For more than a decade, artificial intelligence has lived mostly behind a microphone or chat box. From Siri to Alexa and Google Assistant, AI has been reactive—waiting for instructions.

In 2026, that era is ending. A new generation of agentic AI systems is emerging—AI that doesn’t just respond, but acts. These agents can now manage personal portfolios, execute trades, and pay bills without human prompts, all within defined legal and regulatory frameworks.

What Is Agentic AI?

Agentic AI refers to systems designed with goal-oriented autonomy. Unlike traditional assistants, they can plan, decide, and execute multi-step actions independently.

According to researchers and industry leaders at OpenAI and other AI labs, these agents combine:

- Long-term memory

- Tool access (APIs, financial platforms)

- Rule-based guardrails

- Continuous learning

From Siri to Self-Directed Agents

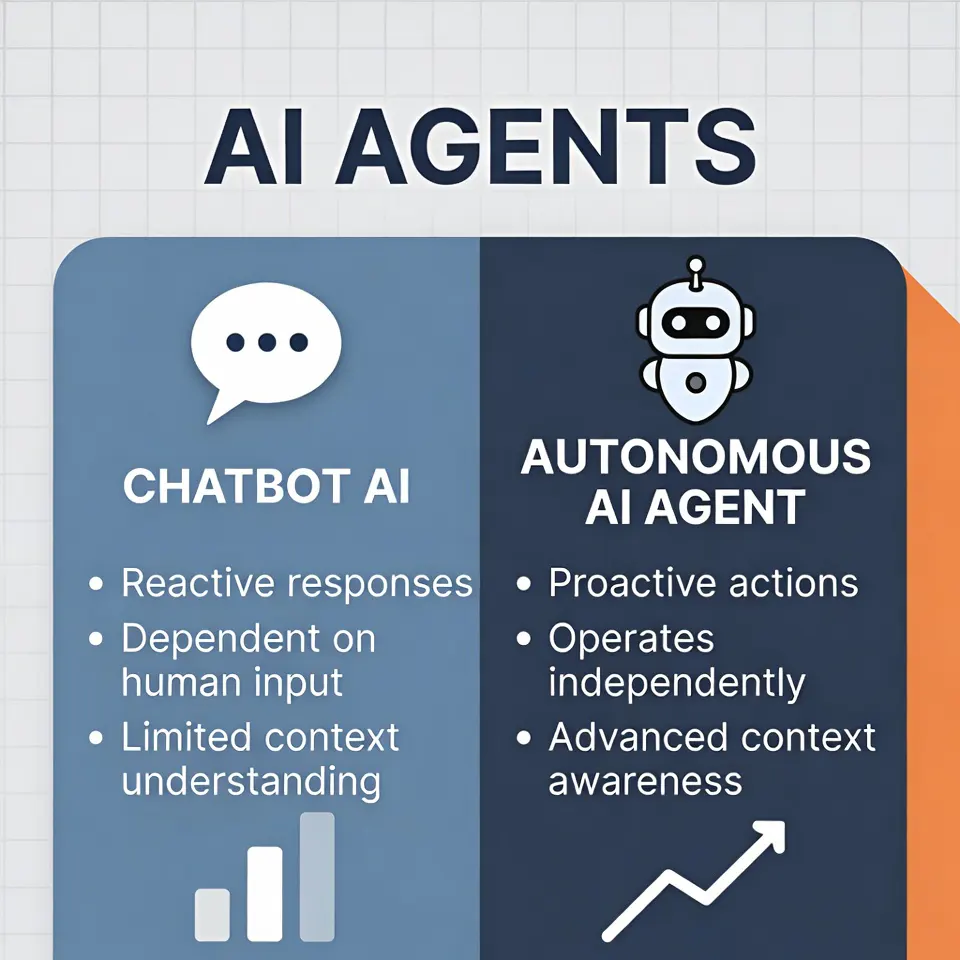

The difference between an AI assistant and an AI agent is profound.

An assistant answers: “What’s my balance?” An agent decides: “Your balance is idle—reallocate it.”

This shift mirrors trends seen in enterprise automation and AI-driven decision systems, now moving rapidly into consumer finance.

How Agentic AI Manages Portfolios

Modern agentic AI platforms can:

- Monitor market conditions 24/7

- Rebalance portfolios based on risk thresholds

- Execute trades via licensed broker integrations

- Harvest tax losses automatically

Unlike earlier robo-advisors, these systems don’t wait for approval on every action. They operate under pre-authorized mandates, similar to discretionary asset management.

Companies operating in the fintech space see this as the next evolution of wealth management.

Yes, They Can Pay Bills Too

Beyond investing, agentic AI is expanding into personal finance operations:

- Automatically paying utilities and subscriptions

- Negotiating lower bills using usage data

- Moving cash to high-yield accounts

By integrating with regulated payment rails and identity systems, these agents operate within compliance standards set by financial authorities.

This level of automation is already being tested by institutions aligned with World Economic Forum recommendations on responsible AI.

The Legal and Ethical Guardrails

Autonomy does not mean lawlessness. Agentic AI systems are constrained by:

- User-defined risk and spending limits

- Regulatory compliance (KYC, AML)

- Audit logs for every decision

Think of them less as rogue traders and more as tireless fiduciary assistants—operating under strict rules.

Why This Matters for the Next Decade

As financial lives grow more complex, human attention becomes the scarcest resource.

Agentic AI promises to offload cognitive and administrative burden—optimizing money quietly in the background, much like autopilot systems in aviation.

Analysts tracking the future of AI in finance believe this transition could redefine personal wealth management by 2035.

Chatbots changed how we talk to machines. Agentic AI is changing what machines are allowed to do.

In 2026, the most powerful financial assistant may not speak at all—it simply acts, optimizes, and safeguards your financial future.

#AgenticAI #AutonomousAI #AIinFinance #FinTechTrends #FutureOfMoney #SmartAutomation