 10% for enjoyment (to prevent burnout)

Step 4: Automate Everything

Automation is key. Set up:

- Automatic bill payments

- Scheduled savings transfers

- Debt payoff reminders

According to Forbes, automating finances drastically reduces late fees and emotional overspending.

Smart Tools & Apps for Managing Your Money

- YNAB: Perfect for zero-based budgeting.

- Undebt.it: Free calculator that shows payoff dates using Snowball or Avalanche.

- Empower (formerly Personal Capital): Tracks investments and net worth.

- EveryDollar: Dave Ramsey’s budgeting app built for Snowball enthusiasts.

Each integrates with U.S. banks and credit card companies for easy automation.

Expert Tips for Staying Debt-Free

Build an Emergency Fund

Save 3–6 months of living expenses in a high-yield U.S. savings account. Bankrate’s guide explains how to grow it strategically.

Invest for the Future

Once debt-free, start investing via:

Investing turns savings into long-term wealth.

Avoid Lifestyle Inflation

Keep expenses stable as income rises. Redirect raises to savings or debt payments instead of luxury purchases.

Common Mistakes to Avoid

- Ignoring interest rates: High-APR credit cards (20–30%) should never be left unpaid.

- Skipping minimum payments: Hurts your credit score and adds fees (see Experian’s warning).

- Lifestyle creep: Regularly audit expenses; keep lifestyle consistent even as earnings grow.

FAQs

1. Which method is better for beginners?

The Debt Snowball—it offers quick wins and boosts momentum. (Dave Ramsey’s guide)

2. Which saves more in the long run?

The Debt Avalanche—it minimizes total interest paid. (Investopedia)

3. Should I invest while in debt?

If your interest rate is under 6%, consider investing alongside repayment. If higher, prioritize debt first. (CNBC)

4. Can I combine both strategies?

Yes—start with Snowball for motivation, then switch to Avalanche for savings. (Wells Fargo)

Take Control of Your Finances Today

A bulletproof personal budget is your shield in today’s uncertain U.S. economy. Whether you choose the Debt Snowball for quick momentum or the Debt Avalanche for maximum efficiency, the key is consistency.

Don’t wait—start tracking, automating, and paying off debt now.

Your future self will thank you.

#DebtSnowball #DebtAvalanche #PersonalFinanceUSA #BudgetTips #MoneyManagement #FinancialFreedom #DebtFreeJourney #SmartBudgeting #FinanceGoals #USABudgetGuide