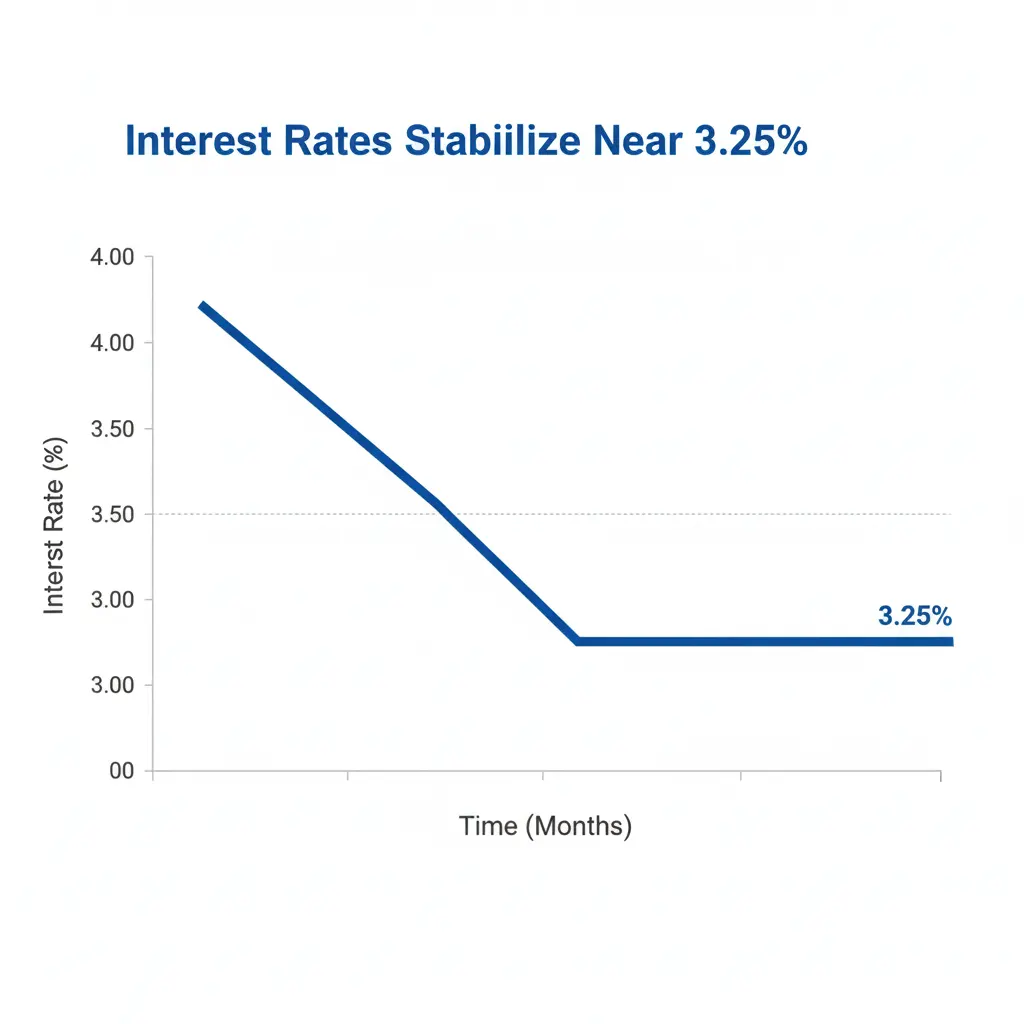

As inflation cools and economic growth normalizes, a new question is dominating financial markets: Are lower interest rates here to stay? With traders and economists increasingly circling 3.25% as a possible benchmark, many are asking whether this level could become the new normal for the Federal Reserve in 2026.

Fed rate cut predictions are no longer just about short-term relief. They’re shaping decisions around mortgages, investments, and business planning well into the next decade.

Why 3.25% Is Emerging as a Key Fed Rate Level

The idea of a 3.25% federal funds rate reflects a growing belief that the U.S. economy is transitioning away from the ultra-low-rate era—without returning to the aggressive tightening of recent years.

According to policy commentary from the Federal Reserve, future rate decisions are expected to balance inflation control with long-term economic stability rather than crisis response.

Market participants tracking futures via the CME FedWatch Tool have increasingly priced in a slower, more measured rate environment beyond 2025.

What’s Driving Fed Rate Cut Predictions for 2026

Several structural forces are influencing expectations for lower, more stable rates:

- Moderating inflation trends

- Slower but steady GDP growth

- Cooling labor market pressures

- Higher global competition for capital

Economists cited by Bloomberg Economics note that the Fed is increasingly focused on avoiding overtightening—especially as fiscal policy and global growth remain uncertain.

In this context, a 3.25% rate represents a compromise: restrictive enough to manage inflation, but flexible enough to support investment.

How a 3.25% Fed Rate Would Affect Consumers

If 3.25% becomes a long-term baseline, the impact would be felt across household finances:

- Mortgage rates could stabilize but remain above pre-pandemic lows

- Credit card and auto loan rates may ease slightly

- Savings yields could normalize at modest but positive levels

Consumer analysts at NerdWallet suggest that borrowers should prepare for a “middle-rate” world—neither cheap money nor prohibitively expensive credit.

What It Means for Markets and Investors

For investors, the idea of a stable 3.25% rate environment could be transformative.

Strategists from Morningstar argue that predictable rates tend to favor:

- Equities with steady cash flow

- Dividend-paying stocks

- Longer-duration bonds

At the same time, risk assets would still need to compete with relatively attractive fixed-income returns—keeping speculation in check.

Is 3.25% Really the “New Normal”?

While markets love round numbers, the Fed has consistently emphasized that there is no fixed target beyond its dual mandate. As explained in research published by the Federal Reserve Bank of San Francisco, neutral interest rates can shift over time due to demographics, productivity, and global capital flows.

That means 3.25% may be a waypoint—not a permanent destination. Still, the growing consensus suggests the era of emergency-level rates is firmly over.

Fed rate cut predictions pointing toward 3.25% reflect a broader shift in how policymakers and markets view economic stability. Rather than chasing extremes, the focus is on sustainability.

Whether or not 3.25% becomes the “new normal,” one thing is clear: the next phase of monetary policy will reward preparation, not speculation.

#FedRates #InterestRates #MonetaryPolicy #USMarkets #EconomicOutlook #FinanceNews