The 2026 investment landscape brings fresh opportunities — from safer income-generating assets to technology-driven sectors with steady growth potential. While no strategy eliminates all risk, investors can balance growth and stability by spreading their capital across diversified, time-tested options.

Resources such as Investor.gov, Morningstar, and Fidelity Research provide ongoing guidance on risk levels, market trends, and diversified portfolio planning.

Broad-Market Index Funds (Low Fees, Reliable Growth)

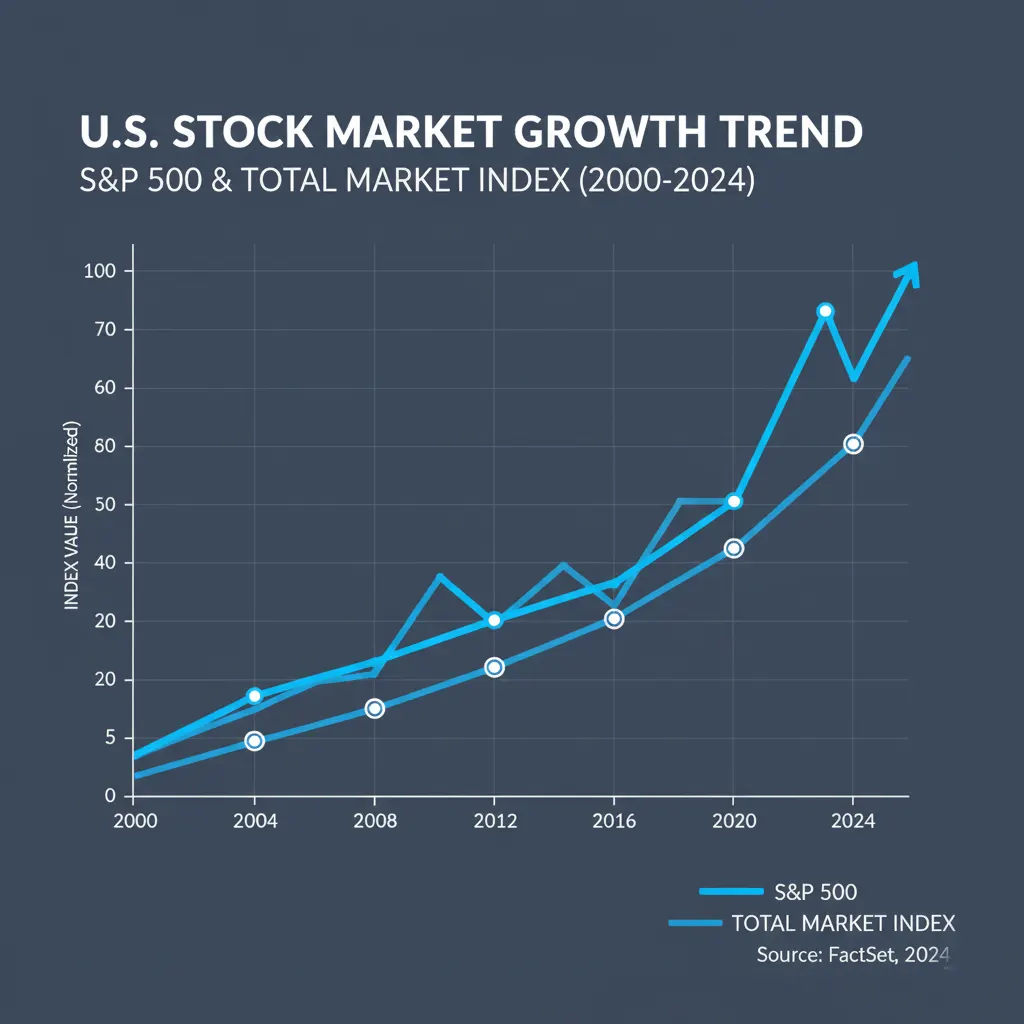

Index funds remain one of the most efficient ways to grow wealth while minimizing risk. They track major benchmarks — such as the S&P 500 or Total Market Index — offering instant diversification.

- Low management fees

- Stable long-term performance

- Ideal for hands-off investors

For performance data, check Vanguard and BlackRock iShares.

High-Yield Savings & Treasury Accounts

Rising interest rates have boosted the appeal of high-yield savings accounts, money market funds, and Treasury-backed securities. Although returns are moderate, they offer excellent liquidity and near-zero default risk.

Popular options include:

- U.S. Treasury Bills (T-Bills)

- High-yield online savings accounts

- Money market mutual funds

Dividend-Growth Stocks

Companies with consistent dividend increases can generate reliable income and long-term capital appreciation. Sectors like healthcare, utilities, and consumer staples often offer stable dividend histories.

For dividend screening tools, see Nasdaq Dividend Calendar.

Bond Ladders for Predictable Income

Bond laddering — buying bonds with staggered maturity dates — helps investors reduce interest-rate risk while maintaining steady payouts. This strategy works particularly well in uncertain markets.

