Headlines about the United States approaching a $40 trillion national debt have sparked widespread concern — especially among current homeowners and prospective buyers. With interest rates already elevated, many Americans are asking a pressing question: Will rising federal debt make mortgages more expensive?

While the national debt doesn’t directly set mortgage rates, it plays a powerful role in shaping the economic forces that do. Here’s how the debt milestone could affect your home loan — and what borrowers should watch next.

What Does the $40 Trillion Debt Really Mean?

The national debt represents the total amount the federal government owes to creditors, funded largely through the issuance of U.S. Treasury securities . As borrowing increases, so does the supply of government bonds — which can influence interest rates across the economy.

According to data from the U.S. Treasury , higher debt levels often coincide with higher yields demanded by investors, especially during periods of inflation or economic uncertainty.

How Government Debt Influences Mortgage Rates

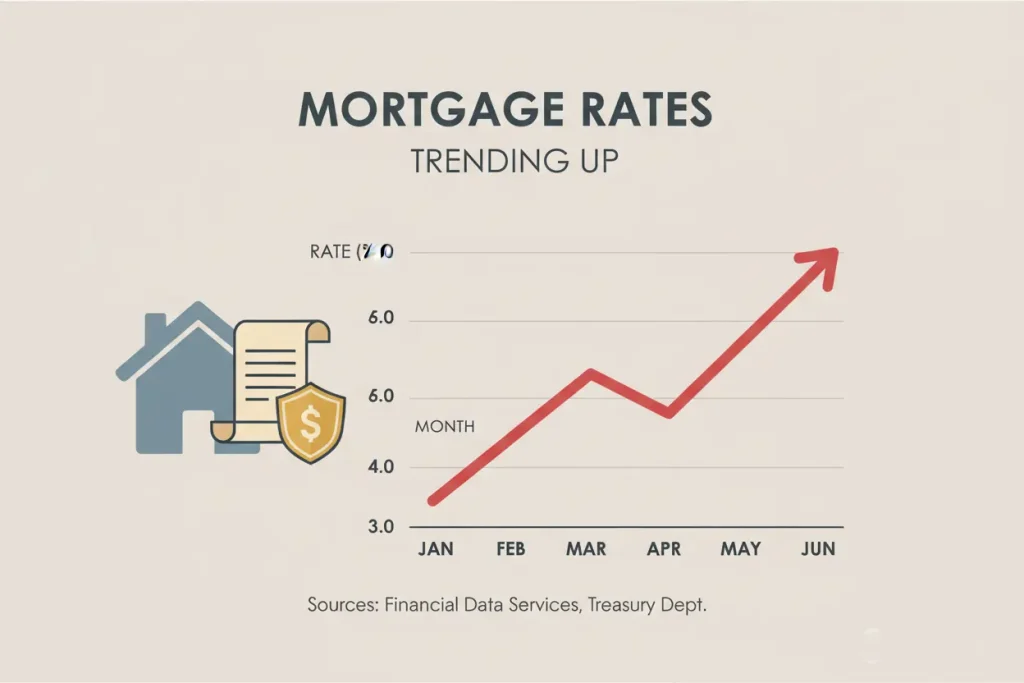

Mortgage rates are closely tied to the yield on the 10-year Treasury note , which serves as a benchmark for long-term borrowing. When the government issues more debt, investors may demand higher returns — pushing Treasury yields upward.

As Treasury yields rise, mortgage lenders typically follow suit, increasing rates on 30-year and 15-year home loans to maintain profitability.

The Federal Reserve’s Role

The Federal Reserve doesn’t control the national debt, but it does respond to its economic consequences. If high government spending fuels inflation, the Fed may keep interest rates higher for longer — directly affecting mortgage affordability.

Conversely, if debt concerns slow economic growth, the Fed could eventually pivot toward rate cuts. This delicate balance makes mortgage rate forecasting especially challenging in high-debt environments.

What This Means for Homebuyers

For buyers, the $40 trillion debt milestone adds uncertainty to an already tight housing market. Higher rates reduce purchasing power, meaning borrowers may qualify for smaller loan amounts or face higher monthly payments.

Housing data from organizations like Freddie Mac shows that even small rate increases can significantly impact affordability over the life of a mortgage.

What About Current Homeowners?

Existing homeowners with fixed-rate mortgages are largely insulated from short-term rate fluctuations. However, those considering refinancing or taking out home equity loans may face higher borrowing costs if debt-driven rate pressure continues.

Adjustable-rate mortgage holders should pay particular attention, as future rate resets may reflect broader shifts in Treasury yields and Federal Reserve policy.

Should You Wait or Act Now?

There’s no one-size-fits-all answer. Some buyers may choose to wait, hoping rates ease if inflation cools. Others may lock in rates now to avoid the risk of further increases tied to rising government borrowing.

Financial advisors often recommend focusing less on national debt headlines and more on personal readiness — stable income, manageable debt, and long-term housing plans matter more than timing the market perfectly.

The $40 trillion debt milestone is a sobering number, but its impact on your mortgage is indirect and gradual. While higher debt can contribute to upward pressure on interest rates, broader economic forces — inflation, growth, and Federal Reserve policy — remain the dominant drivers.

For homeowners and buyers alike, staying informed and financially prepared is the best defense against uncertainty in a high-debt era.

#NationalDebt #MortgageRates #HousingMarket #InterestRates #PersonalFinance #USDebt #HomeBuying