The Current Crash: What’s Happening with Bitcoin (BTC)

The Bitcoin crash 2025 USA headlines dominated every major outlet after the digital asset dropped below $106,000. According to [source: insert CNBC link], the sell-off followed a combination of hawkish Federal Reserve comments, shrinking liquidity, and leveraged liquidations on U.S. exchanges.

Across Wall Street, traders shifted from high-beta assets to Treasuries as risk appetite collapsed. Bitcoin fell more than 8% in 24 hours, while Ethereum, Solana, and other major altcoins mirrored the decline. The move placed the broader U.S. crypto market cap at its lowest level since mid-summer.

According to CNBC’s latest crypto market report, U.S. traders saw the sharpest Bitcoin sell-off since early summer.

Macro Drivers: How the Federal Reserve Shifted Crypto Sentiment

As Bloomberg Markets noted, the Fed’s cautious tone kept Treasury yields elevated.

Rate Policy and Liquidity

During its last FOMC meeting, the Fed cut rates 25 bps but warned that further easing was uncertain — a message that unsettled traders expecting a dovish pivot. [Insert Bloomberg Markets link] notes that higher yields on U.S. Treasuries reduce the appeal of speculative assets like Bitcoin.

Dollar Strength and Bond Yields

The U.S. Dollar Index reached a five-month high, and 10-year Treasury yields hovered near 4.9%. That strength pulled liquidity away from risk assets, fueling what analysts on [Insert WSJ Markets link] called a “mini risk-off storm.”

Technical Structure Behind the Sell-Off

Data from CoinDesk Markets show heavy on-chain liquidations on U.S. exchanges.

On-Chain Stress Signals

Blockchain analytics platforms report heavy outflows from U.S. crypto exchanges and a sharp spike in forced liquidations. Long-term holders trimmed over 100,000 BTC in October — a bearish sign. [Insert CoinDesk Markets link]

Key Support Levels to Watch

- Primary support: ≈ $100K – $101K

- Secondary zone: ≈ $94K

- Critical line: ≈ $88K – $85K

Failure to defend those levels could invite deeper capitulation, similar to prior Wall Street liquidation cascades.

Why Experts Warn of $88K Targets

Strategists cited by [Insert Forbes Crypto link] believe the $88,000 target stems from Fibonacci retracement patterns and the aggregate cost basis of short-term U.S. holders. If momentum remains negative, they see potential downside to that zone before stabilization.

Analysts interviewed by Forbes Crypto warn that $88 K remains a risk zone.

Is This Just a Correction or a Cycle Shift?

The Wall Street Journal’s Markets section described similar risk-off sentiment across U.S. assets.