- Flexible reinvestment timelines

- Stable cash flow

- Lower volatility vs. equities

Diversified ETFs (The All-in-One Portfolio)

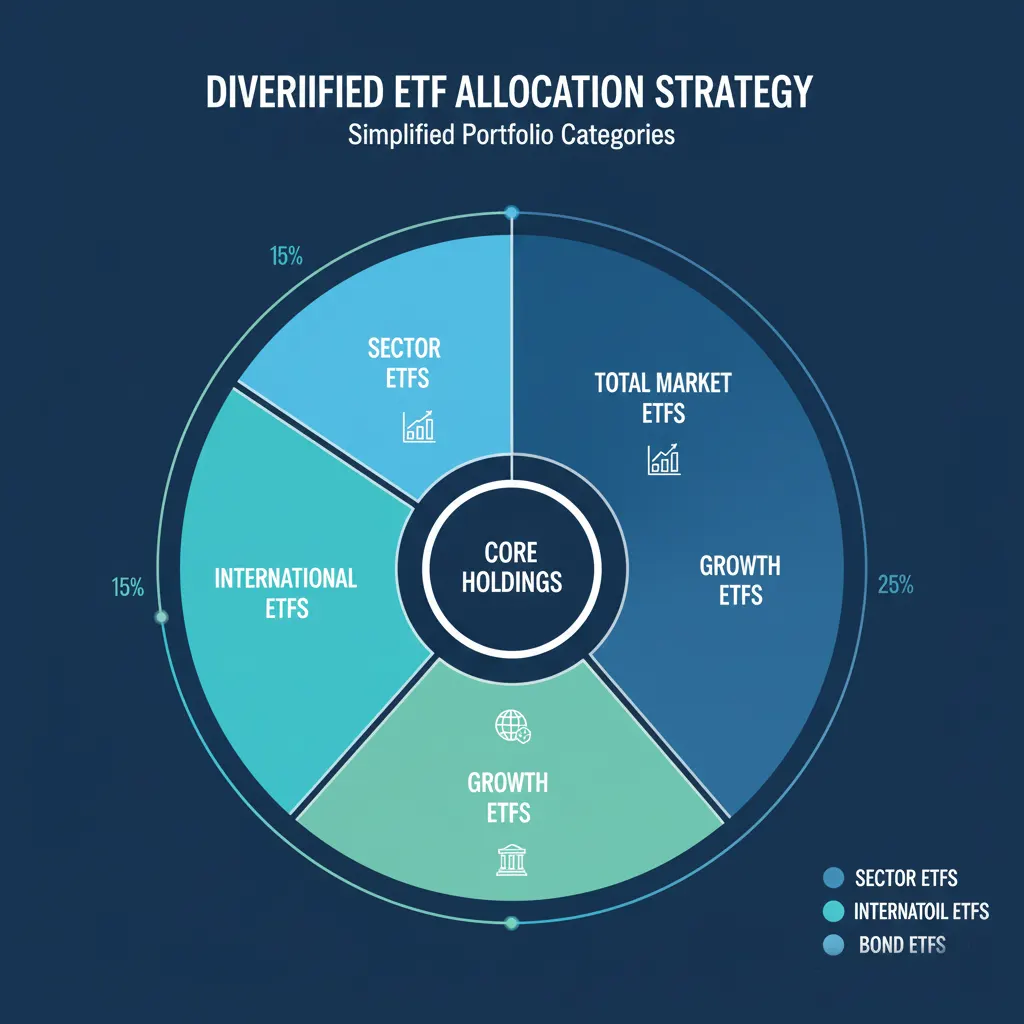

Exchange-traded funds (ETFs) give investors access to broad sectors, global markets, and emerging industries — all within a single asset. Their liquidity and low cost make them ideal for 2026’s evolving market.

Popular ETF categories:

- Total market ETFs

- International ETFs

- Bond ETFs

- Dividend ETFs

- Growth ETFs

Real Estate Investment Trusts (REITs)

REITs allow investors to earn passive income from real estate without owning physical property. In 2026, sectors such as industrial warehouses, medical facilities, and data centers continue to see strong demand.

Real estate insights are regularly updated at Nareit.

Low-Risk Emerging Themes for 2026

Some new sectors offer growth potential with relatively moderate risk — especially when accessed through diversified funds.

- Artificial intelligence infrastructure

- Clean energy & battery storage

- Healthcare innovation & biotech

- Cybersecurity providers

These industries benefit from long-term global demand and steady institutional investment.

The best investment strategies for 2026 balance growth, safety, and diversification. Whether you prefer index funds, income-focused assets, or long-term thematic plays, the key is building a portfolio that spreads risk while positioning you for steady returns. As always, research remains essential — and a diversified approach can help manage uncertainty while supporting long-term wealth.

#Investing2026 #InvestmentTips #FinancialPlanning #SmartInvesting #LowRiskInvesting #WealthBuilding #SmartMoney #FinanceGuide #MarketOutlook2026 #ETFs