Summary: Holiday shoppers across the U.S., UK, and Europe are increasingly feeling the hidden impact of tariffs. Often called a “tariff tax,” these import duties quietly raise prices on everyday gifts, electronics, and seasonal essentials—showing up on your receipt without ever being labeled.

What Is a “Tariff Tax”?

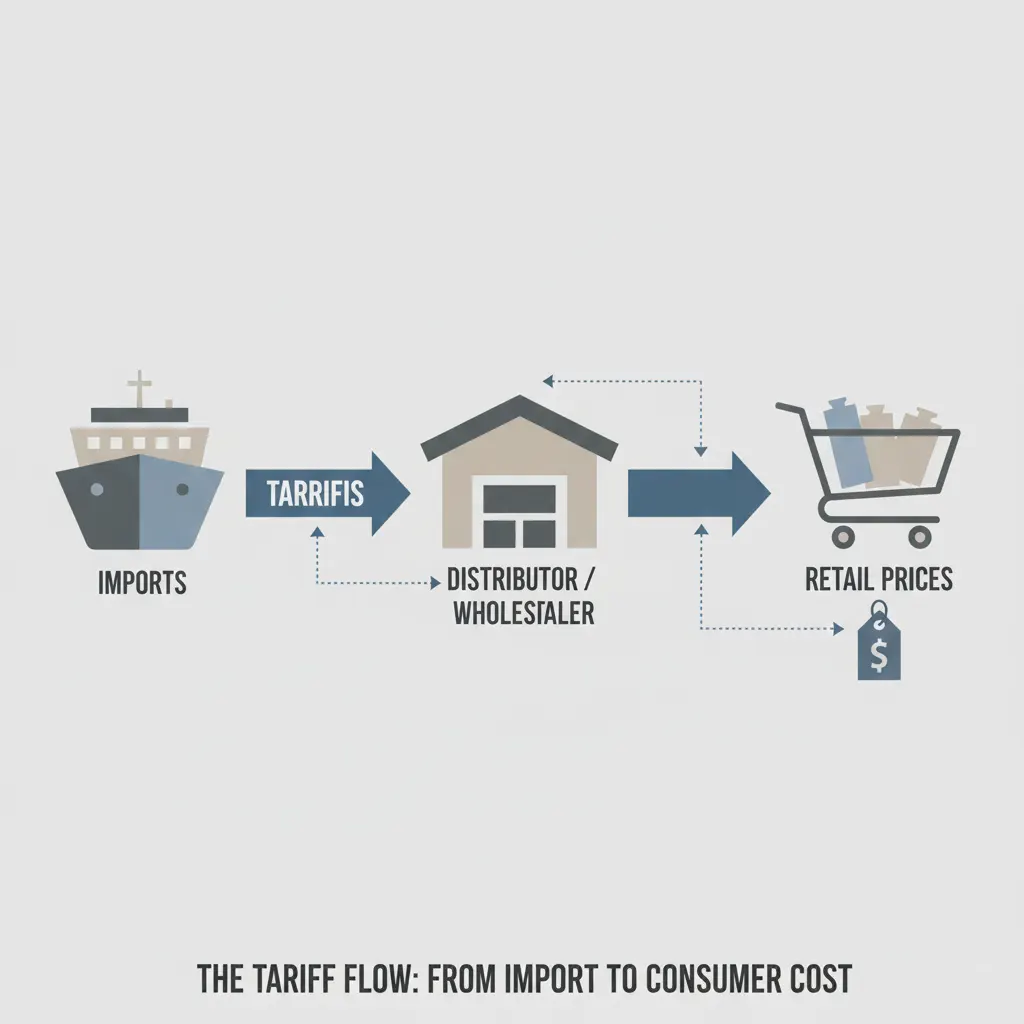

A tariff is a tax imposed by governments on imported goods. While tariffs are officially charged to importers, the cost is frequently passed down the supply chain—ending with the consumer.

According to the World Trade Organization’s tariff framework, tariffs are designed to protect domestic industries or influence trade negotiations. In practice, however, retailers often absorb the cost initially and later adjust prices to maintain margins.

This is why many economists refer to tariffs as a consumer-facing tax, even though they don’t appear as a separate line item on receipts.

Why Tariffs Hit Hardest During the Holidays

Holiday shopping magnifies the impact of tariffs because it coincides with peak demand for imported goods. Popular gift categories—electronics, toys, apparel, and home décor—are heavily dependent on global supply chains.

- Consumer electronics often rely on components imported from Asia

- Seasonal decorations are largely manufactured overseas

- Fashion and footwear supply chains remain globally distributed

The U.S. Trade Representative’s tariff actions over recent years illustrate how trade policy can directly affect retail pricing—especially during high-volume shopping seasons.

How the “Tariff Tax” Shows Up on Your Receipt

Unlike sales tax or VAT, tariff costs are embedded in the product price. Retailers rarely disclose how much of a price increase is tied to import duties.

For example:

- A $600 television may include $40–$70 in tariff-related costs

- Imported toys can see double-digit percentage price increases

- Clothing margins are often adjusted subtly across entire collections

Research cited by the Brookings Institution shows that consumers in high-income countries ultimately shoulder most tariff-related price increases.

Who Pays the Most? A Tier-1 Market Perspective

Shoppers in Tier-1 economies—including the United States, United Kingdom, Germany, France, Canada, and Australia—are disproportionately affected.

Why?

- Higher purchasing power leads to greater exposure to imported goods

- Premium brands rely more heavily on global manufacturing

- Retailers in these markets pass costs through rather than reducing quality

In the EU, tariff structures combined with VAT amplify the effect. The European Commission’s customs duty system highlights how layered taxation can quietly inflate consumer prices.

Can Retailers Absorb Tariffs Instead?

In theory, yes—but only temporarily.

Major retailers may initially absorb tariff costs to stay competitive during peak seasons. Over time, however, sustained tariffs typically result in:

- Higher list prices

- Reduced discounts and promotions

- Smaller product sizes or feature reductions

This strategy—sometimes called “shrinkflation”—has been widely documented by outlets like the Financial Times.

What Shoppers Can Do to Reduce the Impact

While consumers can’t control trade policy, they can shop smarter:

- Compare prices across domestic and international brands

- Buy early, before seasonal demand spikes

- Look for products manufactured locally or regionally

- Use price-tracking tools and browser extensions

Understanding how tariffs work can also help shoppers interpret sudden price jumps more realistically.

The Bigger Picture: Tariffs, Inflation, and Consumer Trust

As inflation remains a concern across developed economies, tariffs add another invisible layer of cost pressure. When consumers don’t understand why prices rise, trust in retailers—and policymakers—can erode.

Transparency around pricing and trade policy is increasingly important, particularly as governments revisit tariff strategies in response to geopolitical shifts.

The “tariff tax” may not be printed on your holiday receipt, but it’s there nonetheless. For shoppers in high-income countries, understanding this hidden cost is the first step toward making more informed purchasing decisions—and recognizing how global trade policy reaches all the way to the checkout counter.

#TariffTax #HolidayShopping #RisingPrices #GlobalTrade #ConsumerCosts #InflationExplained #EconomicTrends