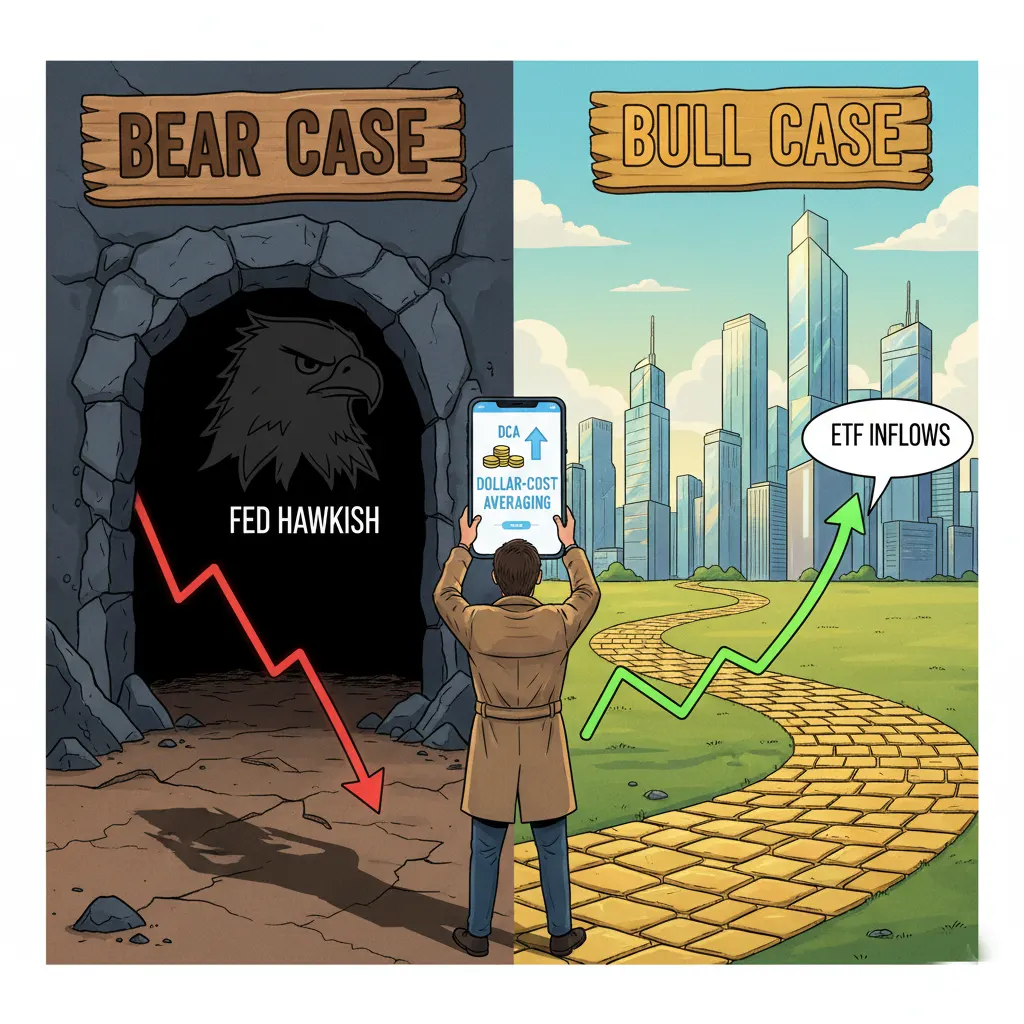

Bull Case

If Bitcoin reclaims the $113K resistance and the Fed tones down its hawkish message, Wall Street risk appetite could revive. Inflows into U.S. Bitcoin ETFs and renewed institutional accumulation might mark a bottom. [Insert MarketWatch Crypto link]

Bear Case

Conversely, if inflation data forces the Fed to remain tight, elevated Treasury yields and a strong dollar may continue to suppress crypto. Analysts on [Insert Reuters Crypto link] warn that the next leg could mirror the 2022 drawdown.

What U.S. Investors Can Do

- Manage leverage: Avoid over-exposure on margin accounts regulated in the U.S.

- Diversify assets: Balance Bitcoin holdings with stable-yield instruments such as Treasury ETFs.

- Follow data: Track CPI releases, FOMC minutes, and Bitcoin ETF flows.

- Maintain long-term discipline: Volatility has historically offered entry opportunities for dollar-cost-averaging investors.

Key Takeaways for U.S. Markets

- The Federal Reserve’s policy tone is dictating crypto’s near-term path.

- Wall Street sentiment remains risk-averse amid elevated yields.

- Bitcoin’s technical floor sits between $88K and $94K; failure there could trigger further downside.

- Upcoming Fed meetings and inflation data are the major catalysts to monitor.

- Institutional participation through U.S. Bitcoin ETFs will likely determine recovery strength.

- U.S. investors watching MarketWatch’s crypto forecasts should note resistance near $113 K.

FAQs

Reuters reported ongoing volatility following the FOMC decision.

1. Did the Fed cause the Bitcoin crash?

Indirectly. The Fed’s cautious rate-cut outlook and persistent inflation pressures reduced liquidity, prompting a broader Wall Street risk-off move. [Insert Bloomberg Economics link]

2. Why is $88K a critical target for Bitcoin in U.S. markets?

Technical models and U.S. trading volume profiles highlight $88K as the 0.786 Fibonacci retracement and a psychological support zone.

3. How does Wall Street affect crypto prices?

Institutional desks in New York and Chicago increasingly trade Bitcoin futures; risk sentiment on equities often spills into crypto. [Insert CNBC Markets link]

4. Could Bitcoin rebound soon?

Yes — if inflation data cools and the Fed signals easing in early 2026, analysts expect renewed ETF inflows.

5. Are U.S. investors still buying the dip?

Retail sentiment remains cautious, but wallet data show gradual accumulation among long-term holders. [Insert Investopedia Bitcoin link]

6. How should Americans manage crypto exposure?

Use regulated exchanges, apply stop-loss orders, and avoid over-concentration; volatility remains high.

For readers new to digital assets, Investopedia’s Bitcoin guide explains core U.S. trading mechanics.

The Bitcoin crash 2025 USA is a clear reminder of how tightly digital assets are intertwined with U.S. monetary policy and Wall Street sentiment. Whether the Fed’s next move revives or restrains crypto will define the path to 2026.

Analysts agree: if Bitcoin holds the $100K floor and macro conditions ease, a recovery could form. But if yields rise and liquidity tightens, the feared $88K scenario may become reality.

#BitcoinCrash #CryptoNewsUSA #BTCPrice #FederalReserve #WallStreet #CryptoMarket #USInvesting #BitcoinAnalysis #CryptoTrends #BlockchainNews